Who pays more for being diagnosed at a young age?

News Article

Publication date:

26 February 2020

Last updated:

25 February 2025

Author(s):

Adam Higgs

Being diagnosed with a debilitating condition at a young age can have significant ongoing repercussions. In this insight, we look at how a number of insurers approach some of the more debilitating conditions if diagnosed at a young age.

The number of conditions covered by today’s critical illness policies is considerable. For most, the likelihood of a client suffering from the condition will increase with age. The impact on a client’s longevity or standard of living will vary from condition to condition and be dependent on the severity of the diagnosis. Clearly some conditions will have a much more debilitating effect than others and if diagnosed at a younger age can have significant ongoing repercussions. In this insight we look at how a number of insurers approach some of the more debilitating conditions if diagnosed at a young age.

Currently there are six insurers in the market (Aviva, LV=, Old Mutual Wealth, Scottish Widows, Vitality and Zurich) that apply special provisions if a client is diagnosed at a younger age. Each have a slightly different approach but in essence, will provide an additional payment above the sum assured set out in the policy if diagnosed before a certain age with a specific condition as shown below:

|

Aviva |

LV= |

Old Mutual Wealth |

Scottish Widows |

Vitality |

Zurich |

|

|

Blindness |

Y |

Y |

||||

|

Deafness |

Y |

|||||

|

Dementia |

Y |

Y |

Y |

Y |

Y** |

Y |

|

Heart Failure |

Y* |

|||||

|

Kidney Failure |

Y |

|||||

|

Liver Failure |

Y |

|||||

|

Loss of Hands or Feet |

Y |

Y |

||||

|

Loss of Speech |

Y |

Y |

||||

|

Motor Neurone Disease |

Y |

Y |

Y |

Y |

Y** |

Y |

|

Paralysis of Limbs |

Y |

Y |

||||

|

Parkinson’s Disease |

Y |

Y |

Y |

Y |

Y** |

Y |

|

Parkinson’s Plus Syndrome |

Y* |

Y |

Y |

Y |

Y*** |

Y |

|

Traumatic Brain Injury |

Y** |

Y |

*These conditions are only included if Upgraded critical illness is selected

**Vitality require the client to be permanently and irreversibly unable to perform 4 out of 6 functional activity tests to qualify.

***The Vitality wording covers Progressive Supranuclear Palsy, the most common Parkinson’s Plus syndrome if permanently and irreversibly unable to perform 4 out of 6 functional activity tests.

Note: Vitality list 37 different conditions in total with most requiring the permanent and irreversible inability to perform 4 out of 6 functional activity tests as a posed to the client meeting their standard definitions.

Being diagnosed with any of the conditions listed would have a severe impact on a client’s standard of living as our independent panel of medical practitioners explain for Motor Neurone Disease and Parkinson’s Plus Syndromes:

“Motor neurone disease (MND) is regarded as a devastating neurological condition, which usually follows a relentlessly progressive deterioration in the muscles of the limbs, spine and those involved with swallowing and breathing.

Parkinson-plus syndromes is another neurological disorder which does not respond to treatment and has a poor prognosis. They are often associated with early onset dementia, significant disability and confinement to bed or wheelchair is typically necessary late in the disease.”

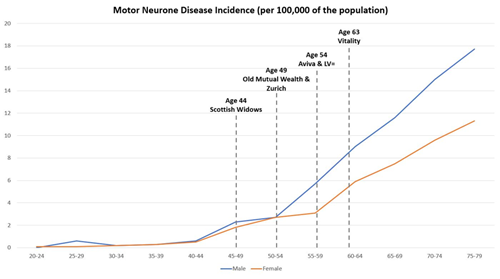

Suffering from one of these conditions will have a massive impact on the remainder of a client’s life, particularly if diagnosed at an earlier age. Fortunately, incidence for these conditions is relatively low especially at younger ages, however a client could still be diagnosed at a young age although this is unlikely. Across the six insurers, the maximum age at which they will pay an additional amount varies. The charts below compare the maximum ages at which insurers will pay an additional benefit against the incidence rates of Motor Neurone Disease across different ages for males and females. This highlights that insurers who offer this to older clients are likely to pay more claims.

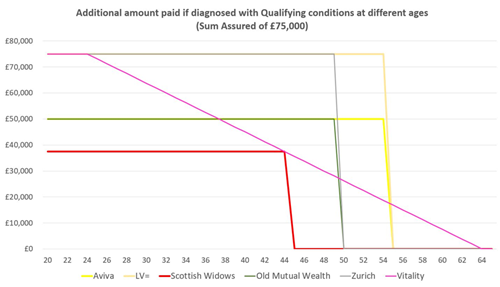

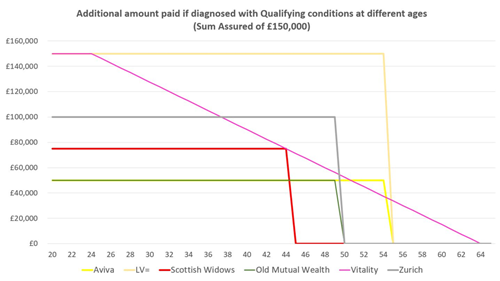

Another area where there are vast differences across the insurers is with regard to the actual amount they will pay. Where a client qualifies for an additional payment due to their age this will be combined with the amount paid for meeting the standard definition. Both Aviva and Old Mutual Wealth will pay an additional fixed £50,000, whilst Zurich will pay £100,000 to a maximum of 100% of the sum assured. The amount LV= and Scottish Widows will pay is dependent on the sum assured of the policy. LV= will effectively double the sum assured up to a maximum of £200,000 extra, whilst Scottish Widows will pay an additional 50% of the sum assured up to a maximum of £200,000.

Vitality on the other hand take a very different approach. Instead of a set lump sum based on a fixed monetary amount or percentage of the sum assured, the amount they pay is based on the client’s age at diagnosis. For every year younger than 64 the client is, Vitality will pay an additional 2.5% of the sum assured capped at an additional 100% of the sum assured. The charts below compare the amount each insurer will pay over different age ranges and sums assured:

LV=, Scottish Widows, Old Mutual and Zurich (Select Product only) provide the additional payments as standard. For Aviva there are additional costs as clients will need to pay for their Extra Care Cover and similarly to include this on one of their serious illness policies, the client would need to pay an additional premium for Serious Illness Cover Booster.

Being diagnosed with one of the conditions highlighted in this insight at any age will be devastating for the client and their family. One could only imagine the impact of being diagnosed at a young age and dealing with the deteriorating effects. The additional payments provided by these insurers could help either provide additional support, help adapt their living environment or even pay for additional treatment that may be required.

At low sums assured the fixed amount paid by Aviva and Old Mutual Wealth would seem to provide the biggest additional payment, whilst at high sums assured the ‘percentage of sum assured’ approach from LV= would pay more. Vitality provide additional payments at the highest age; however a relatively low amount will be paid for older clients. LV= and Aviva on the other hand have a slightly younger maximum age at 54 but are likely to pay more at these ages.

To sign up to the Protection Guru mailing list you can register your details HERE

This document is believed to be accurate but is not intended as a basis of knowledge upon which advice can be given. Neither the author (personal or corporate), the CII group, local institute or Society, or any of the officers or employees of those organisations accept any responsibility for any loss occasioned to any person acting or refraining from action as a result of the data or opinions included in this material. Opinions expressed are those of the author or authors and not necessarily those of the CII group, local institutes, or Societies.