When can life cover be increased without underwriting?

News article

Publication date:

15 January 2020

Last updated:

25 February 2025

Author(s):

Protection Guru

Providing Guaranteed Insurability Options (GIOs) for clients.

Ensuring a client is suitably protected when a significant life event happens is a key part of the annual review process for both financial planners and protection specialists. Getting married, having children or taking out a new mortgage are just a few events that may lead to an increased protection need, but what is the easiest way to increase current cover and how do insurers differ in how this can be increased?

Guaranteed Insurability Options (GIOs) enable clients to increase cover with no further medical underwriting if a certain life event has occurred. Although all insurers provide GIOs as standard on their contracts, looking at the detail of such options identifies significant variations in the scope and number of features.

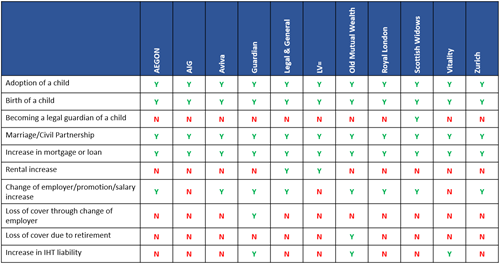

There are various different life events for which insurers offer GIOs on life protection policies. In recent times a number of new options have been added by insurers. Most notably is Scottish Widows and Guardian who have extended their birth/adoption of a child option to include becoming a legal guardian which currently no other insurer offers. Also, relatively new additions are the increase in inheritance tax liability by Guardian and Vitality and rental increase option from Legal & General and LV=.

The table below highlights which insurers offer which option:

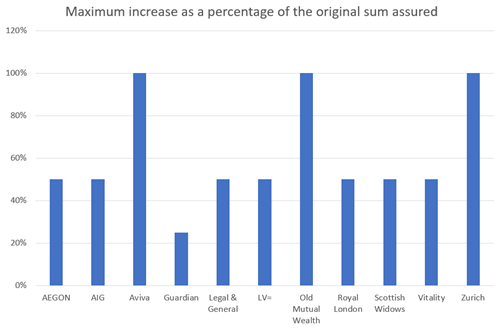

In all cases insurers apply a limit to the increase that can be applied. This is usually the lower of a percentage of the original sum assured and a maximum monetary value. Generally, the maximum percentage the insurer will increase the sum assured by remains consistent across all event options, however there may be further stipulations. One example of this is where the client is increasing their cover due to an increase in their mortgage. In such scenario’s insurers will add a further stipulation that the increase cannot be higher than the increase in mortgage liability. The graph below highlights the maximum increase allowable by insurers as a percentage of the original sum assured when the policy was first taken out:

For key person and shareholder protection policies the limits are generally the same. The graph below shows where different providers set these limits.

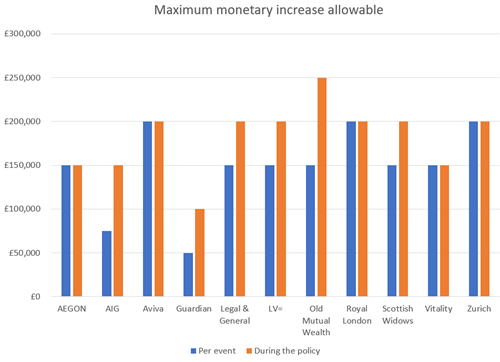

Most insurers allow the client to exercise a GIO on their plans more than once and for some the maximum monetary increase is split between a maximum increase per event and the maximum increase allowable during the policy. For those with a high sum assured, the maximum monetary increase is more likely to have an impact on how much the sum assured can be increased by.

The graph below highlights these maximums:

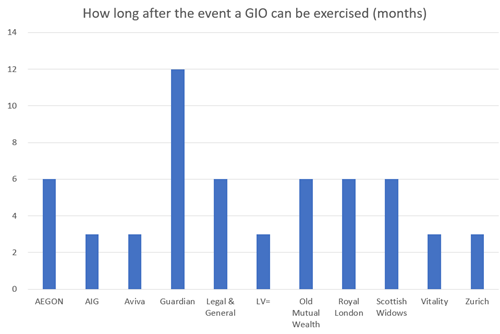

Another area where insurers differ on GIOs is who is able to exercise them and when. Insurers will generally state a maximum age at which clients are able to exercise a GIO. Obtaining the documentation required to prove the life event has happened can take time and therefore advisers should ensure that they understand the time frame set out by insurers. Guardian are the only insurer that do not stipulate a maximum age, whilst for AEGON the maximum age is 69 and Old Mutual Wealth have a maximum age of 55. All other insurers apply a maximum age of 54.

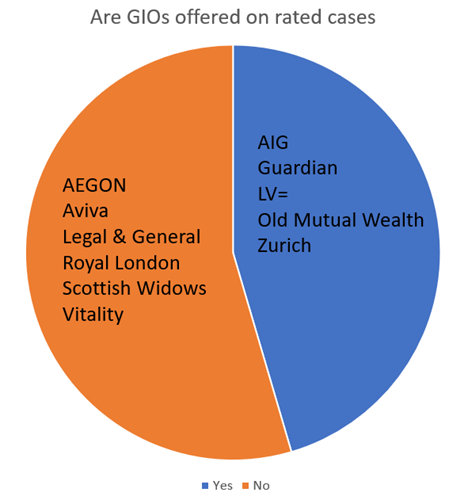

Where a client has a medical or other disclosure that leads to an increase in premium subsequent to the underwriting process, they may not be eligible for Guaranteed Insurability Options. Some insurers will not offer GIOs to any case where a rating has been applied whilst others will dependent on the size of the rating.

The reliance on a specific life event happening means that GIOs are not always going to be an option when looking to increase a client’s cover. Where a life event has happened however, the ability to increase the sum assured without any further underwriting should be appealing, especially if the client’s health has deteriorated since the inception of the policy. In recent history many advisers have noted that applying for a Guaranteed Insurability Option was often as, if not more, time consuming than applying for a new policy all together. Whilst this may still be the case for some insurers, others such as Zurich have made notable improvements to their online systems and allow advisers to apply for GIOs electronically via their extranet making the whole process far easier.

Ongoing servicing of clients is important, more so now as the regulator starts to look upon the protection market and advice services more thoroughly. Ensuring that your client’s protection provisions remain suitable should be a key part of this. Whilst GIOs may not always provide the right answer for the client in many events it can save the client time, effort and stress when increasing cover.

Overall Aviva, Old Mutual Wealth and Zurich are particularly strong when it comes to the amount that cover can be increased by. Guardian, Legal & General, LV=, Old Mutual Wealth and Scottish Widows are also worth highlighting for offering GIOs on events not covered by other insurers. For clients where a rating has been applied AIG, Guardian, LV=, Old Mutual Wealth and Zurich are particularly strong.

To sign up to the Protection Guru mailing list you can register your details HERE

This document is believed to be accurate but is not intended as a basis of knowledge upon which advice can be given. Neither the author (personal or corporate), the CII group, local institute or Society, or any of the officers or employees of those organisations accept any responsibility for any loss occasioned to any person acting or refraining from action as a result of the data or opinions included in this material. Opinions expressed are those of the author or authors and not necessarily those of the CII group, local institutes, or Societies.