What's new bulletin May 2022

News article

Publication date:

23 May 2022

Last updated:

25 February 2025

Author(s):

Technical Connection

Update from 6 May 2022 to 19 May 2022.

TAXATION AND TRUSTS

Crack down on company fraud - new powers for Registrar of Companies

(AF2, JO3)

The Queen's Speech promised a new Economic Crime and Corporate Transparency Bill granting the Registrar of Companies new powers to enforce the accuracy of information on the Companies Register.

According to Companies House statistics, at the end of March 2022, there were 4,894,356 companies on the UK total Companies House register. (This figure includes 395,014 companies in the course of dissolution and liquidation.) The Companies House register can be a very useful source of publicly available business information.

Back in December 2020, the Government published three new consultations intended to support reforms to clamp down on fraud and give businesses greater confidence in transactions:

- Improving the quality and value of financial information on the UK companies register;

- Powers of the registrar;

- Implementing the ban on corporate directors.

The 2022 Queen's Speech 2022, presented to the UK parliament on 10 May 2022, promised a new Economic Crime and Corporate Transparency Bill granting the Registrar of Companies (the Registrar) new powers to enforce the accuracy of information on the Companies Register.

The existence of the draft Bill was first mentioned in February 2022, when legislation implementing the register of overseas entities was introduced to the UK parliament in the immediate aftermath of the Russian invasion of Ukraine. That Bill, now called the Economic Crime (Transparency and Enforcement) Act, was rushed through parliament in a matter of weeks, with the UK Government promising that it would be followed by consultation on a second economic crime Bill increasing the powers of Companies House.

Under the new Bill, the Registrar will be authorised to check, remove or decline information submitted to or already on the Companies Register. People who manage, own and control companies and other UK registered entities will also be subject to identity verification, investigation and enforcement powers operated by the Registrar. Data will be cross-checked against that held by other public and private sector bodies. And all entities registered at Companies House will have to have at least one fully verified natural person directly associated with them on the public register.

The new Bill will also contain anti-abuse measures regarding limited partnerships, including Scottish limited partnerships, strengthening their disclosure requirements and enabling them to be properly wound up.

There will also be a new civil forfeiture power enabling rapid seizure and recovery of cryptoassets, which are the principal medium used by ransomware fraudsters to collect the proceeds of their crimes.

Long-awaited plans on overhauling audit and corporate governance were also outlined in the he Queen’s Speech. A Draft Audit Reform Bill will, among other elements: establish a new statutory regulator, the Audit, Reporting and Governance Authority (ARGA); provide new measures to open up the market, including shared audits; enlarge the scope of public interest entities; and give the new regulator powers to enforce directors’ financial reporting duties. It’s not certain if the required legislation will be put forward during this parliamentary session. If it is, it is expected to set an implementation date of some time in 2024.

Finally, the Government says that its final response to its consultation on the Restoring trust in audit and corporate governance white paper will be published shortly.

HMRC consults on low income trusts and estates

(AF1, JO2, RO3)

HMRC is consulting on legislative proposals to remove trusts and death estates with small amounts of income from income tax.

Back in 2016, following tax on bank and building society interest no longer being deducted at source, HMRC introduced an arrangement to ensure that new burdens did not arise on those managing trusts and estates whose only income consists of small amounts of savings interest. This reflected the fact that following the introduction of the Personal Savings Allowance from the same date, around 95% of savers were expected to be no longer liable for tax on this interest.

However, trustees of trusts and personal representatives (PRs) of death estates do not have tax allowances in the same way as individuals do. As a result, with the payment of interest gross, even the trustees and PRs of the smallest trusts and estates would have become liable to file a self-assessment return when they hadn’t previously had to do so. HMRC’s arrangement therefore removed trustees and PRs from income tax where the only source of income for the trust or estate is savings interest and the tax liability is below £100. This arrangement was intended to be a temporary arrangement pending a longer-term solution.

The new consultation, which runs until 18 July 2022, seeks views on proposals to formalise and extend that concession.

Under the latest proposals, low-income trusts and estates with income from any source up to a ‘de minimis’ amount (to be decided following this consultation) will not be subject to income tax on that income.

For trusts and estates with income more than the de minimis amount, income tax will be due on the full amount of income rather than only applying to the income above the de minimis amount. This is in the interests of simplification for both taxpayers and HMRC, as the rules required to take the alternative approach would be complicated and require additional administration for all involved.

Tax pools apply to discretionary trusts and keep track of income tax the trustees pay. When trustees make a discretionary payment of income it is treated by the beneficiary as if income tax has already been paid at the trust rate (currently 45%); and the trustees must have paid enough income tax (in the current or previous years) to cover this ‘tax credit’. Under these proposals, even where discretionary trusts would be covered by the de minimis rule, they will still have to pay tax when they pay income out to a beneficiary, to ensure that the tax credit remains funded.

HMRC’s impact assessment points out that this measure is expected to have an impact on an estimated 28,000 individuals overall. It is expected to simplify the administration of tax in the majority of cases by avoiding the need for people to claim refunds; but some people are expected to have to return and pay the tax due, where previously that would have been done by the trustees.

We will update you on any developments.

Comment

Note that non-taxable trusts are required to register on the TRS. All trusts which are not “excluded trusts” (please see Trust Registration Service – fundamentals) have to be registered by 1 September 2022 or within 90 days from the trust’s creation, whichever is later. Any new registrable trusts set up from 1 September 2022 will have to be registered within 90 days. For more information please see Trust Registration Service – non-taxable trusts. So, even if a trust does not need to register as a taxable trust, it may still need to be registered as a non-taxable trust (unless it is an excluded trust).

Tax credits and some benefits are ending: claim Universal Credit (AF1, RO3)

Individuals whose benefits are ending are urged to claim universal credit to continue receiving financial support.

Universal Credit is replacing the following benefits for people of working age:

- Child Tax Credit;

- Housing Benefit;

- Income Support;

- income-based Jobseeker’s Allowance (JSA);

- income-related Employment and Support Allowance (ESA);

- Working Tax Credit.

Other benefits, such as Personal Independent Payments (PIP), will not be affected by these changes.

Universal Credit is for people who:

- are on a low income;

- need help with living costs;

- are working (including self-employed or part time);

- are out of work;

- have a health condition that affects their ability to work.

The Department for Work and Pensions (DWP) is writing to those whose benefits will be ending requesting that they apply to claim Universal Credit by the deadline date given in the letter - this is three months from the date the letter was sent out. This should ensure individuals have plenty of time to gather the information required to make the claim.

HMRC’s guidance explains how to make a claim, what information is needed, payment dates and how much will be received. Those affected should read the guidance carefully and ensure they make a claim to continue to receive financial support.

Reform of capital allowance regime

(AF2, JO3)

The Government has published a new policy paper relating to its review of capital allowances, with responses requested by 1 July 2022.

The 130% super-deduction capital allowance allows companies to cut their tax bill by up to 25p for every £1 they invest.

The Government first announced the potential of a reform to capital allowances in its March 2022 Spring Statement, ahead of the ending of the super-deduction on 31 March 2023 – please see here. This new policy paper delves into those options in further detail, which includes:

- increasing the permanent level of the Annual Investment Allowance;

- increasing the rates of Writing Down Allowances;

- introducing general First-Year Allowances (FYAs) for qualifying expenditure on plant and machinery;

- introducing an additional FYA;

- introducing permanent full expensing.

In addition to the Spring Statement options, the guidance now published has three further areas of interest:

i) Investment decisions – The Government would welcome evidence from stakeholders on how firms make investment decisions, the relative importance of capital allowances in those decisions, and how they are taken into account.

ii) The super-deduction – The Government wants to incorporate the latest evidence on the impact of the super-deduction into its decision-making. As part of this, it is interested in views on how the super-deduction has affected the investment decisions of businesses, ahead of it ending in 2023.

iii) The current system of capital allowances – As set out at Spring Statement, the Government acknowledges that the generosity of the permanent system of capital allowances compares unfavourably to international peers and wants to know what more the capital allowances regime can do to support business investment.

You can read the new policy paper here. Views must be submitted by 1 July 2022.

The Government says it will consider stakeholder views ahead of the Budget later this year.

INVESTMENT PLANNING

Help to Buy ISAs - quarterly statistics released

(FA5)

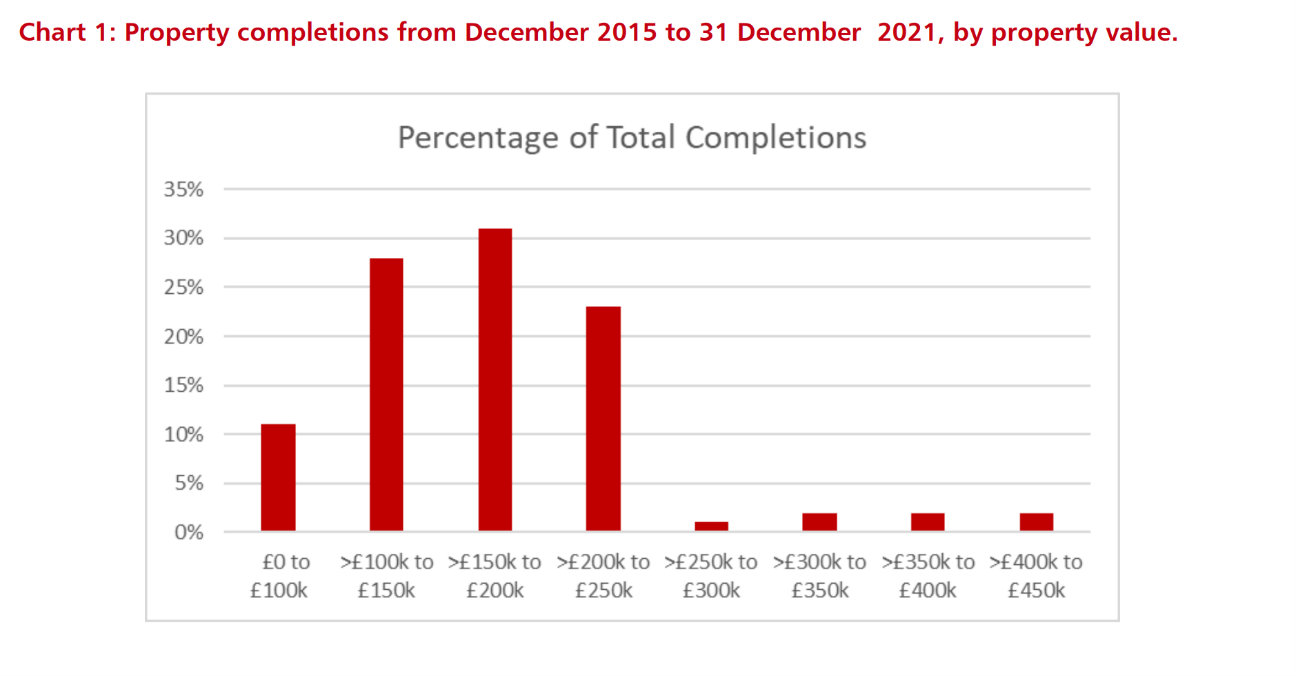

HMRC’s latest quarterly statistics on Help to Buy ISAs have been released. These cover the period from 1 December 2015 to 31 December 2021.

The statistics show that since the launch of the Help to Buy ISA, 480,494 property completions have been supported by the scheme and 630,264 bonuses have been paid through the scheme (totalling £714 million) with an average bonus value of £1,132.

The table below shows the number of property completions supported by the scheme broken down by property value:

The highest number of property completions with the support of the scheme is in the North West and Yorkshire and the Humber, with the lowest numbers in North East, Northern Ireland and Wales.

The statistics also show:

- The mean value of a property purchased through the scheme is £175,849 compared to an average first-time buyer house price of £228,627 and a national average house price of £274,712.

- 65.3% of first-time buyers who have been supported by the scheme were between the ages of 25 to 34.

- The median age of a first-time buyer in the scheme is 28 compared to a national first-time buyer median age of 30.

The venture capital market - new consultation

(AF4, FA7, LP2, RO2)

The Treasury Commons Select Committee has launched a Call for Evidence into the UK’s venture capital industry, including the ability of firms to source financing and the effectiveness of tax incentives. The Committee will also consider the regulation around venture capital, the role of key bodies such as the British Business Bank and the Advanced Research and Invention Agency, and how the UK industry can be strengthened.

From a tax perspective, the focus will be on the operation and effectiveness of the current tax incentives, such as the Enterprise Investment Scheme (EIS), the Seed Enterprise Investment Scheme (SEIS) and Venture Capital Trusts (VCTs) in the venture capital market, including any options for change.

It is also seeking feedback on the operation and effectiveness of the regulatory regimes concerning venture capital.

Mel Stride MP, chair of the Treasury Committee, said: “Venture capital has a key role in ensuring innovative UK firms prosper, and we want to make sure the market is working well.”

The Committee has requested written evidence submissions from stakeholders, academics and those working in the industry. It will hold oral evidence sessions and is likely to produce a report on its findings.

The closing date for comment is 5pm on 7 June 2022.

Another reminder of the risks of investing in crypto

(AF4, FA7, LP2, RO2)

The Financial Conduct Authority is reminding customers of the risks of investing in cryptoassets.

There has been recent social media coverage regarding cryptoassets and non-fungible tokens (NFTs) - a financial security consisting of digital data stored in a blockchain, a form of distributed ledger. The ownership of an NFT is recorded in the blockchain, and can be transferred by the owner which allows NFTs to be sold and traded.

The Financial Conduct Authority (FCA) is reminding customers of the risks involved when investing in cryptoassets. The FCA has not been given regulatory oversight over direct investments in cryptoassets and NFTs – and they are not protected by the Financial Services Compensation Scheme. Therefore, these are regarded as high-risk investments and those who invest ought to be fully aware of this.

Consumers can learn more about high-risk investments here.

Buy-to-let is facing headwinds as interest rates rise

(AF4, ER1, FA7, LP2, RO2)

Recently, Hamptons International gained some press coverage for saying that a 1% rise in base rates could see the net income of some higher rate taxpaying buy-to-let (BTL) investors halved, while a 2% rise could make net income disappear.

This is the type of statement that appears in the personal finance pages without any of the underlying assumptions being set out, so it can be challenging to understand the extremity of the claim.

We have now tracked down the Hamptons research, which showed the underlying assumptions were:

- A property valued at £202,000, which Hamptons says is the average BTL property value.

- A mortgage of 75% of the property’s value.

- A March 2022 mortgage interest rate of 2.1%, based on Bank of England data for secured loans in March 2022 (when base rate was 0.75%).

- Total expenses equal to 31% of gross rent, the average level claimed on 2020/21 self assessment returns. The figure was obtained by Hamptons via an FoI request.

What was missing from the Hamptons data was the gross rental yield, but working backwards, it looks to be about 5.94%, equating to rental income of £12,000. Put all the data into a spreadsheet and the results look like this:

|

|

Mortgage interest rate |

||

|

|

2.10% |

3.10% |

4.10% |

|

Rental income |

£12,000 |

£12,000 |

£12,000 |

|

Expenses (31% gross rent) |

-£3,720 |

-£3,720 |

-£3,720 |

|

Net taxable income |

£8,280 |

£8,280 |

£8,280 |

|

Tax @ 40% |

-£3,312 |

-£3,312 |

-£3,312 |

|

Post-tax pre-interest income |

£4,968 |

£4,968 |

£4,968 |

|

Interest |

-£3,182 |

-£4,697 |

-£6,212 |

|

Tax credit @ 20% |

£636 |

£939 |

£1,242 |

|

Post-tax post-interest net income |

£2,423 |

£1,210 |

-£2 |

Hampton’s numbers therefore stack up, but remember:

- The rental yield is higher than you might expect in the south of England.

- The 2.1% interest rate is an average number. Most BTL mortgages will be fixed rate, so any interest rate changes only become relevant at the end of the fix period. At the moment new two-year fixed rate BTL loans with 75% LTV can be found at under 2.1% and five-year fixes at around 2.5% (ignoring arrangement fees).

- A rise in base rates of 2% does not automatically translate into a 2% rise in fixed term rates, particularly if five-year rather than two-year fixes are being considered.

- For basic rate taxpayers the impact is less as they effectively receive full tax relief on interest. For additional rate taxpayers the numbers are worse (a loss of £415 with a 4.1% interest rate).

- These are figures based on direct ownership of the BTL property, whereas many BTL investors now use companies to hold their properties. Within that framework, interest is fully relieved against corporation tax. At the company level, the position is thus similar to the direct owning basic rate taxpayer. However, the company owner faces higher dividend tax rates in 2022/23 and, potentially, a 6% rise in the corporation tax rate next April.

Comment

The spectre of higher interest rates is not the only cloud on the BTL horizon. The Queen’s Speech promised a Renters Reform Bill which will remove section 21 orders, which currently allow ‘no-fault’ evictions. Further details will ‘shortly’ emerge in a White Paper.

New mortgage scheme: third set of statistics shows a significant increase

(ER1, LP2, RO7)

Official quarterly statistics on the mortgage guarantee scheme: 19 April (scheme launch) to 31 December 2021.

First announced at the March 2021 Budget, the scheme is available to first time buyers or current homeowners buying a house in the UK with a purchase value of £600,000 or less.

According to these latest statistics, there were 12,388 mortgage completions from scheme launch on 19 April to end December 2021, which represents 5% of all residential mortgage completions in the UK from the beginning of April to end December 2021.

This is a significant increase compared to the period ending in September 2021 where there were 6,535 mortgage completions.

The corresponding value of the guarantees was £326 million while the overall value of loans supported by the scheme was £2.2 billion.

The mean value of a property purchased or remortgaged through the mortgage guarantee scheme to the end of December 2021 was £189,804, compared to an average UK house price of £274,712. The median property value was lower at £165,000, reflecting that a higher proportion of properties in the scheme are in the lower value bands.

28% of all mortgage completions through the scheme so far were on properties worth £125,000 or less. 66% were on properties worth £200,000 or less. Only 21% of mortgage completions were made on properties valued at £250,000 and above.

The majority of mortgage completions through the scheme so far have been on terraced houses, making up 35% of total completions. 28% of completions in the scheme were on flats or maisonettes, while completions for detached houses and bungalows were much lower, making up 7% and 3% of the total respectively.

Over half of households who completed a mortgage with the support of the scheme had a household income of between £0 and £50,000. Take-up was lower for those on higher incomes; households with an income over £80,000 made up 11% of all completions. The median household income for borrowers using the scheme was £45,707, whilst the mean household income was slightly higher at £50,548.

86% of mortgage completions through the mortgage guarantee scheme to date have been for purchases by first-time buyers.

67% of completions through the mortgage guarantee scheme were in England, compared to England’s 84% share of overall UK residential mortgage completions.

In Scotland, the proportion of mortgage completions with the support of the scheme was significantly higher than the country’s share of total mortgage completions in the UK as a whole. Since the launch of the scheme, 9% of all UK mortgage completions have taken place in Scotland, compared to 24% of mortgage guarantee scheme completions.

In Wales, mortgage completions made up 4% of the UK total, compared to 5% of mortgage guarantee scheme completions.

In Northern Ireland, mortgage completions made up 3% of the UK total, compared to 3% of mortgage guarantee scheme completions.

PENSIONS

PASA publishes Good Practice Guidance on defined benefit (DB) transfers

(AF3, FA2, JO5, RO4, RO8)

The Pensions Administration Standards Association (PASA) has published its Good Practice Guidance on DB Transfers, which was drafted in response to the industry’s desire for greater flexibility when dealing with DB transfers. The document signals a significant change in approach by PASA, in light of comments received in response to the 2020 consultation on its proposed Code of Practice and the new Conditions for Transfers regulations that came into effect on 30 November 2021.

Many respondents to the 2020 consultation rejected the notion of set timescales for particular stages of dealing with a transfer. Helpfully, the new guidance explicitly recognises that trustees and administrators may be reliant on third parties over whom they have limited influence. It therefore encourages administrators to keep members and others, such as advisers, informed of any delays caused by the third party and to seek “to influence the third party to improve [its] service for the member”.

The guidance acknowledges that trustees and administrators are best placed to apply processes that are appropriate for their particular schemes, but these should be considered and, if appropriate, reviewed to ensure that they accord with the principles set by PASA.

In summary, these principles are that:

- The member’s experience is paramount – each step of the process should be undertaken as quickly and accurately as possible – bearing in mind the member’s perception, quality of outcome and the administrator’s service reputation.

- Member communications should be timely, fair and clear.

- Members and, where appropriate, others should be kept informed of any delays.

- Administrators should be mindful of the importance of safety and security when setting timescales for each stage of the process.

- Working practices should follow the Guidance and administrators should use the standard template for providing scheme information to a member’s financial adviser.

- Administrators should work collaboratively with third parties to meet the objectives and principles of the Guidance.

As in previous versions, the Guidance specifies that certain transfers are out of its scope – including bulk transfers and information relating to pension sharing. In light of the new conditions, introduced in November 2021, for a member to retain a statutory right to transfer, the Guidance considers that transfers to authorised Master Trust, public sector or authorised CDC schemes should be processed quickly, as should those to schemes on an administrator’s established ‘clean list’. Others are likely to be slower in light of the additional due diligence required.

The Guidance also includes links to other helpful guidance such as that from the Pensions Regulator and the Pension Scams Industry Group.

Ultimately, the Guidance states that the proposed processes are not prescriptive with administrators being able “to adapt them as necessary to fit their preferred operating model”, provided they follow the principles.

TPR publishes draft policies for consultation

(AF3, FA2, JO5, RO4, RO8)

The Pensions Regulator (TPR) has published for consultation a new, consolidated and simpler draft enforcement policy and a draft updated prosecution policy.

The scheme management enforcement policy incorporates TPR’s finalised approach regarding the use of its “overlapping powers” (i.e., the ability to impose high financial penalties and/or criminal sanctions in relation to the same act) and its “information-gathering” policies. TPR consulted on these in autumn 2021 alongside policies concerning the imposition of high financial penalties, up to £1m. TPR has therefore, also published final separate versions of its high fines policies in relation to use of its (i) avoidance-type powers and (ii) information requirements.

Moreover, TPR has published its response to last year’s consultation on the proposed approach to its new powers and states that the draft enforcement policy takes account of stakeholder responses.

Background

TPR has powers to intervene in the management of pension schemes or where corporate activity puts members’ benefits at risk. Many of these powers have been in place since the Pensions Act 2004, such as the power to intervene in scheme funding matters including, for example, to be able to modify future accrual or to impose penalties for breaching employer-related investment limits. Readers will be aware that the Pension Schemes Act 2021 extended these powers markedly, allowing TPR to impose much higher financial penalties and to prosecute specified criminal acts. It also widened the range of parties against whom many of these powers could be exercised.

Largely in response to concerns that normal business activity could be adversely affected, TPR has sought to make clear when and how it would use its powers and to set these out in formal policies.

Scheme management enforcement policy

This combines three existing policies covering TPR’s approach to the investigation of cases and potential enforcement action in relation to defined benefit, defined contribution and public service schemes. The draft follows the modular approach adopted for the draft Single Code of Practice, which TPR hopes will help users navigate through it.

It comprises 12 chapters, some of which are divided into sub-sections. Of these, the chapters headed “Investigations” and “Overlapping powers” contain TPR’s finalised policies from last year’s consultation including updated examples of how it expects to exercise its overlapping powers. These pages are marked clearly to say that these chapters are not open to consultation.

The brief chapter headed “Assessment of risk and harm” outlines the factors TPR considers relevant in determining what, if any, action to take, while another three chapters cover use of TPR’s enforcement powers, outcomes sought – which includes prevention, remedy, restoration and deterrence – and the enforcement options available to TPR. The last of these refers to the issuing of statutory notices, anti-avoidance powers, financial penalties and criminal powers.

The remainder of the draft policy covers matters such as the enforcement procedure, how to challenge enforcement action and TPR’s approach to publishing information about cases.

The compliance and enforcement policy for Master Trusts, as well as that concerning automatic enrolment, remain separate.

Draft prosecution policy

This is comparatively short and sets out, amongst other things, TPR’s general approach to prosecuting criminal offences, who it can prosecute and how it will select cases for investigation and prosecution. It also outlines what actions it may take including the issuing of cautions and preventing offenders from benefitting financially from their criminal activity.

Responses to the consultation

Responses should be on TPR’s standardised form published as part of the consultation and must be made by 24 June 2022 to PSA21policies@tpr.gov.uk.

TPR: Spot checks to be targeted at suspect employers across the UK

(AF3, FA2, JO5, RO4, RO8)

TPR has announced in a Press Release that it will carry out spot check inspections on employers suspected of failing to meet their workplace pensions duties. The majority of employers targeted will be those who have failed to make the correct pension contributions for their staff. The spot checks mark a return to larger scale in-person inspections, following the lifting of COVID-19 restrictions earlier this year. On-site inspections will be carried out across a number of regions and cities in the coming months, including Greater Manchester, Nottingham, Greater London and Belfast.

Joe Turner, TPR’s Head of Compliance and Enforcement, said: “Despite the challenges of the past two years, the majority of employers have continued to meet their responsibilities, including paying contributions in full on time and recognising that automatic enrolment is business as usual. But where we are aware that an employer is failing to do the right thing, we will take action to protect savers, including on-site inspections. This means we could be knocking on an employer’s door in any part of the UK. Where an employer fails to meet their automatic enrolment duties, our priority is to make sure they become compliant. We use our wide-ranging powers to do so, including issuing financial penalties where appropriate.”

WPC publishes correspondence relating to tax treatment of pension liberation victims

(AF3, FA2, JO5, RO4, RO8)

The Work and Pensions Committee (WPC) has published correspondence with the Economic Secretary to the Treasury relating to the tax treatment of pension liberation victims. In response to a letter from WPC Chair Stephen Timms, John Glen said that HMRC continued to make progress on a number of areas highlighted by the Committee in its March 2021 report, including improvements to its communications and published guidance.

Mr Glen highlighted that HMRC has a legal duty to collect tax which is lawfully due and carefully considers each case to ensure the tax treatment is correct. Responding to a question regarding discretion, Mr Glen wrote: “Where, based on the facts in its possession, HMRC seeks to collect tax from pensions savers, it does so as it has determined there is sufficient evidence to show that the individual has received, or expected to receive, an unauthorised payment by entering into a scheme which was designed to circumvent the tax rules. Many people involved in pension liberation claim publicly they are victims of pension scams and did not set out to avoid tax. However, when checking against HMRC’s records, HMRC will often find differences between what the individuals say publicly and the established facts... The scope of the Commissioners’ discretionary powers has been the subject of case law decisions over the years. This case law has framed the limits of the discretionary powers and set out the kind of exceptional circumstances in which they may be justifiably exercised.”

Royal Assent given to GMP conversion Bill

(AF3, FA2, JO5, RO4, RO8)

A private members' bill aimed at clarifying and streamlining the process of guaranteed minimum pensions (GMPs) conversion has been granted Royal Assent to become the Pension Schemes (Conversion of GMPs) Act 2022. The Bill was first introduced in June 2021 by Independent MP for Rutherglen and Hamilton West Margaret Ferrier.

Minister for Pensions and Financial Inclusion Guy Opperman commented: “I warmly welcome the passing of this Act and commend MP Margaret Ferrier for introducing this valuable legislation. This will benefit many hard-working people across the country by helping pension schemes equalise the effects of GMPs between men and women.”

This document is believed to be accurate but is not intended as a basis of knowledge upon which advice can be given. Neither the author (personal or corporate), the CII group, local institute or Society, or any of the officers or employees of those organisations accept any responsibility for any loss occasioned to any person acting or refraining from action as a result of the data or opinions included in this material. Opinions expressed are those of the author or authors and not necessarily those of the CII group, local institutes, or Societies.