What's new bulletin July 2022

News article

Publication date:

01 August 2022

Last updated:

19 February 2026

Author(s):

Technical Connection

Update from 15 to 28 July 2022.

TAXATION AND TRUSTS

Making Tax Digital - an update

(AF1, AF2JO3, RO3)

From April 2024, Making Tax Digital (MTD) for income tax, will apply to unincorporated businesses and landlords with business and/or property income over £10,000.

The Income Tax (Digital Requirements) Regulations 2021 (SI 2021 No 1076) set out the requirements that relevant persons must comply with under MTD for Income Tax. These include the use of MTD-compatible software to keep and preserve their business records (business income and expenses) digitally, send quarterly updates of their records to HMRC, and submit an end of period statement to HMRC.

HMRC is inviting views on these which provide additional information on the key requirements of MTD as they relate to:

- the use of functional compatible software;

- the information required when submitting a quarterly update and end of period statements;

- retail sales election.

The draft notices specify the proposed dataset requirement. You can read the consultation here. It closes at 11:45pm on 28 July 2022.

Later in the year, HMRC will publish guidance to explain how taxpayers can reflect any accounting and tax adjustments that may be required to reconcile the quarterly submissions to the final taxable profits for the year.

OTS review of tax simplification

(AF1, RO3)

The Office for Tax Simplification (OTS) is an independent adviser to Government on tax simplification; it does not implement changes - these are a matter for Government and for Parliament.

The OTS policy paper:

- sets out an analysis of tax complexity and its impact;

- recommends principles for officials to use in tax policy development;

- refreshes the OTS’s future aims and priorities, and measures of success.

This has been published as a result of a formal review commissioned by the previous Chancellor and the Financial Secretary, focusing on conclusions that can inform how the OTS and Government should prioritise simplification efforts over the next five years.

OTS recommendation

Whilst undoubtedly officials will not set out to make complex law, sometimes the policy itself or other drivers will make it so. The OTS has suggested a framework of questions which officials and ministers may wish to consider when developing and re-visiting policy to look for complexity and mitigation:

- Are the rules, their purpose and their consequences easy to understand and predict?

Are the tax rules logical, with their purpose understood and the outcomes of choices clear and running with the grain of the lives and businesses they encompass? Do they add complexity when taken in aggregate with the immediate and wider existing rules? - Are the rules and their administration taking advantage of modern developments, including technology?

Can technology shoulder some of the administrative or process burden for taxpayers? Can technology help manage the complexity without undermining informed choice? Is this technology available and accessible for the majority, and how are the digitally excluded or challenged served? Are tax policies capable of being implemented in a digital manner? - Is it easy enough to comply with the rules?

As well as the core rules themselves, can taxpayers understand the administration, processes, and obligations? Whether they are in scope, what they need to do and when? Is the cost to taxpayers, intermediaries, advisers, and government proportionate? - Can taxpayers be better supported?

Are there ways that intermediaries can take some of the burden away from taxpayers in reporting or payment, or by directing taxpayers to HMRC guidance? Is the guidance fit for the audience? Are advisors enabled to help their clients manage their tax affairs, including through access to taxpayer data and HMRC systems?

This report says that it recognises that this should neither be as simple nor as rigid as a ‘checklist’, but considered proportionately and meaningfully.

IHT receipts rise again

(AF1)

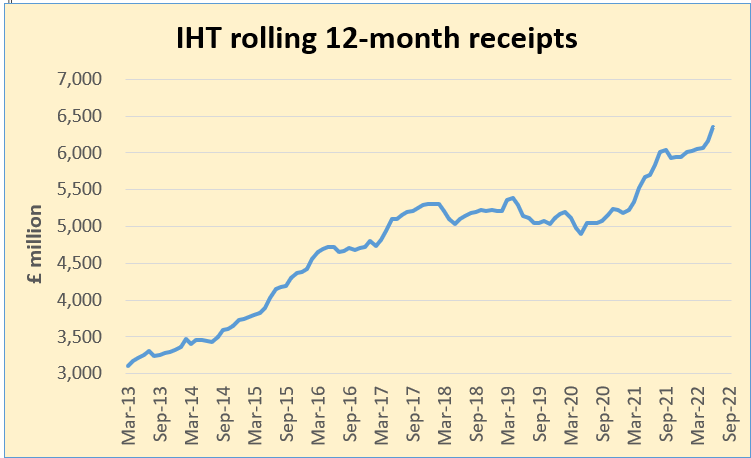

According to HMRC’s latest statistics, inheritance tax (IHT) receipts for April to June 2022 were just under £1.8 billion, which is £.3 billion higher than in the same period a year earlier. There were record high receipts in June 2022 of £726 million. According to HMRC, this can be attributed to a small number of higher-value payments than usual.

The above chart contains 12-month rolling receipts since March 2013. Receipts for the 12 months to June 2022 were £6.348 billion, up from £6.161 billion for the 12 months to May 2022.

The OBR forecasts for the current year and future years are: £6.7 billion for 2022/23; £6.9 billion for 2023/24; £7.3 billion for 2024/25; £7.8 billion for 2025/26; and £8.3 billion for the following year, 2026/27.

These projected increased IHT receipts provide another reminder of the importance of IHT planning.

Government sets out conditions for disclosure of TRS data

(AF1, JO2)

The purpose of the TRS is to capture information on most trusts under the anti money laundering rules. These rules also require that this information be available, in principal, for public scrutiny.

However, the UK will implement a strict regime with requests being carefully examined before any information is released.

HMRC has published the following:

Trust Data requests

From September 2022, HMRC may share information on the TRS in limited circumstances with some third parties following a Trust Data Request. Trust Data Requests can be submitted on or after 1 September 2022.

Legitimate Interest Trust Data Request

Individuals or organisations must demonstrate that they are looking into a specific instance of money laundering or terrorist financing in relation to a specific trust, and that the information on the register that is the subject of the request will further that investigation.

Offshore Company Trust Data Request

Data can be requested on a trust that holds a controlling interest in a non-EEA (‘third country’) company or other legal entity. A ‘controlling interest’ is usually where the trust holds more than 50% of the shares in the entity or can control it in some other way.

HMRC also confirmed that the type of information that will be shared will be limited and includes details of the beneficial owners that are associated with the trust including the name, month and year of birth, country of residence, nationality, and their role in the trust.

HMRC will not share data on certain types of trusts, including non-express taxable trusts that are registered, only because of a liability to UK taxation and not also as a registerable express trust.

HMRC will not disclose information on specific individuals if exemptions apply to them, for example those under 18 or lacking mental capacity, or where releasing the information might produce a disproportionate risk of fraud, kidnapping, blackmail, extortion, harassment, violence or intimidation.

Comment

It is good to see that only where a legitimate reason has been submitted will information be provided to those that request it.

INVESTMENT PLANNING

CGT free gilts - an update (AF4, FA7, LP2, RO2)

HMRC has updated its list of gilt-edged securities which have a redemption date on or after 1 January 1992, disposals of which are exempt from tax on chargeable gains under section 115 of the Taxation of Chargeable Gains Act 1992.

Gilt-edged securities or gilts are UK Government loan stock. Since 2 July 1986 all disposals of gilt-edged securities have been exempt from capital gains tax (CGT).

The formal definition of gilt-edged securities is in TCGA92/SCH9/PARA1. They are:

- securities listed in Part II of Schedule 9. This includes all securities which were listed up to April 1992;

- securities which are specified by Treasury Order. These are securities which have been issued since April 1992.

HMRC updates this list each time a Treasury Order specifies further exempt gilts. See the latest list.

June inflation numbers

(AF4, FA7, LP2, RO2)

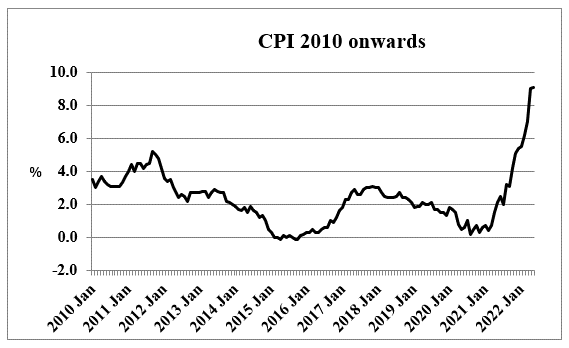

The UK CPI inflation rate moved higher in June.

The CPI annual rate for June rose by 0.3% to 9.4%, 0.1% above market expectations, according to Reuters. Again there are no historical precedents, as the modelled CPI data, by the Office for National Statistics (ONS), only goes back to January 1989. A year ago the annual CPI reading was 2.5%, underlining the story told by the graph of a sudden and unprecedented inflationary surge - June’s monthly rise of 0.8%, compared with 0.7% in May. The last three months have seen a 4.0% rise in the CPI.

The CPI/RPI gap narrowed to 2.6% with the RPI annual rate up 0.1% to 11.8%, its highest level since January 1982. Over the month, the RPI index was up 0.9%.

The ONS’s favoured CPIH index also rose by 0.3% to an annual 8.2%. The ONS notes that the increase in inflation was mainly due to the following factors:

Upward drivers

Transport. This category made the largest upward contribution in June. Overall, prices rose by 2.4% between May and June 2022, compared with 1.3% between the same months a year ago. Predictably, the main upward effect came from motor fuels, which have seen a 42.3% rise in the last year. The ONS says average petrol prices rose by 18.1p a litre in June, with diesel up 12.7p. Elsewhere, there was again an offsetting, downward contribution, from second-hand cars, where prices fell 2.5% in May to June 2022, the fifth consecutive month of declines. A year ago, the monthly increase was 4.4%. Second-hand car inflation is now running at an annual 15.2%.

Food and non-alcoholic beverages. Food and non-alcoholic beverage prices rose by 9.8% in the year to June 2022, up from 8.7% in May, and the highest rate since March 2009. There was a 1.2% rise between May and June 2022, the largest between May and June since 2008. Over the last three months, this category has recorded a price increase of 4.3%.

The increase in the annual rate between May and June 2022 was driven by price movements across many of the more detailed classes. The largest upward effect came from milk, cheese and eggs, where prices of milk and cheese rose between May and June 2022, compared with price falls a year ago. Other upward effects came from vegetables, meat and other food products (such as ready meals).

In June 2021, the food and non-alcoholic drinks category was still experiencing declining prices - annual deflation was 0.6%.

Restaurants and hotels. Prices charged in restaurants and for accommodation rose by 8.6% in the year to June 2022, up from 7.6% in May. The annual rate to June 2022 was the highest since August 2021, which was influenced by the effect of the previous year's Eat Out to Help Out scheme.

Prices rose by 1.2% between May and June 2022, compared with a smaller rise of 0.3% a year ago. However, it should be noted that some items within this category were imputed in June 2021 because they were still not available following the coronavirus lockdown earlier in the year. This means that monthly movements for those items in 2021 reflect imputed index movements and should be interpreted with caution.

Downward drivers

Clothing and footwear. Prices were little changed on the month in 2022, but rose by 0.8% between May and June 2021. Prices normally fall at this time of year as the summer sales season begins, but there was little movement in 2022 and, in 2021, prices were still rising following the end of the coronavirus lockdown. Arguably, in the current environment, prices not rising count as a sale…

Six of the twelve broad CPI categories saw annual inflation increase, while five (Alcoholic beverages and tobacco, Clothing and footwear, Furniture, household equipment and maintenance, Health and Recreation and culture) fell, and one was unchanged. Housing, water, electricity, gas and other fuels was predictably the category with the highest annual inflation rate at 19.6% (up from 19.4%). Next highest was another energy dependent sector, transport, at 14.9%, up 1.1%.

Core CPI inflation (CPI excluding energy, food, alcohol and tobacco) fell by 0.1% to 5.8%. Goods inflation in the UK rose 0.3% to 12.7%, while services inflation also added 0.3% to 5.2%.

Producer Price Inflation was 16.5% on an annual basis, up from a revised 15.8% in May on the output (factory gate) measure. Input price inflation was 24.0%, up from a revised 22.4% in May, again establishing a new high since records began in January 1985. Metals and non-metallic minerals, and food products provided the largest upward contributions to the annual rates of input and output inflation, respectively.

Comment

On Tuesday, Andrew Baily, the Governor of the Bank of England, made clear that a 0.5% base rate rise was “on the table” for August’s Monetary Policy Committee meeting. These latest inflation numbers have reinforced the likelihood of the base rate being 1.75% on 4 August.

Relief on disposals of joint interests in land - new measures

(AF4)

Members in LLPs and partners in Scottish partnerships are currently unable to claim CGT relief on an exchange of interest in land or private residences held, prior to the disposal, by the partnership (in contrast to English partnerships).

This was not the intention of the relevant legislation (The Taxation of Chargeable Gains Act 1992), and the Government is therefore amending it.

Legislation will be introduced in Finance Bill 2022-23 to amend sections 248A and 248E of the Taxation of Chargeable Gains Act 1992.

These clauses clarify legislation to ensure roll-over relief and private residence relief are available for LLPs and Scottish partnerships when an exchange of interest in land or private residences held by the LLP or partnership takes place as it is when the land is held by the individual members or partners.

This measure will have effect for claims for relief made on or after the Budget 2022.

PENSIONS

Tax relief for low earners in net pay pension schemes

(AF3, FA2, JO5, RO4, RO8)

As announced in the Autumn 2021 Budget, the Government is introducing legislation to correct an anomaly in the tax system that disadvantages some low earners. Currently, low earners in net pay schemes (generally occupational schemes) do not receive any tax relief on pension contributions where their income is below the personal allowance. Relief is given by reducing the individual’s level of taxable income and if that income is not subject to tax then no relief is available. This contrasts with a relief at source scheme (generally personal pensions) where even non-tax payers benefit from 20% relief that is automatically added by the scheme to any contributions that are paid.

To rectify this, the new rules place a duty on HMRC to make top up payments “as far as is reasonably practicable” directly to eligible individuals. The new rules take effect from the 2024/25 tax year with the first payments expected to be made as soon as possible after the end of the tax year.

The top up payments will be made at the relevant basic rate based on the individual’s residency.

It is expected that individuals will not need to confirm their entitlement, as HMRC will identify eligible individuals based on information already held. However, individuals will need to confirm or provide their payment details via a digital service for the top up payment to be made.

The Government estimates this will benefit 1.2million low earning individuals.

Comment

Whilst it’s good to see further steps being made to rectify this anomaly in the tax system, it is disappointing that it is taking so long to implement. Low earners will not see the benefits of the measure for around three more years. Let’s hope that the time delay will ensure the payment process can be smoothly implemented when it eventually does come into force. In the meantime, although low earners can receive tax relief via a relief at source scheme, opting out of any current occupational scheme may lead to the loss of a far more valuable employer contribution, so caution should be taken if advising clients in this area.

Pension Schemes Newsletter 141 – July 2022

(AF3, FA2, JO5, RO4, RO8)

Pension Schemes Newsletter 141 covers the following:

- Legislation Day (L-Day) 2022;

- Relief at source — annual return of information for the tax year 2021 to 2022;

- Managing Pension Schemes service;

- Accounting for Tax (AFT) returns;

- Pension flexibility statistics; and

- Qualifying Recognised Overseas Pension Schemes (QROPS) transfer statistics.

Areas of interest

Pensions flexibility statistics

From 1 April 2022 to 30 June 2022 HMR processed

- 7345 - P55 forms

- 1,746 - P53Z forms

- 947 – P50Z forms

In total more than £33 million of tax was repaid to over 10,000 people with an average reclaim of £3,363.

Qualifying Overseas Pension Schemes (QROPS) transfer statistics

The number of QROPS transfers increased by 30% in the 2021/22 tax year up to 3,900 from 3,000 in 2020/21. The total value of transfers was £517m. However, the 2021/22 numbers are still well below the 2019/20 figures and it is likely that the 2020/21 figures are the anomaly in an otherwise downward trend in numbers and values since 2014/15.

DWP responds to its consultation on dashboard regulations

(AF3, FA2, JO5, RO4, RO8)

The DWP has published a lengthy response to its consultation on dashboard regulations. It has also published a useful and relatively readable summary of the key policies following the consultation.

Overall, and unsurprisingly, the DWP is by and large continuing on the same course but some points of note from the response and summary are as follows:

Some staging dates have been put back

The staging deadline for public service pension schemes has been pushed back five months from 30 April 2024 to 30 September 2024.

The deadlines for the first two staging cohorts have been pushed back by two months from 30 June 2023 to 31 August 2023 for master trusts with 20,000 or more relevant members and from 31 July 2023 to 30 September 2023 for money purchase schemes used for automatic enrolment with 20,000 or more relevant members.

In addition, the staging date for hybrid schemes will now be based on a “simplified approach” where the deadline is determined by totalling the number of relevant members across both money purchase and non-money purchase sections and using that total to determine the staging deadline as if the hybrid scheme were a non-money purchase scheme. This is a significant change from earlier proposals where the entire scheme would stage based on the earlier of the two sections’ equivalent staging dates.

Some data and timing adjustments

For members with non-money purchase benefits who are deferred members, trustees or managers must provide an accrued value, but this may be calculated using a simplified method in certain circumstances within 2 years of the scheme’s connection date.

Where a non-money purchase benefit is comprised of tranches, trustees or managers must provide either a combined value, or separate sets of values, depending on what they consider is the best representation of the benefit.

The DWP is clear that it does not feel it is appropriate for hybrid schemes to get a blanket 10-day response time for providing value data. Therefore, in such schemes each benefit should be returned on its own merit (i.e. within 3 days for a money purchase benefit and within 10 days for a non-money purchase benefit).

Other matters

Schemes in wind up will still be required to connect according to their staging deadline. However, connected schemes (or sections of schemes) in wind up should only provide value data (plus contextual and signpost information) if the trustee or manager of the scheme considers it appropriate to do so.

The criteria for allowing applications to defer a scheme’s staging deadline will not be expanded and therefore, importantly, the deadline for applications to defer must be submitted no more than 12 months from when the regulations come into force – the deadline is not primarily linked to the scheme’s own staging date.

The DWP states that it will not be seeking to prohibit data export from dashboards in the Regulations and will leave it to the Financial Conduct Authority to address this issue in its own rules.

Comment

The first staging dates remain only just over a year away but the change of staging deadline for public service pension schemes may be significant since it is understood that the DWP only wants to launch dashboards to the public when a majority of members would be able to use the service. This was expected to be summer 2024 but if public service schemes have not staged by then this timetable must now be in doubt.

It is positive that a simplified method for calculations for deferred non-money purchase members has been agreed; this was one of the more controversial areas in the original consultation. However, it continues to be a concern about the risks posed by allowing the export of data from dashboards to other, possibly less well-regulated, environments and therefore, it is to be hoped that the FCA rules will give strong consumer protection in this area, provided they are ahead of the curve on this one.

TPO publishes factsheet on approach to McCloud and Sargeant complaints

(AF3, FA2, JO5, RO4, RO8)

The Pensions Ombudsman (TPO) has published a factsheet entitled The Pensions Ombudsman’s (TPO) approach to McCloud and Sargeant age discrimination complaints, following the age discrimination in public sector pension schemes identified by the Court of Appeal. The note discusses:

- a brief background of the issues;

- TPO’s view on what affected members and schemes can do now; and

- TPO’s present approach to complaints and disputes concerning these issues.

It explains that because schemes cannot, due to the implication of tax rules take action to remedy the position before legislation is changed and the fact that legislation is to be changed, TPO is unlikely to take any steps to investigate complaints. However members/dependant can initiate a complaint under the relevant scheme’s internal disputes resolution procedure (IDRP) and, once that two-stage process has completed refer the matter to TPO if they wish.

DWP consultation on Defined Benefit Scheme funding

(AF3, FA2, JO5, RO4, RO8)

The DWP are seeking feedback on the draft Occupational Pension Schemes (Funding and Investment Strategy and Amendment) Regulations 2023. These draft Regulations set out the detail of the new requirements in the Pensions Act 2004, inserted by the Pension Schemes Act 2021, for defined benefit pension schemes to have a funding and investment strategy and submit a statement of strategy to the Pensions Regulator.

This consultation also invites comments on the proposals to amend the Occupational Pension Schemes (Scheme Funding) Regulations 2005 and details of the new requirement for defined benefit schemes to appoint a Chair where they do not already have one.

The closing date for responses is 17 October 2022, with the response due to be published before or with the Statutory Instrument when it is laid.

This document is believed to be accurate but is not intended as a basis of knowledge upon which advice can be given. Neither the author (personal or corporate), the CII group, local institute or Society, or any of the officers or employees of those organisations accept any responsibility for any loss occasioned to any person acting or refraining from action as a result of the data or opinions included in this material. Opinions expressed are those of the author or authors and not necessarily those of the CII group, local institutes, or Societies.