What's new bulletin April - May 2022

News article

Publication date:

13 May 2022

Last updated:

25 February 2025

Author(s):

Technical Connection

Update from 22 April to 5 May 2022.

TAXATION AND TRUSTS

Temporary non-residence and CGT

(AF1, RO3)

HMRC has recently updated its guidance. Individuals are normally charged capital gains tax (CGT) on the gains on disposal of assets if they are resident in the UK. An individual’s residence status is determined by the rules within the Statutory Residence Test (SRT).

The SRT rules also provide that a tax year may be split into a UK part and an overseas part. CGT would normally only apply to gains arising in the UK part of a split year. RDR3 Guidance Note: Statutory Residence Test (SRT) has detailed information about the SRT.

However, an individual who is not resident in the UK may be taxed on gains if they dispose of:

- Assets which are (or have been) used by a trade they carry on in the UK through a branch or agency (please see CG25500Pfor further information).

- A direct or indirect disposal of an interest in UK land. This includes UK residential property (please see HS307)).

Subject to this, an individual who left the UK to live abroad and ceased to be resident in the UK will not be chargeable on gains made in years of assessment after they left the UK unless their non-residence was temporary and they resume tax residence in the UK within a certain time. Generally, the temporary non-residence rules will apply where an individual meets the following conditions:

- They had ‘sole UK residence’ for either the whole or a part of at least four out of the seven tax years preceding the year of departure.

- They had a ‘residence period’ that was not ‘sole UK residence’ in between two periods of ‘sole UK residence’.

- The total of the ‘residence periods’ that were not ‘sole UK residence’ did not exceed five years in length.

For these rules, the temporary period of non-residence may start or end within a tax year due to the ‘split year’ treatment (please see section 5 of RDR3 Statutory Residence Test notes).

Important concepts within these rules are those of ‘sole UK residence’ and ‘residence period’. These are explained in section 6 of RDR3 Statutory Residence Test notes.

So, an individual who ceased to be UK resident in 2015/16 or earlier and does not become UK resident again until 2021/22 will not be within the scope of the rules. If they were away from the UK for a shorter period, they may need to consider the detailed rules. Further discussion of these is available in CG26500) and section 6 of RDR3 Statutory Residence Test notes.

Temporary non-residence and CGT

If an individual whose year of return to the UK is 2021/22 meets the conditions for temporary non-residence outlined above, then certain gains and losses arising during their period of temporary non-residence are treated as arising in 2021/22. Such gains will therefore be taxed, with losses also becoming allowable, in 2021/22.

Example 1

Mr Smith, who has lived all his life in the UK, left the UK on 25 March 2017 for a contract of employment abroad. He returned to the UK and resumed residence in the UK on 2 February 2022. He realised a chargeable gain (on an asset acquired before he left the UK) of £35,000 on 15 September 2017. Mr Smith fulfils all of the residence conditions in section 10A TCGA 1992:

- he has resumed UK residence in 2021/22 (the year of return);

- there’s a period not exceeding five years immediately before non-sole UK residence where he was not resident in the UK;

- he had sole UK residence for at least four out of the seven tax years immediately prior to his year of departure (in this example, in fact, all seven).

Mr Smith will be chargeable on this gain in the tax year of return to sole UK residence (2021/22) on the gain of £35,000.

If the individual is non-UK domiciled and claims the remittance basis in 2021/22, then any foreign chargeable gains accruing and remitted to the UK during the period of temporary non-residence become chargeable in the year of return.

Treaty non-residence

Other countries may have different financial years and residency rules, so an individual may be resident in the UK under its domestic law as well as resident in another country under its law. Where an individual is a resident of both countries, the Double Taxation Agreement (DTA) between the countries will provide tie-breaker rules to enable residence for the purposes of the agreement to be determined.

Whole tax years, or UK parts of split years, where an individual is regarded as non-UK resident in accordance with a double taxation treaty, form part of the period of non-UK residence for the rules determining whether an individual was temporarily non-resident (please see CG26680 and, for examples, CG26690).

What gains and losses are included

Some gains and losses arising during periods of temporary non-residence are not within the scope of these rules. An individual may acquire assets after leaving the UK for a period of temporary residence abroad. If such assets are disposed of in that period, any gains or losses on such assets are not normally treated as arising when UK residence is resumed.

Example 2

Continuing with Mr Smith from example 1, on 6 June 2017 Mr Smith bought 20,000 shares in a UK company. He sold all of the shares on 15 March 2018, realising a gain of £12,000. Mr Smith is within the temporary non-residence rules, but because the shares were acquired after his departure from the UK the gain is not treated as arising in the year of return.

While gains and losses on assets acquired after leaving the UK are in general excluded from the scope of the temporary non-residence rules, there are some important exceptions to this exclusion. Some assets acquired after the period of non-sole UK residence begins, have a connection with the earlier period of sole UK residence. Gains accruing on the disposal of such assets during a period of temporary non-residence are not excluded, they would be chargeable in the tax year of return.

These exceptions fit into three categories:

- assets acquired from another person who themselves acquired them under no gain or no loss rules (please see CG26610);

- assets which have had their acquisition cost reduced by a rollover relief given on the disposal of another asset which had been acquired by the individual (please see CG26630);

- gains or losses which represent those on an asset held before the individual left the UK that were deferred until another asset was disposed of — when that other asset is disposed of, crystallizing the gain during the period of temporary non-residence, it will be chargeable in the period of return (please see CG26630).

Gains of non-resident companies and settlements

Gains accruing to a company or a settlement during the period of non-residence may also need to be considered when UK residence is resumed. These are:

- gains accruing to a closely controlled non-resident company, attributed to UK resident participators in proportion to the extent of their participation (please see CG57200P);

- gains accruing to settlor-interested non-resident settlements that are attributed to a UK resident and domiciled settlor (please see CG38430P and HS299) — the amount charged on the temporarily non-resident settlor may be reduced if gains have also been charged on UK resident beneficiaries (please see CG26590);

Where such gains arose in the temporary period of non-residence and would have been chargeable on the individual had they been UK resident, they are treated as accruing in the period of return. Where the remittance basis may be relevant, please see CG26650 onwards.

Double Taxation Relief

In some cases, the temporary non-residence rules may mean that a gain is taxed in another country in the year that it arises and then in the UK for the year of return. If tax has been paid on the gain in another country, the taxpayer may be able to claim relief for double taxation. HS263 Relief for Foreign Tax Paid explains this further and provides details on how to claim.

Please see HMRC’s guidance for more information.

Rising England and Wales probate application volumes keep grant backlog high

(AF1, RO3)

The Society of Trust and Estate Practitioners has reported that there has been an increase in grant applications from 18,275 in December 2021 to 23,572 in January 2022 received by HMCTS. This increase is in line with the expectations based on recent figures which shows that 17,000 more grants were issued in 2021 which makes that year the 2nd highest in the last ten years.

HMCTS claims that it expects the number of grant applications to decline in May 2022 stating it has everything in hand and have confirmed that the backlog is not increasing due to them processing the new applications.

To give an indication as to the timescales, digital applications in January took on average 4.2 weeks to process from submission of the application to the grant being issued where there were no “stops” in the process.

“Stops” are where there are interruptions to the process generally where an estate is due to pay inheritance tax or where there are anomalies in the application forms. Where inheritance tax (IHT) is due applications are normally made at the same time to HMCTS and HMRC resulting in a delay of 20 working days before HMCTS can act on the application. Where there is a “stop” in the process it expands the timeline on average to 15.8 weeks.

Where the submission is on paper the average time taken to process is 9.8 weeks without “stops” and 21.5 otherwise.

HMCTS have taken the decision to put more resource into processing the “stop” cases rather than on processing new applications and is looking at further changes to its IT systems to reduce these stops.

Comments

We can only wait and see whether the numbers reduce as predicted to ascertain whether or not the process time will reduce. It is already a very emotional time for clients when they have to deal with the death of family or friends so any improvement in process and time when dealing with obtaining the grant will be welcome.

Clamping down on promoters of tax avoidance - updated guidance

(AF1, RO3)

The Government has introduced new legislation to clamp down on promoters of tax avoidance. This includes the publication by HMRC of information about tax avoidance schemes. HMRC’s guidance is intended to help people understand this measure and how this will be applied in practice. Information regarding penalties for facilitating avoidance schemes involving non-resident promoters has been added.

The new legislation in Part 6 of the Finance Act 2022 will enable HMRC to publish details of schemes they suspect to be tax avoidance schemes and to name suspected promoters of such schemes at an earlier stage than previously possible. It will also allow HMRC to challenge misleading information that promoters of tax avoidance communicate to taxpayers and release into the public domain.

Penalties for facilitating avoidance schemes involving non-resident promoters

This new guidance is based on legislation contained in Finance Act 2022 which introduces a new penalty applicable to UK-based entities who facilitate tax avoidance schemes involving non-resident promoters. The penalty can be for an amount up to 100% of the total fees, or the amounts which are the economic equivalent of fees, received by all entities involved in the promotion of that avoidance scheme. This would include fees paid directly to the non-resident promoter, together with fees paid to any other entities or persons who form part of the promotion structure for the scheme.

It is more difficult for HMRC to investigate avoidance involving offshore promoters and to challenge the behaviours of the persons involved because complex offshore enquiries take much longer and require far more resource than equivalent UK cases.

A person is a promoter in relation to arrangements or a proposal that are relevant arrangements or a relevant proposal under section 234 of Finance Act 2014 if the person does anything that would cause the person to be carrying on a business as a promoter in relation to the arrangements or proposal under section 235 of Finance Act 2014, or, where the person is a member of a promotion structure, to be treated as doing so. A non-resident promoter is a person who carries on a business as a promoter and is resident outside the UK.

A penalty for facilitating an avoidance scheme involving a non-resident promoter (referred to as a ‘further’ penalty) is chargeable on a UK person where the UK person:

- has undertaken activities as a member of the same promotion structure as a non-resident promoter in relation to a tax avoidance scheme promoted by that non-resident promoter (the UK person’s activities are referred to as the ‘original activities’);

- is liable to pay one or more specified penalties in respect of the original activities (these penalties are referred to as ‘the original penalties’).

The full guidance can be found here.

INVESTMENT PLANNING

Gilt yields - real returns

(AF4, FA7, LP2, RO2)

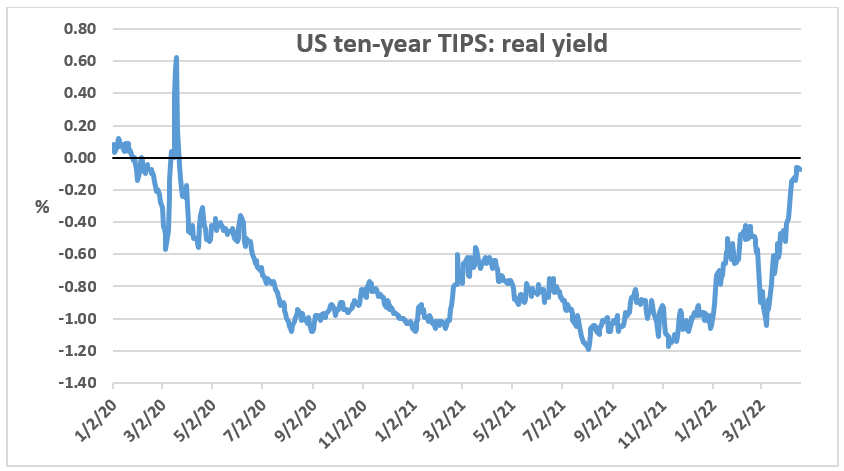

The yields on index-linked securities are rising

Source: St Louis Fed

You may have noticed that the Annuity Interest Rate (AIR) for TVAS calculations rose again for the coming month, the third successive 0.2% increase. The underlying interest rate in the AIR calculations is a three-month average of the real yields for FTSE indices covering index-linked gilts with a term to maturity of more than five years. The averaging means that the AIR usually changes only slowly, which is not what has happened recently.

If we look at those FTSE real yields, they have moved from -2.55% on 15 November 2020 to -1.69% on 14 April 2022 – a rise of 0.86% in five months. That has taken the real yield back to the level last seen at the beginning of 2019. Real yields have not been positive since 2014.

That is not the case in the USA, where during the trading day of 19 April, the yield on ten-year Treasury Inflation-Protected Securities (TIPS) briefly turned positive (please see the graph above). As with UK index-linked stock, US TIPS real yields have risen sharply this year. Real yield moves have not received as much attention as the rise in nominal yields on traditional fixed interest Government bonds, but they are significant.

Real yields are the measure of the return investors require once allowance is made for inflation. Rising real yields – even if they remain negative – suggest investors are looking for higher post-inflation returns. In theory, rising real yields are bad news for growth stocks because their future earnings become subject to a higher rate of discount on valuation, reducing their price. There has already been evidence of that in the US, where values of the racier tech stocks promising jam (or the next Tesla) tomorrow have taken a hit, both in the listed and private markets.

However, there is a similar puzzle on both sides of the Atlantic about the future inflation rate implied by Government bond yields. In the US, the conventional ten-year bond yield is around 2.9%. If US investors are looking for a real yield of around 0%, that implies they are expecting inflation to average around 2.9% over the next ten years, against a reading for March of 8.5%.

In the UK, the same mathematics gives a ten-year RPI inflation expectation of 4.2%, against the March RPI of 9.0% (index-linked gilts are all RPI-based). Put that in CPI terms using the average RPI/CPI wedge of 0.9% over the last ten years and the implied CPI inflation is 3.3% (against a current 7.0% rising to 8%+ next month).

In both instances, the implied inflation numbers suggest that the central bankers will quickly succeed in getting inflation back towards their 2% targets. That might be optimistic.

Comment

Real yields are worth watching, although, particularly in the UK, there is an argument that they have been kept artificially low by defined benefit (DB) pension schemes seeking liability-matching investments.

Stock market performance: two months on from February 24

(AF4, FA7, LP2, RO2)

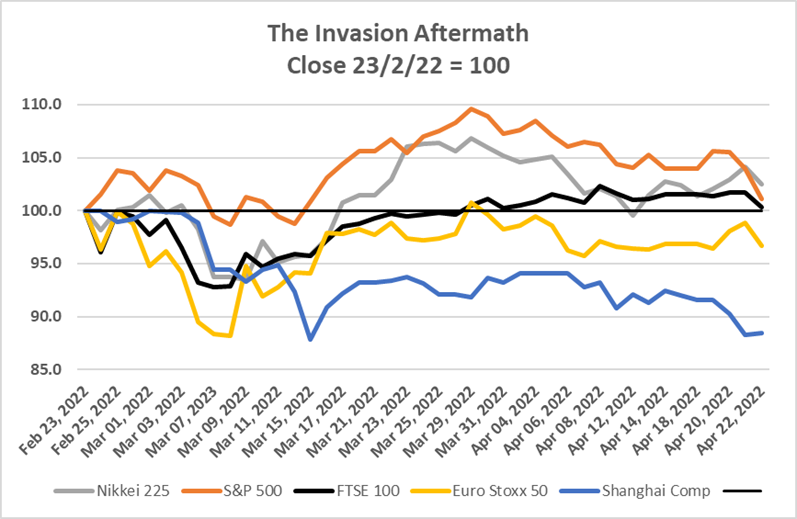

Equity markets are weakening as the third month of the Russian war with Ukraine begins.

Sunday marked the start of the third month of the Russian invasion of Ukraine, so we thought we would revisit our earlier graph of market performance since the tanks rolled in.

Markets have retreated from the post-invasion peaks reached at the end of March, but now the Ukraine war appears to be having only indirect effects, primarily through knock-ons to inflation:

- The S&P 500 is now just 1.1% above the 23/2 close, with the final two days of last week delivering a 4.2% fall. That has been driven by concerns about just how fast the Federal Reserve will raise interest rates in the face of inflation now running at 8.5% on the CPI measure. In round numbers the yield on the 10-year Treasury Bond has gone from 2.0% to 2.9% since Mr Putin’s adventure began.

- The Nikkei 225 is the best performer since 23/2, but there is a sting in the tail. The Japanese central bank is holding out against any change in its zero interest rate policy, which is leaving the country and outlier and punishing the Yen. Since 23/2 the Yen has fallen 10.6% against the US dollar.

- The FTSE 100 is virtually back to square one – up just 0.3% on its 23/2 level. Interestingly, it remains 1.9% up since the start of 2021, which beats the other indices, all of which are firmly in negative territory for the year to date. The Footsie if benefiting from its commodity and energy exposure – the old world has become more appealing than the techy new world. The yield on the 10-year gilt has risen since 23/3, but not as fast as in the US – it is up about 0.5% at 1.97%.

- On top of its adjacency to Ukraine, Europe, as measured by the Euro Stoxx 50, has an amalgam of the US and Japanese problems – inflation running at 7.4% and interest rates not yet being moved up by the European Central Bank. The ECB’s tardiness has not stopped German Bund yields continuing upwards – on 23/2 the 10-year offered 0.23%, whereas now it is 0.96%. Once the land of negative yield, all German bonds with a term above one year now boast a positive return.

- The worst performer, the Shanghai Composite, is being dragged down not by the Ukraine war, but President’s Xi’s battle against the Omicron variant. China has eased some of its monetary policy to help the economy, but the People Bank of China is not reducing its main rates. The Shanghai Composite is down 15.2% so far this year.

PENSIONS

Pension Schemes Newsletter 138 – April 2022

(AF3, FA2, JO5, RO4, RO8)

Pensions Schemes Newsletter 138 covers the following:

- relief at source

- the annual allowance calculator

- Scheme Pays reporting

- non-taxable payments following a member’s death and Real Time Information (RTI) reporting ― charity lump sum death benefits

- pension scheme migration

- accounting for tax returns

- registration statistics

- pension flexibility statistics

Areas of interest

Relief at Source

HMRC confirm that as there were no changes to the tax rates in England, Northern Ireland, Scotland and Wales for 2022/23 there are no changes to how schemes operate relief at source.

Annual allowance calculator

The HMRC annual allowance calculator has been updated to include the 2022/23 tax year.

Registration statistics

For 2021/22 HMRC received 1,591 applications to register new pensions schemes. Of these 79% have been registered and 13% have been refused. The remaining 8% are still being considered.

Since 2012/13 there has been an 89% decrease in the number of applications to register for pension schemes.

Pensions flexibility statistics

The newsletter provides the latest statistics on the number of repayment claim forms processed for tax reclaims where individuals have flexibly accessed their pensions.

From 1 January 2022 to 31 March 2022, HMRC processed:

- P55 ― 4,693 forms

- P53Z ― 1,903 forms

- P50Z ― 816 forms

The total value of tax repaid for the quarter was £22,317,529

FCA introduces emergency rules to prevent BSPS advisers disposing of assets

(AF3, FA2, JO5, RO4, RO8)

The FCA has used emergency powers to prevent financial advice firms who advised members of the British Steel Pension Scheme (BSPS) from disposing of assets to avoid paying compensation. The temporary asset retention rules, set out in PS22/4, were introduced without consultation in a policy statement and apply to firms that advised five or more BSPS members to transfer out of the pension scheme between 26 May 2016 and 29 March 2018. The requirements mean that in-scope firms have to inform the FCA whether they can meet the potential cost of the BSPS redress. Firms must comply with the asset restriction rules until they confirm to the FCA that they have sufficient resources to pay their potential redress bill. The asset retention rules take effect at 12.01am on 27 April 2022 and will continue until 31 January 2023. Some have questioned why the restrictions were only placed on firms completing five or more transfers as there is potentially as much risk below that arbitrary threshold.

FCA Executive Director of Consumers and Competition Sheldon Mills commented in their Press Release that: “Firms who gave poor advice to British steelworkers must ensure that they retain assets and funds to pay redress under our proposed scheme. We are using these emergency powers today to prevent firms from avoiding paying any redress that is due to their customers and to help reduce the potential burden on the Financial Services Compensation Scheme. We will act swiftly if the rules aren't being followed.”

Government rejects automatic enrolment into guidance appointments and tax-free cash ‘decoupling’

(AF3, FA2, JO5, RO4, RO8)

In the Work and Pensions Committee seventh special report: “Protecting pension savers—five years on from the Pension Freedoms: Accessing pension savings: Government response to the Committee’s Fifth Report.” The Government has rejected calls to automatically enrol pension savers into a guidance appointment with Pension Wise before accessing their retirement pot. Policymakers say concerns over costs plus the risk would be pushed towards guidance that was inappropriate for them drove the decision. The Government also pours cold water on proposals to ‘decouple’ the decision to take your 25% tax-free cash from choosing a retirement income route.

TPR publishes 2022 Annual Funding Statement

(AF3, FA2, JO5, RO4, RO8)

TPR has published its latest Annual Funding Statement (AFS), which highlights the need for DB pension scheme trustees to be alert to the likelihood of their scheme's funding position, investments and covenant being more volatile in the current economic climate. As trustees approach triennial valuations, the AFS notes that schemes need to be aware of changes in liquidity demands and cyber risks, whilst the impact of the conflict in Ukraine and the sanctions imposed on UK schemes is unclear. The AFS states: “For many businesses, these factors may be compounded by the lingering effects of COVID-19 and Brexit. An open dialogue with management when assessing the employer’s covenant is important. While we can see the effects of COVID-19 on the scheme’s recent mortality experience, the longer-term impact on future mortality trends continues to be an area of uncertainty, attracting different views.”

TPR's Executive Director of Regulatory Policy David Fairs commented in their Press Release that: “Favourable investment conditions over the last three years mean that many schemes' funding levels are ahead of plan, but now is not the time for complacency. Conditions remain challenging for some schemes and employers and so we urge trustees to continue to focus on their long-term funding target and strategy. An actuarial valuation is an opportunity for trustees to review their funding plans and it may be a good time to seek future protections such as contingency plans and dividend-sharing mechanisms.”

Hymans Robertson Partner Laura McLaren said, in their Press Release, that whilst the statement is unlikely to cause a major stir, there are some useful reminders on how DB pension schemes should be approaching 2022 valuations in the current landscape. She commented: “It’s no surprise that the Russian and Ukrainian conflict, as well as the lingering effects of COVID-19 and Brexit, are notable themes. High inflation and slowing economic growth will impact the outlook for scheme assets and liabilities... With so much uncertainty, it’s hard to see many schemes emerging from 2022 valuations without more defined contingency plans in place.”

LCP highlighted that the language used in the statement around the expectations of fair treatment of contributions versus dividends has returned to what it was in 2019. LCP stated: “This feels very much like a return to 'business as usual' expectations as the Regulator arguably took a softer line in its pandemic-influenced 2020 and 2021 statements.” In conclusion, LCP said: “This latest annual statement is, as expected, more 'evolution' than 'revolution', with the Regulator acknowledging the likely difficulties that many schemes are likely to face as a consequence of current market challenges. It is, as yet, unable to move forward to regulate valuations in accordance with the new funding regime. We look forward to the updated guidance for assessing and monitoring the employer covenant — and to seeing how this interacts with the draft code of practice that will be published at the same time.”

Fraudsters jailed for a total of 10 years for £13 million pension scam after TPR prosecution

(AF3, FA2, JO5, RO4, RO8)

Following a prosecution brought by The Pensions Regulator (TPR), Alan Barratt and Susan Dalton were sentenced at Southwark Crown Court on Friday after admitting charges of fraud by abuse of position arising from their roles as pension scheme trustees. The pair were part of a criminal enterprise which persuaded 245 members of genuine occupational pension schemes to transfer their pension savings, with a total value of £13.7m, into scam pension schemes under the control of the defendants. Mr Barratt was sentenced to five years and seven months in prison, whilst Ms Dalton received a sentence of four years and eight months. Following a request by TPR, they were also banned from acting as company directors for eight years. Under the Proceeds of Crime Act, the court set a timetable (with an initial hearing set for 4 November) to establish whether any of the of the money taken in the fraud can be recovered from the defendants.

TPR Executive Director of Frontline Regulation Nicola Parish commented in their Press Release that: “This is a despicable case which highlights the devastating impact pension scammers have on their victims... In their role as trustees, the pair enabled millions of pounds to be taken from the schemes and channelled offshore, where it was used to enrich others involved in the criminal enterprise and to profit themselves. This prosecution and substantial custodial sentence sends a clear message that TPR and the courts will take tough action against fraudsters. Our successful extradition of [Mr] Barratt from Spain also shows there’s no haven for scammers.”

PASA publishes fraud guidance on pre-employment checks for pensions administrators

(AF3, FA2, JO5, RO4, RO8)

The Cybercrime and Fraud Working Group (CFWG) for the Pensions Administration Standards Association (PASA) has published guidance on vetting new employees in the pensions administration industry. According to PASA, the guidance has been produced to support administrators in ensuring pre-employment checks are as effective as possible and in making decisions on the extent of checks required in order to counter the risk of individuals deliberately gaining employment with the specific intention of committing fraud.

The reasoning behind this new guidance is because of the CFWG being made aware of cases of fraud which have been undertaken or assisted by employees of pensions administrators. In some cases, individuals have deliberately gained employment with the specific intention of committing fraud. To counter this risk, PASA has produced Guidance to support administrators in ensuring pre-employment checks are as effective as possible and in making decisions on the extent of checks required.

Jim Gee, Chair of the PASA CFWG, said in their Press Release that: “This guidance indicates the types of checks which can be carried out and the information which can be verified, rather than what should be done in every case. Administrators are responsible for ensuring any checks and vetting are proportionate, necessary and relevant to the level of risk associated with the position being recruited and carried out in accordance with applicable law.”

This document is believed to be accurate but is not intended as a basis of knowledge upon which advice can be given. Neither the author (personal or corporate), the CII group, local institute or Society, or any of the officers or employees of those organisations accept any responsibility for any loss occasioned to any person acting or refraining from action as a result of the data or opinions included in this material. Opinions expressed are those of the author or authors and not necessarily those of the CII group, local institutes, or Societies.