Technical news update 23/01/2020

Technical article

Publication date:

11 February 2020

Last updated:

25 February 2025

Author(s):

Technical Connection

Update from 23 January 2020 to 5 February 2020

Taxation and trusts

- Corporate Non-UK resident landlords – New HMRC guidance

- Property sellers warned about changes in the CGT rules

- Consultation on the proposed changes to the Trust Registration Service – a brief summary

- Consultation on the proposed changes to the Trust Registration Service – a detailed overview

- Revenue Scotland and the Scottish Government - Working Together on Tax

- The Treasury has published draft regulations setting out the 2020/21 NIC limits

- Switching to a more affordable mortgage – FCA update

- National Insurance Contributions thresholds to rise to £9,500 per year

- Draft regulations have been published setting out the benefit rates for 2020/21

- Another Inheritance Tax review

- Maturing Child Trust Funds will retain tax-free status

- A record breaking 11.1 million people filed their Self-Assessment return by the 31 January deadline

- Financial Services and Brexit – a further update from the FCA

Investment planning

- Borrowing numbers improve a little

- How did UK shares and Residential Property compare in the 2010s?

- Growth in UK dividend payments was over 10% in 2019

Pensions

- Pension Schemes Newsletter 116 - January 2020

- PPF publishes 14TH edition of Purple Book

- The Withdrawal Agreement and Benefits and Pensions for UK Nationals in the EEA or Switzerland

- Money & Pensions Service sets out ten-year vision to improve millions of lives

- HM Treasury issues a draft of the Social Security Benefits Up-rating Order 2020

TAXATION AND TRUSTS

Corporate Non-UK resident landlords – New HMRC guidance

(AF2, JO3)

From 6 April 2020, non-UK resident companies, including those who invest in UK property through collective investment vehicles, will pay corporation tax instead of income tax on profits from UK property.

If a company’s property is suitable for residential use, the company may also have to pay the Annual Tax on Enveloped Dwellings (ATED). Find out more about it here.

Here’s a summary of what is covered in the new guidance.

What a non-UK resident company will need

HMRC says that the company will be automatically registered for corporation tax and will be sent a company Unique Taxpayer Reference (UTR). A company should contact HMRC if it has not received its UTR by 30 June 2020 or if it already has a company UTR.

The company will also have to register with HMRC Online Services to file its company tax return online. Note that the company will need to purchase suitable software to prepare and submit its company tax return to HMRC online – a non-UK resident corporate landlord will not be able to use HMRC’s free filing service to file its tax return.

The company will need to calculate profits on which corporation tax is due using corporation tax rules and transitional rules.

Note that a non-UK resident company will not be required to register for corporation tax and file a company tax return for an accounting period if:

- its liability to corporation tax is fully offset by tax deducted under the Non-UK resident Landlord Scheme;

- it has no chargeable gains for that period.

Using an agent or adviser

If the company has a tax agent or adviser acting on its behalf, HMRC says that their existing authorisation will not be valid once the company starts paying corporation tax.

So, the company will need to submit a new authorisation form to allow a tax agent or adviser to deal with its corporation tax on its behalf.

Transitional rules

There are transitional rules that a non-UK resident company landlord will need to take into consideration when calculating its corporation tax.

Pre-6 April 2020 income tax losses

If the company’s UK property business is reporting a cumulative loss that is chargeable to income tax, this will be carried forward to its corporation tax. This applies if the company’s UK property business is still operating at 5 April 2020.

The company can offset this loss against future profits from the same UK property business or any non-trade loan relationship profits relating to that UK property business.

The income tax loss cannot be relieved against capital gains where the company may be chargeable to corporation tax.

This type of loss is to be used in priority to any losses made on or after 6 April 2020 under corporation tax. It is not affected by the restriction to relief for corporation tax losses that arise on or after 1 April 2017.

The guidance also explains the treatment of capital allowances when the company moves to corporation tax in April 2020 and how relief for finance expenses will work.

Accounting periods

Under the corporation tax rules, the company’s profits from a UK property business will be calculated by reference to accounting periods. These are aligned to the period for which the company prepares its annual accounts.

The first accounting period for corporation tax will be set to start on 6 April 2020 and end on 5 April 2021.

If the company’s annual accounts are not prepared to 5 April, its accounting periods for corporation tax will:

- begin on 6 April 2020 and end on the same date as the company accounts if this is the company’s first accounting period;

- will begin and end on the same date as the company accounts for its second and next accounting periods.

You can read the full guidance here.

Note that the new guidance does not apply to a company if it:

- has tax deducted under the Non-UK resident Landlord Scheme and is not required to file a tax return;

- files an income tax return that is not a non-UK resident company income tax return (SA700).

Source: HMRC Guidance: Paying Corporation Tax if you’re a Non-resident company landlord – dated 15/20, January 2020.

Property sellers warned about changes in the CGT rules

(AF1, RO3)

The Chartered Institute of Taxation recently issued a press release alerting property owners who make taxable gains on their residential properties to plan for a ‘seismic change’ in how tax is paid.

From 6 April 2020 UK residents who sell a residential property that gives rise to a capital gains tax (CGT) liability, e.g. a buy-to-let property, must send a new standalone online return to HMRC and pay the tax due within 30 days of completion of the sale. This new filing and payment timeframe is, of course, different from the current position where taxpayers have until the self-assessment deadline (31 January after the tax year in which the disposal is made) to complete a tax return and pay the CGT.

The current system means that, depending on timing of the sale, CGT is due anything from 10 months to 22 months after the sale or disposal. The new 30-day deadline means people will have less time to calculate the CGT, report the gain and pay any tax.

The new return will need to be done online, requiring taxpayers to have a Government Gateway account to either submit the return themselves or to digitally authorise a tax agent to do it for them.

The CIOT has also received confirmation from HMRC, for the avoidance of any doubt, that the new reporting and payment regime applies only to taxable gains accruing on disposals of UK residential property made on or after 6 April 2020 (in the tax year 2020/21). This means that where contracts are exchanged under an unconditional contract in the tax year 2019/20 (6 April 2019 to 5 April 2020) but completion takes place on or after 6 April 2020 the 30 days filing requirement does not apply. The gain should be reported in the 2019/20 self-assessment return in the usual way.

If, however, exchange of contracts takes place on or after 6 April 2020, or the contract is conditional and the condition is not satisfied until after 5 April 2020, a return will be required within 30 days of completion of the transaction together with a payment on account within the same 30 days’ timescale.

Those selling second properties or buy-to-let properties on or after 6 April 2020 will be brought within the scope of these new rules and will therefore need to ensure that they plan ahead to meet the necessary deadlines otherwise they could face penalties. They will also need to have an understanding of their income position as the rate of CGT applicable will depend on their income for the whole of the tax year.

Sources:

- CIOT News: The new CGT 30-day reporting and payment regime from 6 April 2020: no application to disposals in the tax year 2019/20 – dated 23 January 2020;

- CIOT Press Release: Property sellers warned of ‘seismic’ shift in tax rules – 22 January 2020.

Consultation on the proposed changes to the Trust Registration Service – a brief summary

(AF1, JO2, RO3)

On 24 January the Government published its consultation on proposed changes to the Trust Registration Service. The consultation runs until 21 February 2020.

The Money Laundering and Terrorist Financing (Amendment) Regulations 2019 came into effect on 10 January 2020. These were necessary in order to comply with the EU's Fifth Money Laundering Directive (5MLD). Although the UK is due to leave the EU, it has nevertheless agreed to transpose the Directive.

The provisions relating to trust registration have been delayed until later in 2020, following a more detailed technical consultation on its implementation. 5MLD requires not just public access to the trust register, but also that it is extended from trusts with UK tax consequences to include all express trusts. It was estimated that this could extend the number of registrable trusts from around 200,000 to as many as two million.

As promised on 10 January the Government is now holding a detailed technical consultation on its proposals (including draft legislation) to extend the Trust Registration Service (TRS) to comply with the 5MLD. This deals with the types of express trust that will be required to register, data collection and sharing, and penalties.

The Government is interested in views on whether the draft regulations adequately reflect the Directive in terms of the scope of registration, the information to be collected and the framework for making data sharing requests

These are the key points of relevance to financial advisers:

- The existing TRS will be expanded to include UK express trusts and some non-EU resident express trusts irrespective of whether the trust has incurred a tax liability.

- It is proposed that all express trusts that are not included in a category designated as “Out of scope” will be required to be registered.

The “Out of scope” trusts are to include the following:

- Statutory trusts, such as those arising on intestacy or necessary solely for the purpose of jointly owning a home.

- Trusts arising by virtue of ownership of an asset such as a joint bank account.

- Bare trusts.

- Maintenance fund trusts for historic buildings.

- Approved share option and profit-sharing schemes.

- Vulnerable beneficiary trusts.

- Personal injury trusts.

- Trusts consisting solely of a life policy which is a pure protection policy and payment is not made until the death or terminal illness of the insured.

- Pension scheme trusts that are registered with HMRC on ‘Pension Schemes Online’ or ‘Manage and Register Pension Scheme’.

- Charitable trusts.

- Trusts already registered in another EU member state.

Fortunately, it appears that the Government does not propose to include absolutely all trusts in the expanded TRS which is a relief for all those concerned with trusts in the UK. Indeed, the list of the “Out of scope” trusts is considerable. In particular, the relief for trusts of pure protection life policies, bare trusts and for statutory trusts is most welcome.

Consultation on the proposed changes to the Trust Registration Service – a detailed overview

(AF1, JO2, RO3)

The requirement for trusts to be registered under the Trust Registration Service will be extended as a result of the introduction of the 5th Money Laundering Directive. This will mean that trusts of certain life policies with an investment content will need to register even though there is no current tax liability.

The overall objective of the Money Laundering Directives is to ensure that the UK’s anti-money laundering and counter terrorist financing regime is up-to-date, effective and proportionate.

As part of this purpose, the Fourth Money Laundering Directive (4MLD) created a register of trusts – the Trust Registration Service (TRS) - under which certain trusts need to register details of the trust, such as the name(s) of the settlor(s), trustee(s) and beneficiary(ies). In general, trusts and estates only need to register if they have some kind of tax liability and are making a tax return.

It is intended that the ambit of the TRS will be extended by 5MLD, but the current rules remain in place. This means that if a trust is excluded from registration under 5MLD (see below), but it has a tax liability, it will need to be registered under the current system.

The Government appreciates that any extension to the TRS in 5MLD will create considerable administrative work for trustees and their advisers and therefore wish to consult with interested parties over the extent of any new provisions before implementing them. However, the consultation period is short because the revised regulations must be implemented by 10 March 2020. Further to our, earlier, brief summary, below we give a more detailed overview of HMRC’s Technical consultation: Fifth Money Laundering Directive and Trust Registration Service.

What trusts will be covered?

Currently, only trusts that have a tax liability (including inheritance tax) have to register. So, a trust holding a single premium bond, where no encashments are made, would not need to register until a 10-year inheritance tax charge arises. Under the new provisions, it is proposed that all express trusts will need to be registered – irrespective of any tax liability.

What is an express trust?

An express trust is created by the express intention of the settlor.

Financial Action Task Force (FATF), an inter-governmental body which aims to set standards in combatting money laundering and terrorist financing, defines an ‘express trust’ as one clearly created by the settlor, usually in the form of a document, such as a written deed of trust. This type of trust can be contrasted with trusts that come into being through the operation of the law and that do not result from the clear intent or decision of a settlor to create a trust or similar legal arrangement (for example, an implied trust). Therefore, implied trusts do not meet this definition and so they are outside the scope of the register.

Are all express trusts required to register?

The Directive recognised that the measures to implement the Directive should be proportionate to the risks and have due regard to the individual’s right to the protection of personal data.

Therefore, certain trusts will not be required to register – these are known as “out of scope” trusts. However, should an out of scope trust suffer a tax liability, it will need to register under the existing rules for a trust tax return to be issued.

So what trusts are out of scope?

Various trusts are out of scope.

- Statutory Trusts

Some trusts do not arise from the clear intention of the settlor but arise because of statutory provision. A good example of this is an intestacy where statute introduces trusts to protect the interests of minor children. Another example is the imposition of a joint ownership trust so that people can own land jointly. The law imposes a trust in these situations – the trust does not arise from the intention of the settlor(s).

Because of the risk of money laundering in such cases being so low, it is proposed that such statutory trusts will be out of scope of the new provisions.

- Other Trusts

Other trusts that will be out of scope are:

- Trusts that arise where two or more people co-own an asset – such as a bank account or shareholding with concurrent interests;

- Bare trusts where a named beneficiary is absolutely entitled. However, HMRC is still monitoring this area as it is not certain of the extent to which such trusts are used in money laundering;

- Express trusts that have been established to, for example, meet certain statutory provisions that are required for beneficial tax treatment, for example:

- Maintenance fund trusts for historic buildings;

- Approved share option and profit-sharing schemes;

- Vulnerable beneficiary trusts;

- Personal injury trusts;

- Certain trusts of life insurance policies:

The use of trusts to hold life insurance policies, income protection policies or policies solely for the payment of retirement death benefits is often for estate planning purposes. Where the trust consists solely of a policy which is a pure protection policy and payment is not made until the death or terminal illness of the insured, it is proposed that these trusts will not be required to be registered on the TRS as that would be disproportionate to the risk of them being used for money laundering or terrorist financing activity.

It will be necessary to consider the precise ambit of this exclusion. For example, would it extent to critical illness carve-out trusts?

- Trusts of certain pension plans:

Registered pension schemes held in trust are already subject to regulation by either the Financial Conduct Authority or the Pensions Regulator. There are also income tax controls on sums going into and out of the fund, and the benefits that can be provided by the funds. These controls reduce the risk of them being used for money laundering and terrorist financing and it is therefore proposed that they are not in scope for registration. Pension scheme trusts that are not registered with HMRC on ‘Pension Schemes Online’ or ‘Manage and Register Pension Schemes’ will be required to register on the TRS.

- Charitable trusts need to satisfy a whole host of provisions to qualify. Therefore, HMRC regards the risk of these trusts being used for money laundering or terrorist financing as low

- Trusts already registered in other EU Member States

What information will be collected?

For newly registered trusts with no tax liability, the trustees will only need to provide information on the settlors, trustees and beneficiaries.

The current system means that, where a trust registers, HMRC can set up a tax record for the trust, provide a Unique Taxpayer Reference and issue a trust tax return where required.

Trusts already registered on the TRS will need to give further information under 5MLD by accessing the updated TRS system when launched.

When must registration be made?

The Government has taken note of the responses received to the HM Treasury consultation. The regulations will come into force in 2020 and it is expected that the TRS will be ready for these trusts to register in 2021. Therefore, the Government proposes that:

- trusts in existence at 10 March 2020 (in line with the Directive) must register by 10 March 2022;

- trusts that are set up after 10 March 2020 must register within 30 days, or by 10 March 2022, whichever is the later;

- trusts that are set up on or after 10 March 2022 will have 30 days to register.

Who can access the information on the TRS?

There will be three distinct processes for the sharing of TRS data. These will be:

- An application process for ‘legitimate interest’ and ‘third country entity’ requests, for third parties to gain access to trust data;

- A mechanism for obliged entities (those entering into a business relationship with the trust) to receive the required extract from the register, managed by trustees through the TRS;

- The existing and continuing arrangements for law enforcement agencies.

Legitimate interest

For these purposes, the definition of legitimate interest will be set out in the regulations and this definition will aim to ensure that each request will be rigorously reviewed on its own merits, and access given only where there is evidence that it furthers work to counter money laundering or terrorist financing activity.

Third country entity requests

Access to the beneficial ownership information on the TRS may also be granted to a third party where a trust holds a controlling interest in a non-EEA legal entity. These “third country entity” requests apply where a trust registered on the TRS:

- holds a controlling interest in any corporate or other legal entity; and

- that entity is not required to be registered on a corporate beneficial ownership register in an EU member state.

Whilst anyone can make a third country entity request, the Directive states that the request may be refused where there are reasonable grounds to believe that the request is not in line with the objectives of the Directive.

Obliged entities

The Directive requires that, when entering into a new business relationship with a trust, obliged entities must collect either:

- proof of registration on the trust register; or

- an excerpt from the register.

The Government proposes that the onus will be on the trustee to provide this information rather than the obliged entity having direct access to the register. This means the trustee has control over who sees the information.

Law enforcement agencies

There is currently a procedure in place for HMRC to share information with other law enforcement authorities. 5MLD does not change this process.

When must responses to the Consultative Document be made?

Comments must be made by 21 February 2020.

Revenue Scotland and the Scottish Government - Working Together on Tax

(AF1, RO3)

The Scottish Government and Revenue Scotland have published ‘Working Together on Tax’, setting out a commitment from both organisations to work together to develop and maintain an effective and efficient tax system for Scotland.

This new publication follows on from feedback received to the Scottish Government’s recent consultation, ‘Devolved taxes: a policy framework’. The new publication sets out four guiding principles to the tax system:

- Proportionate to the ability to pay – the tax system should be progressive, with those who are able to pay more tax contributing a greater share;

- Certainty for the taxpayer – individuals and businesses should have confidence in the tax system when making financial decisions;

- Convenience – the tax system should be as simple as possible and easy to understand and comply with; and

- Efficiency – tax policy should be designed to ensure that it is cost-effective to administer.

It also says that the Scottish Government through its tax policies, and Revenue Scotland through its compliance activities, will take the toughest possible approach to tackling tax avoidance in relation to the devolved taxes, and that the Scottish approach to taxation is engagement with people, communities and businesses.

The new publication also sets out four principles that the Scottish Government and Revenue Scotland will be guided by:

Accountability - clear roles and responsibilities for each organisation that are understood by all.

Interdependence - recognition that the organisations work together to deliver and are reliant on each other to fulfil their responsibilities.

Information and skills exchange - information is shared regularly and timeously, and skills and experience are utilised across boundaries.

Collaborative approach with stakeholders - the Scottish approach to taxation is characterised by engagement with people, communities and businesses.

You can read the full publication here.

Source: CIOT News: Revenue Scotland and the Scottish Government – working together on tax – dated 23 January 2020.

The Treasury has published draft regulations setting out the 2020/21 NIC limits.

(AF1, AF2, JO3, RO3)

In recent years Budget contents have been so well trailed that the event has almost become an anti-climax. Sajid Javid has taken one step further by issuing a Treasury news story announcing ‘31 million taxpayers to get April tax cut’.

If that sounds eerily familiar, it is. When National Insurance contributions (NICs) rates are increased or bands widened, politicians go out of their way not to describe NICs as a tax. However, NICs have now become a ‘tax’, in the Chancellor’s eyes, because his proposed changes will reduce the NICs bill for most employees and the self-employed. However, announcing a reduction in NICs does not have the same headline-grabbing potential as a tax cut.

The ‘cut’ is a further replay of the Conservatives’ manifesto pledge to ‘raise the National Insurance threshold to £9,500’. Irritatingly the £9,500 pledge means that the annual primary threshold will no longer be 52 times the weekly figure. The maximum saving for an employee is £104 a year, based on comparison with the 2019/20 threshold, or £87 a year if, as the Institute for Fiscal Studies suggests, you assume that the threshold would have increased by £3 a week in any event by virtue of indexation.

What might surprise many is that the rise in the primary (employee’s) Class 1 threshold is not flowing across to the secondary (employer’s) Class 1 threshold, which is simply being increased in line with inflation (1.7% CPI to September 2019). A look back at the costings document published alongside the Conservatives’ manifesto shows that this was always the plan, even if it was never explicitly stated. To have included employers in the threshold increase would have more than doubled the £2.17bn cost to the Exchequer, based on HMRC’s ready reckoner.

A smaller surprise is that the draft regulations, detailing the new NIC thresholds, make no changes to the upper earnings limit and upper profits limit, which stay at £50,000. Unless Mr Javid intends to break the link between these limits and the higher rate tax threshold, the freeze suggests that he will not amend the Finance Act 2019 legislation fixing the personal allowance at £12,500 and basic rate band at £37,500 for both 2019/20 and 2020/21.

The proposed new NIC thresholds are shown in the table below. Note that the new 2020/21 Employment Allowance £100,000 eligibility ceiling is currently in draft legislation, but the allowance increase from £3,000 to £4,000 is so far only a (costed) Conservative manifesto pledge.

National Insurance Contributions

|

Class 1 Employee |

||||

|

|

2019/20 |

2020/21 |

||

| Employee |

Employer |

Employee |

Employer |

|

|

Main NIC rate |

12% |

13.8% |

12% |

13.8% |

|

No NICs on first: Under 21* 21* & over |

£166 pw £ 166 pw |

£962 pw £166 pw |

£183 pw £ 183 pw |

£962 pw £169 pw |

|

Main NIC charged up to |

£962 pw |

No limit |

£962 pw |

No limit |

|

Additional NIC rate on earnings over |

2% £962pw |

N/A |

2% £962pw |

N/A |

* 25 for apprentices

|

Employment Allowance |

||

|

|

2019/20 |

2020/21 |

|

Per business* |

£3,000 |

£4,000+ |

* Not available if a director is the sole employee

+ Only available if 2019/20 secondary NICs were less than £100,000

Limits and Thresholds |

2019/20 |

2020/21 |

||

|

Weekly £ |

Yearly £ |

Weekly £ |

Yearly £ |

|

Lower earnings limit |

118 |

6,136 |

120 |

6,240 |

|

Primary earnings threshold |

166 |

8,632 |

183 |

9,500 |

|

Secondary earnings threshold |

166 |

8,632 |

169 |

8,788 |

|

Upper secondary threshold – U21s* |

962 |

50,000 |

962 |

50,000 |

* 25 for apprentices

Self-employed and non-employed |

2019/20 |

2020/21 |

|

|

Class 2 |

|||

|

Flat rate Small profits threshold |

£3.00 pw £6,365 pa |

£3.05pw £6,475pa |

|

|

Class 4 (Unless over state pension age on 6 April) |

|||

|

On profits |

£8,632– £50,000 pa: 9% Over £50,000 pa: 2% |

£9,500 – £ 50,000 pa: 9% Over £ 50,000 pa: 2% |

|

|

Class 3 (Voluntary) |

|||

|

Flat rate |

£15.00 pw |

£15.30 pw |

|

The removal of matching thresholds for primary and secondary Class 1 contributions and the decision to stick with £9,500 rather than go to £9,516 (£183 x 52) adds to the complexity of the NICs system. Meanwhile the anachronistic Class 2 survives another year.

Sources: Treasury 30/1/20

Switching to a more affordable mortgage – FCA update

(ER1, LP2, RO7)

The FCA introduced new rules on 28 October intended to help so called mortgage prisoners. Generally, these are consumers who couldn’t switch to a more affordable mortgage because of changes to lending practices during and after the 2008 financial crisis and subsequent regulation that tightened lending. These borrowers are often trapped on high variable rates, unable to re-mortgage to a cheaper deal because they no longer fit the profile of a 'good' borrower.

The FCA said it would separately review the extent that consumers of both inactive lenders and unregulated entities have switched to a more affordable mortgage with an active lender, based on the modified assessment. It wanted to estimate how many of these consumers may have been unable to switch as their circumstances have put them outside lenders’ risk appetites.

Following on from that the FCA has recently published further data on the mortgage prisoner population.

Key findings:

- Around 250,000 people are in closed mortgage books or have mortgages owned by firms that are not regulated by the FCA.

- However, the FCA’s research shows around 170,000 of these borrowers are up-to-date with payments and would be eligible to switch because of its new rules.

- Over half of the group that are eligible are paying interest of 3.5% or less. 39% are paying an interest rate of less than 3.0%.

- Of those eligible to switch, 40,000 have less than £50,000 to repay, many of whom have less than 10 years remaining on their mortgage.

- Both these sets of borrowers may find limited value in switching depending on the deals the FCA has found.

- The FCA estimates around 14,000 eligible mortgage prisoners should be both likely to meet commercial lending criteria and stand to make a meaningful saving.

- It adds that this aligns with the estimates published in its Consultation Paper on changes to the responsible lending rules in October 2019.

Next steps

The FCA says that it wants as many lenders as possible to offer a modified affordability assessment. However, the evidence so far has shown little desire from larger lenders to adopt the changes. It is therefore calling on more lenders to step forward and offer products to mortgage prisoners in the coming three months.

Treasury response

Following on from that John Glen, Economic Secretary to the Treasury, has written a letter to Stephen Jones, Chief Executive Officer of UK Finance reiterating that they expect lenders to take the lead.

Sources: FCA News: Understanding mortgage prisoners – dated 22 January 2020;

HMT Correspondence: A letter from John Glen to Stephen Jones on Mortgage Prisoners – dated 28 January 2020.

National Insurance Contributions thresholds to rise to £9,500 per year

(AF1, AF2, JO3, RO3)

The Government has confirmed that National Insurance thresholds for 2020/21, the level at which taxpayers start to pay National Insurance contributions (NICs), will rise to £9,500 per year for both employed and self-employed people.

According to the Chancellor’s figures, a typical employee will save around £104 in 2020/21, while self-employed people, who pay a lower rate, will have £78 cut from their bill.

For the future, the Government has said that it has an “ambition” to raise the National Insurance thresholds to £12,500.

All the other thresholds for 2020/21 will rise in line with inflation, except for the upper NICs thresholds which will remain frozen at £50,000, as announced at Budget 2018.

In particular, the Government has confirmed that the threshold changes will not affect low earners’ entitlement to contributory benefits such as the State Pension, with the Lower Earnings Limit and Small Profits Threshold, above which individuals start building entitlement to contributory benefits, rising only in line with the CPI measure of inflation.

In addition to increasing the NICs threshold the Government will also end the freeze to working age benefits, which has been in place since 2016. From April 2020, the majority of working age benefits will be uprated in line with inflation.

The changes will be made through three separate Statutory Instruments:

- The Social Security (Contributions) (Rates, Limits and Thresholds Amendments and National Insurance Funds Payments) Regulations 2020;

- The Social Security Benefits Up-rating Order 2020; and

- The Tax Credits, Child Benefit and Guardian’s Allowance Up-rating Regulations 2020.

Source: HM Treasury News story: 31 million taxpayers to get April tax cut - National Insurance contributions thresholds to rise to £9,500 per year – dated 30 January 2020.

Draft regulations have been published setting out the benefit rates for 2020/21.

(AF1, AF2, JO3, RO3)

One of the side effects of an Autumn Budget arriving in Spring is that there has been a long wait to see what DWP benefit rates will be for 2020/21. That wait is now over, as draft up-rating regulations were issued on 30 January.

The main numbers to note are:

- The New State Pension (aka single tier) will rise by £6.60 a week (3.9%) to £175.20, an increase that is well above the current rate of inflation (1.3% on the CPI).

- The Old State Pension (aka basic) will rise by £5.05 a week (also 3.9%) to £134.25.

- Additional Pension, Graduated Pension and other pension increments will rise by 1.7%, in line with CPI inflation to September 2019.

- The four year long freeze on the main working-age benefits, such as Employment Support Allowance, Jobseeker’s Allowance, Income Support and much of Universal Credit will end, with most benefits uprated by 1.7% from April.

These numbers are as expected. However, as the National Minimum Wage (for workers aged 25 and over) will rise by 6.2% to £8.72 an hour from April, on the basis of a 35-hour week, the New State Pension will shrink from 58.7% of minimum pay to 57.4%.

Source: Treasury Press Release 30/1/20

Another Inheritance Tax review

(AF1, RO3)

The All-Party Parliamentary Group for Inheritance and Intergenerational Fairness has produced a set of radical proposals for inheritance tax (IHT) reform.

All-party parliamentary groups (APPGs) are informal groups of MPs, members of the House of Lords and external individuals and organisations with a common interest in particular issues. The latest (pre-Election) parliamentary listing shows a large number of groups with interests ranging from the Pitcairn Islands to pigeon racing. The APPGs sit somewhere in a hinterland between select committees and think tanks such as the Institute for Fiscal Studies (IFS). One such APPG is the APPG for Inheritance and Intergenerational Fairness, which has just published a report entitled ‘Reform of Inheritance Tax’.

The report’s arrival could hardly be timelier as we await the Budget on 11 March. The Chancellor should then reveal his response to the two papers on IHT simplification published by the Office of Tax Simplification (OTS). The APPG report is more radical in its content than the OTS work because the OTS had a specific remit of simplification, not redesign. Thus, the APPG report makes proposals which the OTS could not. The result is a new perspective on a tax which, as the APPG notes, has ‘more or less’ been left untouched by successive governments for 35 years.

Unconstrained by any government terms of reference, the APPG recommends ‘replacing the outdated IHT regime with a more understandable alternative that reflects changes in modern society’. The main features of the APPG alternative would be:

Nil Rate Band and Residence Nil Rate Band These would both be scrapped and replaced by a death allowance of ‘something like £325,000’. Moving from a nil rate band to a (transferable) death allowance would remove the opportunity to use the nil rate band for gifting every seven years. Culling the residence nil rate band would remove a large layer of complexity but simultaneously increase the number of estates paying tax as the theoretical 2020/21 threshold for a married couple/civil partners would drop from £1,000,000 to £650,000. Based on the OTS report data, the number of taxpaying estates could increase by 70%. You can see the headlines already….

Lifetime gifts All the existing lifetime gift exemptions, such as small gifts and normal expenditure, would be scrapped and replaced by a single annual gifts allowance, which the APPG suggests would be set at £30,000. The OTS had put forward a similar approach, albeit their figure was £25,000.

Any gift above the new allowance would be taxable but would not be added back to the estate for IHT calculation purposes on death, regardless of when that occurred. Potentially exempt transfers and seven/fourteen-year cumulation period issues would thus disappear. Taxing all lifetime gifts above the allowance would also mean that reservation of benefit and pre-owned assets income tax rules could be abolished.

The APPG notes that HMRC has little data on lifetime gifting, other than via estate returns and proposes compulsory electronic reporting of lifetime gifts over the current annual exempt amount of £3,000.

Tax rates For lifetime gifts above the £30,000 exempt amount, an immediate 10% tax charge would apply, to be withheld by the donor. For example, once the allowance is exhausted a net gift of £90,000 would create a tax liability of £10,000 ([£90,000 + £10,000] @ 10% = £10,000). If the gift were of an illiquid asset, then the donor would have the option to pay over ten years in interest-bearing instalments (although, in the case of businesses and farms, this could be interest-free instalments).

At death, a rate of 10% would apply on the first £2 million of the estate above the death exemption, with 20% applying thereafter.

Business and Agricultural Relief These would both be scrapped and replaced with an option to pay tax over ten years in interest-free instalments. The APPG reckons that such an approach should be affordable as it would represent a yield of 1%-2% on the assets involved.

Capital gains tax uplift on death This would also be scrapped, with the recipient inheriting the base cost of the deceased. Any capital gains tax (CGT) would only be payable on a subsequent disposal. In parallel, the same no loss/no gain approach would apply to all lifetime gifts rather than being restricted to chargeable transfers and relievable assets as at present.

Pensions All pension funds remaining at death would be taxed at the flat rate of 10% (or added to the estate and the excess taxed at 20% if the value was over £2 million) unless passing to the spouse/civil partner. There is no comment on whether income tax would continue to apply from age 75 or how the two would interact. Ironically, the result could be a return to a total tax charge on death of 55% (or higher), as used to apply before April 2015.

Trusts Gifts into trust would be taxed as lifetime gifts, with a flat tax rate of 10% above the £30,000 allowance. Trusts would lose their nil rate band. An annual (unspecified) fixed rate tax would apply to trusts with discretionary beneficiaries and tax would be levied when property comes out of the trust.

Domicile The APPG takes the next logical step from the way UK legislation has been moving and proposes the concept of domicile be abandoned. It suggests tax residence becomes the main connecting factor and that those who have been UK tax resident for more than ten out of the last fifteen years should pay tax on all subsequent lifetime gifts and transfers on death. Excluded property trust advantages would also disappear at the ten year point if any UK resident could benefit.

This revamp would still leave IHT based on the donor rather than the recipient, although the APPG suggests that the alternative donee-based tax (capital accessions tax) should also be considered by the Government. The tax rates proposed need to be treated with some caution, as the APPG accepts that the Treasury and HMRC have better access to the data necessary to determine the rate at which taxpayer behaviour changes. However, the APPG principle should stay in place: low tax rates across a broader base, creating less incentive to take avoidance measures.

Source: Reform of inheritance tax January 2020. A report by the all-parliamentary group Inheritance and Intergenerational Fairness

Maturing Child Trust Funds will retain tax-free status

(AF1, AF4, FA7, LP2, RO2, RO3)

HMRC has now published a policy paper and regulations which confirm that maturing Child Trust Funds will retain their tax-free status from 6 April 2020.

It is estimated that six million Child Trust Fund (CTF) accounts were set up for children born between 1 September 2002 and 2 January 2011 and many may have forgotten that these accounts exist.

Even though the new rules apply from 6 April 2020, the first CTF accounts will mature in September 2020.

Broadly, these changes mean that providers will have the ability, upon instruction from the account holder, to transfer the investments at maturity to a tax-advantaged ‘matured account.’ The ‘matured account’ can be a continuing CTF account, or a cash ISA or stocks and shares ISA offered by the original CTF provider.

In the situation where the CTF provider has received no instructions on the future of the investments from the account holder, those investments must be placed, at maturity, in a ‘protected account’ pending instructions. Again, the ‘protected account’ can be a ‘matured account’ or a cash ISA or stocks and shares ISA offered by the original CTF provider.

The rules also state that the cash moved to an ISA won’t count towards the saver’s annual ISA subscription limit for that year. This means that if the matured amount is transferred into an ISA following September 2020, it will still be possible for the individual to use their annual ISA subscription limit to add to the same account.

This will no doubt be a welcome change for many, especially for those who may have forgotten that a CTF account exists given that their savings can continue to grow in a tax-free environment.

Source: https://www.gov.uk/government/publications/maturing-child-trust-funds/maturing-child-trust-funds

A record breaking 11.1 million people filed their Self-Assessment return by the 31 January deadline

(AF1, RO3)

HMRC recently issued a press release stating that a record breaking 11.1 million taxpayers submitted their Self Assessment return by the 31 January deadline.

According to HMRC around 11.7 million customers were required to file their 2018/2019 tax return by the 31 January deadline.

Interestingly, more than 702,171 submitted their tax returns on the 31 January - the peak hour for filing was between 4pm to 4:59pm when 56,969 filed. And, thousands of customers filed their tax returns at the last minute, with 26,562 completing their returns from 11pm to 11:59pm on Friday 31 January 2020.

The number filing online soared to more than 10.4 million for the first time ever.

Even though those filing online and on time has increased, there are still a number of returns which have not yet been submitted. It is therefore vital for anyone who has missed the deadline to contact HMRC as soon as possible. If customers can show that they have a genuine excuse for late filing HMRC will treat them leniently.

Source: https://www.gov.uk/government/news/record-breaking-104-million-customers-filed-online

Financial Services and Brexit – a further update from the FCA

(AF2, JO3)

The FCA has published further information for firms during the Brexit implementation period.

On 31 January 2020 the UK left the European Union (EU) and entered an implementation period, which is due to last until 31 December 2020. During the implementation period, EU law will continue to apply. Firms and funds will continue to benefit from passporting between the UK and EEA. Consumer rights and protections derived from EU law will also remain in place.

There will therefore be no changes to the reporting obligations for firms, including those for MiFIR transaction reporting, under EMIR, and for CRAs, which will continue in line with existing EU regulatory requirements.

The windows for EEA firms to notify the FCA that they wanted to use the Temporary Permissions Regime (TPR), or for fund managers to notify the FCA of any funds they wanted to continue to market in the UK under the Temporary Marketing Permissions Regime (TMPR), closed on 30 January.

The FCA’s note states that firms and fund managers that have already submitted a notification need take no further action at this stage. The FCA will confirm its plans for reopening the notification window later this year, which will allow additional notifications to be made by firms and fund managers before the end of the implementation period.

As things develop during the year, all financial services firms should consider how Brexit will impact their business and what action they need to take to be ready for 1 January 2021 to minimise risks to customers.

The FCA will continue to provide regular updates on its dedicated Brexit webpages, and firms can also call the FCA Brexit information line (0800 048 4255) if they have any further questions. The FCA’s new Brexit webpages can be viewed here.

Source: FCA News: Information for firms during the Brexit implementation period – dated 31 January 2020.

INVESTMENT PLANNING

Borrowing numbers improve a little

(AF1, AF2, AF3, AF4, ER1, FA2, FA4, FA5, FA7, JO2, JO3, JO5, LP2, RO2, RO3,RO4, RO5, RO7, RO8)

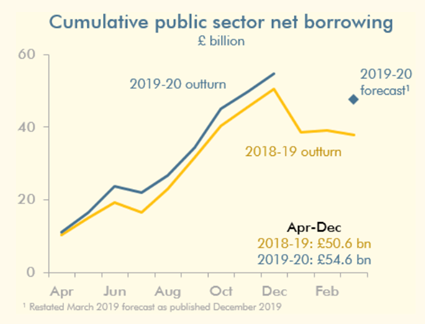

Three quarters of the way through 2019/20, Government borrowing figures just released show a slower rate of growth than the Office for Budget Responsibility (OBR) recently (re)projected.

Last month the OBR revised its March 2019 Spring Statement forecast for Government borrowing to allow for various accounting changes, but not actual economic performance in 2019. As we explained at that time, the result was a 62% increase in the quantity of red ink.

Just over a month after the OBR’s restatement, the latest Public Sector Net Borrowing Requirement (PSNBR) data have prompted the OBR to say that “Borrowing has risen so far this year, but at a slower rate than anticipated in our restated March forecast”.

In the first nine months of 2019/20 total borrowing amounted to £54.6bn, £4.0bn (7.9%) more than in 2018/19 (on a like-for-like basis of calculation). For the month of December 2019 alone, the OBR says that the Government borrowed £4.8bn, £0.2bn down on 2018 and £0.5bn below market expectations.

In its commentary on the latest data, the OBR notes that:

- Total central Government receipts for December rose by 3.7 % in December. Year-to-date receipts growth of 2.8% is above the OBR’s restated March forecast of a 2.3% rise in 2019/20 as a whole.

- Central Government spending was up by 2.9% in December and up 3.3% for the year to date. Year-to-date spending is a little above the OBR’s restated March forecast of a 3.2% rise in 2019/20 as a whole.

- To meet the OBR’s restated forecast of £47.6bn for 2019/20 as a whole would require a materially worse performance for the public finances over the rest of the year than was the case last year.

- Total Public Sector Net Debt (PSND) was down by 0.9% of GDP from a year earlier at 80.8% (£1,819.0bn). The fall was largely a result of £4.9bn that was received earlier in the year from the sale of Bradford and Bingley mortgages by UK Asset Resolution (UKAR) and £13.1bn from early repayments of the Bank of England’s Term Funding Scheme (TFS) loans since the start of the financial year.

These numbers are slightly better than expected. Nevertheless, as usual, much still depends upon next month’s figure, which is the bumper month of the year for tax receipts. Mr Javid will be watching those January numbers with great interest.

Source: OBR: Commentary on the Public Sector Finances: December 2019 – dated 22 January 2020.

How did UK shares and Residential Property compare in the 2010s?

(ER1, LP2, RO7)

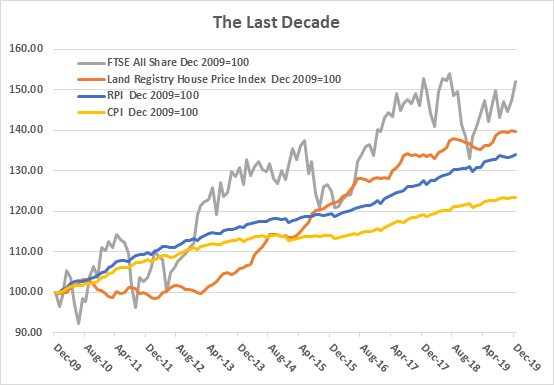

The Great British Public has long had a love affair with bricks and mortar - witness the continued (if waning) popularity of buy-to-let, despite all the tax obstacles being thrown at it (with more to arrive in April). It set us wondering what the last decade revealed about the returns from UK residential property compared to UK shares.

The graph above is a limited attempt to do just that, looking also at inflation, as measured by the RPI and CPI:

- It rebases everything to 100 at December 2009 for consistency.

- It uses the Land Registry index of house prices, which only runs to November 2019 – December’s figures at 29 January are about a fortnight away. The Land Registry numbers are slower to appear than those of Nationwide and Halifax but include more underlying data as cash purchases are covered. Interestingly, the Nationwide figure for the decade shows house price growth of 33% against about 40% for the Land Registry. At 33%, the Nationwide Index very marginally underperformed the RPI over the ten year period.

- Similarly, we have used the more comprehensive FTSE All-Share index rather than the FTSE 100 index to show UK equity market performance. The FTSE 100 posted a gain of 39.9% over the decade, against 52.0% for the FTSE All-Share. That difference reflects the strong performance over the period of the FTSE 250 mid-cap shares (in the tier below the FTSE 100) – up 135.1%.

- The gap between the RPI (blue line) and CPI (yellow line) is a 0.84% a year difference, which helps explain the controversy surrounding moves to reform the older index.

- The FTSE All-Share and House Price data are capital values only. Consideration of income has been excluded mainly because of the paucity of rental data. For the FTSE All-Share, reinvesting dividend income would have produced a total return of 114.6% (7.94% a year).

Past performance is not a guide to the future, as every financial ad reminds us. However, it can be a useful reminder of the past. How many people remember that house prices spent much of the first half of the decade growing at a slower pace than inflation?

Growth in UK dividend payments was over 10% in 2019

(AF4, FA4, FA7, LP2, RO2)

UK dividend growth once again outpaced inflation in 2019, helped by a burst of special dividends. 2020 looks set to be rather different.

Link Asset Services has published its latest quarterly dividend monitor, showing what appears to be a surprisingly high level of dividend growth over 2019. However, the headline figure comes with several important qualifications:

- In 2019, total dividend payouts were 10.7% higher (£10.7bn) than in 2018 at £110.7bn.

- Special dividends accounted for £12bn of payouts in 2019 against £3.9bn in the previous year. Only 2014 has seen a bigger special dividend payout, when Vodafone made the largest single dividend payout in UK corporate history. In 2019 there were a spread of companies making one-off payments, with three-quarters coming from the mining, banking and IT sectors.

- Underlying dividend growth (excluding special dividends) was a much more modest 2.8%, a deceleration from 8.7% in 2018.

- Exchange-rate effects were complex in 2018 as sterling danced to political tunes. About 40% of UK dividends are declared in dollars, so the sterling total moves up and down with the £/$ exchange rate. This effect can be seen in Shell, the UK’s largest dividend payer. It paid four $0.47 dividends in 2019, but the amount sterling investors received varied between 41.54p and 42.52p. Strip out currency effects and Link calculates underlying growth (excluding special dividends) was just 0.8%, lower than CPI inflation for the year of 1.3%.

- The fourth quarter of 2019 saw UK total dividends rise by just 3.0% year-on-year to £17.5bn as the special dividend effect faded.

- The Banking and Financial industry accounted for the largest share of dividend payouts, as it has since 2012, with dividend growth in 2019 of 15%.

- A major boost again came from mining companies, with a total dividend increase of 42% from the sector. This was a continuation of the recovery that started in 2017, but in 2019 was all about special dividends. Strip these out and there was a 1% contraction in underlying dividends.

- As in 2017 and 2018, 13 out of 19 sectors increased pay-outs in 2019, while five saw a fall. The largest drop (65%) was in the motor manufacturing and parts sector, a very small sector.

- Payouts from the top 100 companies rose 11.1% year-on-year on an underlying basis, although underlying payments grew only 3.5%, again reflecting the impact of special dividends. The top 100 accounted for 85% of the UK’s total dividend payments.

- The more UK-focused Mid 250 registered a 0.9% underlying dividend decrease, but a total increase of 11.8%.

- The concentration of dividend payouts in a handful of companies remains a serious issue. The top five payers (Shell, HSBC, BP, Rio Tinto and British American Tobacco) accounted for 34% of total payments, the same as last year. The next 10 companies accounted for 30%, meaning that just 15 companies were responsible for 64% of all UK dividends in 2019 (up from 58% in 2018).

- Link expects 2020 to herald a decline in dividends, with a drop of 0.7% on an underlying basis, and a 7.1% fall on a total payout basis because of a likely decline in special payments.

Link’s projections for 2020 assume that sterling will strengthen over the year – on a constant-currency basis it estimates underlying growth of 1.1% for this year.

Source: Link Asset Services January 2020

PENSIONS

Pension Schemes Newsletter 116 - January 2020

(AF3, FA2, JO5, RO4, RO8)

HMRC Pension Schemes Newsletter 116 covers the following:

- Pension flexibility statistics

- Pension Schemes Online service

- Managing Pension Schemes service

- Relief at Source - notification of residency status report for 2020 to 2021

- Trust Registration Service

Issues of particular interest

Pension flexibility stats

The quarterly release of official statistics on flexible payments from pensions for the period 1 October 2019 to 31 December 2019 will be published shortly.

HMRC can now give more information on the number of tax repayment claim forms processed for pension flexibility payments.

From 1 October 2019 to 31 December 2019 HMRC processed:

- P55 = 5,759 forms

- P53Z = 3,422 forms

- P50Z = 1,154 forms

Total value repaid: £32,191,054

Figures for the period 1 January 2020 to 31 March 2020 will be published in April 2020.

Trust registration service

HMRC remind readers that the HM Treasury laid the regulations for the EU 5th Anti-Money Laundering and Terrorist Finance Directive (5MLD) on 20 December 2019 and the regulations did not include proposed changes to the trust register.

HMRC and HM Treasury published a consultation on the expansion of the existing Trust Registration Service as part of 5MLD on 24 January 2020. This includes details of the proposed scope of the register and the process by which data will be shared.

You can find details about how to respond in the consultation document. The deadline is 21st February. Although pension schemes are currently not impacted the proposed changes may bring them into scope.

PPF publishes 14TH edition of Purple Book

(AF3, FA2, JO5, RO4, RO8)

In the fourteenth edition of the Purple Book, there are estimated to be 5,436 schemes in the Pension Protection Fund (PPF) eligible universe as at 31 March 2019, a reduction from 5,524 as at 31 March 2018. The declining universe reflects schemes winding up, scheme mergers, and schemes entering PPF assessment. This year, The Purple Book dataset covers 5,422 schemes – 99.7 per cent of the estimated 5,436 schemes eligible for PPF compensation.

Key Points:

- Aggregate funding level of DB schemes has risen 3.5 percentage points to 99.2 per cent, the highest it has been since 2014.

- On an estimated full buy-out basis, the net funding position improved to a deficit of £475.6 billion from a deficit of £584.0 billion the year before, with the funding ratio improving from 72.9 per cent to 77.3 per cent.

- The best funded schemes were the smallest, with an aggregate buy-out funding ratio of 80.5 per cent for schemes with fewer than 100 members.

- The number of active members is less than a third of those found in the first The Purple Book dataset in 2006 and has dropped 14 per cent in the last year.

- The percentage of schemes that are open to new members has decreased from 12 to 11 per cent in the last year. This continues the trend since 2012 where only small changes in the proportion of active members have been observed.

- £28.9 billion of risk transfer deals were completed in 2018, the second highest year on record after deals totalling £38.6 billion in 2014. Deals in 2019 are on track to exceed 2018 and challenge the record year in 2014.

- The total deficit of schemes entering PPF assessment in the year to 31 March 2019 was £1,862 million, which exceeded even last year’s £1,661 million and is mainly due to a very large claim from the KPP2.

The Withdrawal Agreement and Benefits and Pensions for UK Nationals in the EEA or Switzerland

(AF3, FA2, JO5, RO4, RO8)

The Department for Work and Pensions (DWP) has issued its guidance, on The Withdrawal Agreement and UK State Pensions and benefits.

Living in the EEA or Switzerland by 31 December 2020

The Withdrawal Agreement covers those UK nationals living in an EEA state or Switzerland by 31 December 2020. If this applies, the individual will get their UK State Pension uprated every year for as long as they continue to live there. They will be eligible for the uprating even where they don’t claim their pension until on or after 1 January 2021.

In addition, those working in the EEA or Switzerland will be able to count future social security contributions towards meeting the qualifying conditions for their UK State Pension.

Moving to an EEA state or Switzerland from 1 January 2021

Those who move to live in an EEA state or Switzerland from 1 January 2021 will not be covered by the Withdrawal Agreement. The entitlement to UK benefits will depend on the outcome of the negotiations with the EU. They will continue to receive their entitlement to their UK State Pension as long as they meet the usual qualifying conditions (i.e. sufficient National Insurance credits etc.), however, there is no guarantee these will be uprated.

Moving to Ireland from 1 January 2021

The position for those moving to Ireland has already been agreed and those UK nationals moving to Ireland from 1 January 2021 will continue to get their UK State Pension uprated.

Money & Pensions Service sets out ten-year vision to improve millions of lives

(AF3, FA2, JO5, RO4, RO8)

The Money & Pensions Service (MaPS) has set out its strategy to improve the UK’s financial wellbeing, identifying five priority areas to help people make the most of their money and pensions.

They hope that by 2030 they will achieve the following goals:

- Financial Foundations – 2 million more children getting a meaningful financial education.

- Nation of Savers – 2 million more working age ‘struggling’ or ‘squeezed’ people saving regularly.

- Credit Counts – 2 million fewer people using credit for food and bills.

- Better Debt Advice – 2 million more people accessing debt advice.

- Future Focus – 5 million more understanding enough to plan for, and in, later life.

Initially MaPS will work with leaders and experts to set out clear delivery plans to achieve the five goals and create specific plans for England, Scotland Wales and Northern Ireland.

You can access the full strategy document here.

HM Treasury issues a draft of the Social Security Benefits Up-rating Order 2020

(AF3, FA2, JO5, RO4, RO8)

HM Treasury has issued a draft of the Social Security Benefits Up-rating Order 2020. This confirms the April 2020 increases to various Social Security payments. It confirms that:

- The New Single-tier State pension will increase from £168.60 per week to £175.20 per week.

- The Basic State Pension will increase from £129.20 per week to £134.25 per week.

- The Category D State Pension will increase from £77.45 per week to £80.45 per week

In due course a full list will be made available at the following address:

gov.uk/government/publications/benefit-and-pension-rates-2020-to-2021

This document is believed to be accurate but is not intended as a basis of knowledge upon which advice can be given. Neither the author (personal or corporate), the CII group, local institute or Society, or any of the officers or employees of those organisations accept any responsibility for any loss occasioned to any person acting or refraining from action as a result of the data or opinions included in this material. Opinions expressed are those of the author or authors and not necessarily those of the CII group, local institutes, or Societies.