Technical news update 27/01/2020

Technical article

Publication date:

28 January 2020

Last updated:

25 February 2025

Author(s):

Technical Connection

Update from 9 January 2020 to 22 January 2020.

Quick Links

Taxation and Trusts

- The Scottish Budget

- Trust registration – A new consultation

- A single easy access rate for cash savings – FCA proposals

Cryptoasset activities – the FCA becomes AML and CTF supervisor

- April 2020’s IR35 changes – A new factsheet for contractors

- New UK Money Laundering Regulations in force – more detail

Intestacy - increased statutory legacy for partners

- Proposed changes to RPI – date for new consultation

- The UK finalises the cross-border tax planning disclosure regulations

- National Insurance and benefit entitlement in non-EEA countries

Investment planning

Pensions

- HMRC update guidance on tax relief on contributions to overseas pension schemes

- PPF publishes updated PPF 7800 index - January 2020

- NHS Wales confirm they will offer the same interim annual allowance solution as NHS England

- GMP Rectification – HMRC’S timetable slips again, with consequences for GMP equalisation

- PPF hits 1000th schemes

- The Pension Regulator news

TAXATION AND TRUSTS

(AF1, AF2, AF3, AF4, ER1, FA2, FA4, FA5, FA7, JO2, JO3, JO5, LP2, RO2, RO3,RO4, RO5, RO7, RO8)

Back in mid-November 2019 the Scottish Government issued a news release announcing that it would defer the publication of its 2020/21 Budget (originally due on 12 December) because of the postponement of the UK Budget. The Scottish Finance Secretary, Derek Mackay, said at the time that “The Scottish Budget should be published after the UK Budget, a view the Finance Committee have indicated they share. Without a UK Budget we would not know the final details of any Barnett consequentials from UK spending, or the impact of UK tax decisions”.

Nine weeks later, the Scottish Government found itself in an even worse position. Mr Javid gave it no advance warning of his 11 March Budget date, much to the annoyance of Mr Mackay. The late date meant the Scottish Parliament would have to introduce an emergency procedure to pass their Budget. Previously the Scottish Budget process has lasted for about two months.

However, on 13 January Derek Mackay announced that the Scottish Government’s Budget would be published on 6 February 2020.

Mr Mackay said that “The timing of the UK Budget made it impossible for us to publish our own budget after the UK Government’s without drastically restricting the time for parliamentary scrutiny… That is why we have made the decision to publish our budget in February which will allow local authorities to set their budgets and council tax before the legal deadline of 11 March”.

Wales, which in theory could set its own tax rates (but not bands) for 2020/21, has confirmed it will not be doing so.

Trust registration – A new consultation

(AF1, JO2, RO3)

Draft regulations have been laid, which took effect from 10 January 2020, to implement the Customer Due Diligence aspects of the 5th Money Laundering Directive (5MLD). The amended regulations came into force on 10 January 2020 for all elements, but do not include the Trust Registration Service (TRS). Early in 2020 HMRC will consult on the technical detail of regulations to implement the TRS aspects.

HMRC has provided the Chartered Institute of Taxation (CIOT) with the following update on the impact of the 5MLD on the Trust Register.

The update, confirms that detailed technical consultation on the changes to bring existing legislation on the Trust Register, in line with the provisions of 5MLD, will be occurring in early 2020:

‘As you know, the government held a consultation on 15 April 2019 entitled ‘Transposition of the Fifth Money Laundering Directive’ (the consultation), and invited views on how the government could best implement the Directive. Over 200 responses were received from a cross-section of stakeholders. The government is grateful for the views received and will publish its response in early 2020.

The overall objective of transposition is to ensure that the UK’s anti-money laundering and counter terrorist financing regime is up-to-date, effective and proportionate. Transposition of the Directive will enable the UK to have a comprehensive regime, responsive to emerging threats, and in line with evolving international standards set by the Financial Action Task Force.

Following agreement to extend the UK’s membership of the EU until 31 January 2020, the UK will remain a Member State on the 10 January 2020 transposition deadline. Following this, if the October 2019 Withdrawal Agreement is approved, the UK will be in an implementation period from 31 January 2020 during which EU law, including obligations under the fifth money laundering directive (5MLD), will continue to apply.

The provisions in 5MLD will be legislated in ‘The Money Laundering and Terrorist Financing (Amendment) Regulations 2019’. These regulations will make amendments to ‘The Money Laundering, Terrorist Financing, Transfer of Funds (Information on the Payer) Regulations 2017’. The amended regulations will come into force on 10 January 2020 for all elements, but do not include the trust registration service (TRS).

The HMT consultation confirmed that HMRC would run a more detailed technical consultation on the details of implementation. Further details on this technical consultation and how you can contribute will be shared in early 2020. TRS must contain a robust and proportionate framework, and this consultation will include additional information on the proposals for the type of express trusts that will be required to register, data collection and sharing, and penalties.

As part of this technical consultation draft legislation for the trust registration elements of 5MLD will be shared. This will be transposed into domestic law during 2020. We will keep impacted trusts and their representatives up to date on when the requirement to provide information on TRS under 5MLD will commence and understand that sufficient notice will be required in order to ensure business readiness.’

Source: STEP News: UK government transposes 5AMLD on time – dated 7 January 2020

A single easy access rate for cash savings – FCA proposals

(AF4, FA7, LP2, RO2)

The Financial Conduct Authority (FCA) is proposing to reform the easy access cash savings market. Under new rules all firms will have to set a single easy access rate (SEAR) across all easy access accounts. Firms will have the flexibility to offer multiple introductory rates for up to 12 months, then they will need to choose one SEAR for their easy access cash savings accounts, and one for their easy access cash savings ISAs.

The FCA’s proposals aim to improve competition in the market, encouraging firms to increase the interest rates they offer as well as protecting those consumers that currently receive the lowest interest rates. The FCA estimates that consumers will benefit by £260m from higher interest payments.

The FCA expects that longstanding customers will benefit from higher interest rates because firms will compete on the SEAR. The SEAR works by requiring firms to pay the same rate to longstanding customers as to customers who have recently come off an introductory offer and are deciding whether to switch or stay with their current product. To retain customers coming off introductory offers, it is expected that firms will set their SEARs higher than the current rates offered to longstanding customers.

The proposals will also require firms to publish data every six months on the SEARs they offer. This is intended to make it easier to compare the rates at the time of opening an account, with the rates that other firms are currently offering. Longstanding customers should also find it easier to see whether their existing product gives them a good interest rate because their provider will have only one such rate rather than many such rates changing over time.

The proposals are limited to easy access savings accounts because this is where the FCA has said that it found harm in the cash savings market study.

The FCA’s consultation paper can be found here.

It is seeking feedback on its proposals by 9 April 2020.

Source: FCA News: FCA acts to help customers get better rates for cash savings – dated 9 January 2020.

Cryptoasset activities – the FCA becomes AML and CTF supervisor

The FCA is now the anti-money laundering and counter terrorist financing (AML/CTF) supervisor for businesses carrying out certain cryptoasset activities.

From 10 January 2020, any UK business conducting specific cryptoasset activities falls within the scope of the amended Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017 (MLRs).

The FCA has produced a dedicated cryptoasset webpage, which sets out which cryptoasset businesses must comply, how to register, the timeline for registration and payment of the registration fee. The FCA’s webpage can be found here.

The FCA says that, amongst other things, it requires cryptoasset businesses to:

- identify and assess the risks of money laundering and terrorist financing which their business is subject to;

- have policies, systems and controls to mitigate the risk of the business being used for the purposes of money laundering or terrorist financing;

- where appropriate to the size and nature of its business, appoint an individual who is a member of the board or senior management to be responsible for compliance with the MLRs;

- undertake customer due diligence when entering into a business relationship or occasional transactions;

- apply more intrusive due diligence, known as enhanced due diligence, when dealing with customers who may present a higher money laundering / terrorist finance risk. This includes customers who meet the definition of a politically exposed person;

- undertake ongoing monitoring of all customers to ensure that transactions are consistent with the business’s knowledge of the customer and the customer’s business and risk profile.

The FCA stresses that this is not an exhaustive list. More information can be found on its webpage. The FCA will supervise firms’ compliance with the new regulations, and says that it will take swift action where firms fall short of desired standards and cause risks to market integrity.

Registration with the FCA:

- New businesses carrying out cryptoasset activity in scope of the MLRs must be registered with the FCA before conducting business – registration forms are available on Connect. You can find out more about the registration process on the FCA’s website.

- Existing businesses already conducting cryptoasset activity before 10 January 2020 may continue their business but will need to ensure their compliance with the MLRs with immediate effect.

- All existing businesses undertaking cryptoasset activities must be registered by January 2021. To ensure this deadline is met, these businesses must submit a completed application for registration via Connect by June 2020.

- Existing Financial Services and Markets Act firms, e-money institutions or payment services businesses undertaking cryptoasset activity will also be required to apply for registration.

The FCA has provided the following email address for any queries regarding the new regime: firm.queries@fca.org.uk

Source: FCA News: FCA becomes AML and CTF supervisor of UK cryptoasset activities – dated 10 January 2020.

April 2020’s IR35 changes – A new factsheet for contractors

(AF2, JO3)

The Government has published a new factsheet for contractors reflecting the forthcoming changes to the off-payroll working rules (IR35). The new factsheet can be found here.

From 6 April 2020, all medium and large-sized private sector clients will be responsible for deciding if the IR35 rules apply to their contractors. This moves the onus for IR35 decisions away from the worker to the (medium and large) private sector engager.

This responsibility already applies to public sector authorities. However, from 6 April 2020, there are also extra responsibilities that will affect public sector authorities.

However, it should be noted that if a worker provides services to a small client in the private sector, the worker will continue to be responsible for deciding their employment status and if the IR35 rules apply.

The new factsheet is intended to help contractors decide if they will be affected. It provides the following explanations of how the changes may affect contractors:

- If the contractor is affected, the organisation they are providing their services to will determine their employment status for tax purposes from 6 April 2020.

- The contractor’s ‘hirer’ will give the contractor a ‘Status Determination Statement’, which will set out the determination the hirer has made and the reasons behind this. The contractor may be asked to provide the hirer with some information to help them make their determination.

- If the hirer determines that the contractor is employed for tax purposes, they (or the agency they have hired the contractor through) will pay the necessary tax and National Insurance before they pay the contractor.

- If they determine that the contractor is self-employed for tax purposes, the contractor will remain responsible for meeting their own tax obligations.

- Depending on the contractor’s own personal circumstances the terms of their contract may change.

- It is also possible that the contractor will pay additional income tax and National Insurance if they had not previously been applying the off-payroll rules (IR35) correctly. However, HMRC says that it will not use information resulting from these changes to open a new enquiry into earlier years unless there is reason to suspect fraud or criminal behaviour.

HMRC suggests that any contractors who think they may be affected should seek a Status Determination Statement from their hirer, and speak to them to help them understand what this means for them.

Note that on 7 January 2020, the Government launched a review into the implementation of the changes to the off-payroll working rules and the effectiveness of the recently updated Check Employment Status for Tax (CEST) tool. The review will gather evidence from affected individuals and businesses and is intended to ensure “smooth implementation of the reforms”, which are due to be introduced on 6 April 2020. This review will conclude by mid-February.

Source: HM Treasury News: Changes to off-payroll working rules (IR35) – New Factsheet for contractors – dated 13 January 2020.

New UK Money Laundering Regulations in force - more detail

(AF2, JO3)

Business owners should review the new regulations to continue to reduce the risk of their business being used to launder criminal money or finance terrorism, and remain compliant with the Money Laundering Regulations.

The Money Laundering and Terrorist Financing (Amendment) Regulations 2019 came into force on 10 January 2020, updating existing regulations.

While all firms must be fully compliant with the new requirements from 10 January, HMRC says it will take into account the short lead-in time businesses have had to implement all the new requirements in assessing the response to any non-compliance and it will assess each case on its own merits.

The key changes include:

- money service businesses and trust or company service providers who apply to register from 10 January 2020 will not be able to carry out relevant activity until HMRC has determined their application for registration;

- HMRC will now supervise two new groups of businesses that are subject to the new anti-money laundering regulations - high value items can be a good way of hiding criminal proceeds and laundering money, so the regulations are being expanded to include businesses trading in art and high value letting agents;

- letting agents which rent out property valued at 10,000 euros or more for a minimum of one calendar month, including both commercial and residential property - the online system for these letting agency businesses to register will open in May 2020;

- those in the art market who deal in sales, purchases and storage of works of art with a value of 10,000 euros or more, whether this is for a single transaction or series of linked transactions, regardless of payment method used - art market participants can register via the online system from 10 January.

Businesses must register by 10 January 2021.

Specific changes that may affect a business include:

- an expanded definition of what a tax adviser is, which means anyone who provides support with tax matters, either directly or indirectly, or even just a repayment agent, will now come under the definition of an accountancy service provider subject to anti-money laundering (AML) reporting rules;

- the regulations now apply to art dealers and letting agents who deal with or are intermediaries to transactions worth euro 10,000 or more;

- businesses need to carry out a money laundering risk assessment of new products, business practices, or technologies before they implement them;

- individuals convicted of relevant offences must not act in key roles in regulated firms;

- relevant persons must apply customer due diligence measures where there is a legal duty under the relevant international tax compliance regulations, or a duty to review information relevant to the risk assessment or beneficial ownership of the customer;

- requirements for measures to be taken to understand the ownership and control structure of persons, trusts and companies as a customer, and to verify the identity of senior managing officials responsible for managing corporate bodies, particularly when the beneficial owner cannot be identified;

- a requirement to check trust and company beneficial ownership registers before establishing a business relationship, and to report any discrepancies found to Companies House;

- ‘risky’ products to include oil, arms, precious metals and tobacco;

- firms will have to monitor transactions that are either complex or unusually large, whereas the previous criterion was transactions that were both complex and unusually large.

HMRC says it will update its guidance shortly to reflect the changes.

In the meantime, for more information, please see HMRC’s policy paper here.

Sources:

- STEP News: New UK AML regulations in force – dated 13 January 2020;

- HMRC Policy paper: Money laundering and terrorist financing (amendment) regulations 2019 – dated 10 January 2019.

Intestacy - increased statutory legacy for partners

A statutory instrument (The Administration of Estates Act 1925 (Fixed Net Sum) Order 2020) has been laid, increasing the net sum that a surviving spouse or civil partner is entitled to receive if a person dies intestate leaving “issue”.

This statutory legacy has been increased from £250,000 to £270,000 with effect from 6 February 2020 for deaths occurring on or after 6 February 2020.

Generally speaking, the term “issue” is used instead of “children”, but “issue” has a wider meaning and includes the lineal descendants, i.e. children, grandchildren etc.

The statutory instrument can be found here.

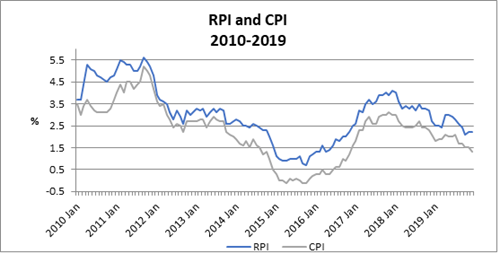

Proposed changes to RPI – date for new consultation

(AF1, AF2, AF3, AF4, ER1, FA2, FA4, FA5, FA7, JO2, JO3, JO5, LP2, RO2, RO3,RO4, RO5, RO7, RO8)

The Chancellor has written to the chair of the House of Lords Economic Affairs Committee announcing that a joint consultation between the Government and the UK Statistics Authority (UKSA) on a proposed change “to address the shortcomings in the Retail Prices Index (RPI)” will now launch at Budget 2020 (11 March) .

The consultation, which is being launched in response to the UKSA’s January 2015 report on consumer price statistics, had previously been scheduled to launch this January.

The consultation will be open for responses for a period of six weeks, closing on 22 April. The Government and UKSA will respond to the consultation before the Parliamentary summer recess.

However, this consultation will not lead to any immediate change. The Chancellor has said that he will not make any changes to the RPI before February 2025 at the earliest. So, this consultation will be looking at whether the UKSA’s proposed reforms should be made at a date between 2025 and 2030.

Source: HM Treasury Correspondence: A letter from Sajid Javid to Lord Forsyth on the launch date of the upcoming joint consultation on the Retail Prices Index – dated 13 January 2020

The UK finalises the cross-border tax planning disclosure regulations

(AF1, RO3)

The Government has now laid final regulations implementing the DAC6 requirements on the mandatory disclosure of cross-border tax arrangements.

DAC6 is a European Directive that introduces an additional level of disclosure designed to detect potentially aggressive tax planning with an EU cross-border element. It needs to be implemented in UK legislation by 1 July 2020. However, DAC6 also provides for implementation with retrospective effect from 25 June 2018. These rules therefore catch arrangements which are being used now.

The purpose of DAC6 is to enable tax authorities to obtain early knowledge of such arrangements so that they can take prompt action where appropriate to counteract them.

HMRC published draft guidance and legislation for DAC6 implementation on 22 July 2019. However, many professional bodies criticised the proposals as being too broad. In particular, there were concerns about the penalty regime, the risk of over-reporting, the interaction of the rules with legal professional privilege and the 'hallmark' definitions. The 'hallmark’ definitions were seen to be much wider than the UK's existing disclosure of tax avoidance schemes (DOTAS) rules, and concerns were raised that they would routinely catch benign or commercial arrangements with no tax motive.

The Government has therefore now published revised regulations that, HMRC says, take account of these, and other, criticisms to make the regulations more proportionate, within the limits imposed by the legal requirement to implement DAC6. The key changes include:

limiting the scope of the term 'tax advantage' only to taxes covered by the Directive;

- amending the rules to ensure that the same intermediary does not have an obligation to report in multiple jurisdictions;

- limiting the scope of the rules to UK intermediaries so that they do not apply to those without a UK connection;

- ensuring that the rules are compatible with legal professional privilege; and

- increasing the flexibility of the penalty regime to avoid 'unduly penalising those who make genuine mistakes'.

If an intermediary has reasonable procedures in place to secure compliance with these rules, this will be taken into account in determining whether they have a reasonable excuse for a failure. The default position will be a one-off penalty of up to £5,000, with daily penalties applying only in more serious cases, and subject to review by an independent tribunal.

HMRC maintains that the 'main benefit' test – that the main benefit, or one of the main benefits, of the arrangement is the obtaining of a tax advantage – is ‘proportionate’.

HMRC is currently working on guidance to support the regulations. It has identified concerns in relation to the meaning of ‘concerning’ multiple jurisdictions, ‘made available’, ‘partnerships’ and when aid, assistance or advice is ‘given’. Legal professional privilege and penalties will also need to be discussed in more detail.

As mentioned earlier, the reporting requirements apply from 1 July 2020, although retrospective reporting of historic arrangements as far back as June 2018 will also be required. Member States must exchange information within one month from the end of the quarter in which the information was filed. The first exchanges should therefore take pace by 31 October 2020.

Source: STEP News: UK finalises cross-border tax planning disclosure regulations – dated 16 January 2020

National Insurance and benefit entitlement in non-EEA countries

(AF1, RO3)

The list of non-European Economic Area (EEA) countries that have a reciprocal agreement with the UK about National Insurance and benefit entitlement has been updated.

The UK has agreements about National Insurance and benefit entitlement with the following non‐EEA countries:

- Barbados

- Bermuda

- Canada

- Chile

- Isle of Man

- Israel

- Jamaica

- Japan

- Jersey and Guernsey

- Mauritius

- New Zealand

- Philippines

- Republics of former Yugoslavia (the Republics of Bosnia-Herzegovina, North Macedonia, Serbia, Montenegro and Kosovo)

- South Korea (also known as The Republic of Korea)

- Turkey

- USA

Chile, Japan and South Korea only cover social security contribution liability and do not include benefits. These are known as Double Contribution Conventions.

The agreement with New Zealand refers to UK domestic legislation to consider social security contributions.

Source: HMRC Guidance: Reciprocal agreements re National Insurance and benefit entitlement – date 15 January 2020

INVESTMENT PLANNING

The December inflation numbers

(AF4, FA7, LP2, RO2)

The CPI for December showed an annual rate of 1.3%, down 0.2% from November. The market had expected no change, according to Reuters. The CPI is at its lowest level since November 2016. Across November to December prices were flat, whereas they rose by 0.1% a year ago (roundings account for the 0.1% year-on-year difference).

The CPI/RPI gap widened by 0.2% to 0.9%, with the RPI annual rate remaining at 2.2%. Over the month, the RPI was up 0.3%.

The Office for National Statistics’ (ONS’s) favoured CPIH index fell 0.1% for the month to 1.4%. The ONS notes the following significant factors across the month:

Downward

Restaurants and hotels: The largest downward contribution to change in the CPIH 12-month inflation rate came from this category (0.08%). Overall, prices for overnight hotel accommodation fell by 7.5% between November and December 2019, compared with a rise of 0.9% between November and December 2018.

Clothing and footwear: This category accounted for 0.04% of the CPIH drop, with the main effect coming from women’s clothing. The ONS notes ‘evidence of increased discounting, with the proportion of women’s clothing items recorded on sale being higher in December 2019 than in December 2018’. That ties in with some of the bad news coming from the High Street.

Food and non-alcoholic beverages: This category provided a small downward contribution of 0.03%, as prices overall rose between November and December 2019 but by less than a year ago. CPI food price inflation is now at 1.7% against 0.6% a year ago.

Transport: A mix of offsetting contributions – air fares up less than last year, fuel prices falling slower than last year – meant that, overall, transport had a small downward contribution of 0.02% on the CPIH.

Upward

The ONS notes that ‘There were small partially offsetting upward contributions from furniture and furnishings, major appliances and small electrical goods, and mobile phone charges, which all increased between November and December 2019 by more than between the same two months in 2018’.

In seven of the twelve broad CPI groups, annual inflation decreased, while three categories posted an increase and the remaining two were unchanged. The category with the highest inflation rate remains in the Communications category which rose 1.0% to 4.3%.

Core CPI inflation (CPI excluding energy, food, alcohol and tobacco) fell 0.3% to 1.4%. Goods inflation rose 0.1% to 0.6%, while services inflation was down 0.3% at 1.4%.

Producer Price Inflation was 0.9% on an annual basis, up 0.4% on the output (factory gate) measure. Input price inflation increased to -0.1% year-on-year, a 1.8% rise from November. The main driver here – as ever - was oil prices.

These inflation figures were lower than expected. With earnings growth of 3.2% a year (total pay – 3.5% regular pay only) according to the latest statistics, real earnings growth continues to look healthy.

These numbers add further weight to the expectation that at the Monetary Policy Committee meeting, on 30 January, the Bank of England will reduce its key interest rate by 0.25% to 0.5%.

Source: ONS 15/01/2020

The MSCI principles of sustainable investing - published 21 January

(AF4, FA7, LP2, RO2)

The Morgan Stanley Capital International (MSCI) report is calling for all investors globally to more readily integrate environmental, social and governance (ESG) considerations throughout their investment processes in order to identify new investment opportunities, manage emerging risks and achieve long-term, sustainable investment performance.

The MSCI report is designed to illustrate specific, actionable steps that investors, including pension funds, can and should undertake to improve practices for ESG integration.

The MSCI says that it believes that a convergence of factors (climate change, social attitudes, institutional governance, technological innovation) will significantly impact the pricing of financial assets and the risk and return of investments and lead to a large-scale re-allocation of capital over the next decades, adding:

“Investors who treat these factors as a fad and continue to operate in a wait-and-see mode could find themselves unprepared for the dramatic repricing of assets that could result.”

The MSCI says that this will require innovative and transformational change from the investment industry to embrace and incorporate new information and establish new practices and processes. It calls on all investment institutions worldwide to embrace this new world, benefit from the enormous opportunities it provides, and mitigate the inherent risks it brings.

They MSCI’s views and recommendations on the core principles and best practices for ESG integration by investors globally, cover:

Approaches to Sustainable Investing, including:

- Values-based investing

- Impact investing

- ESG

The MSCI says that although these three approaches have distinct objectives, they are not mutually exclusive and investors may blend elements of each approach. These Principles of Sustainable Investing focus on the ESG integration approach, which aims to improve long-term risk-adjusted financial returns.

Core Principles of ESG Integration, including:

- Investment Strategy;

- Portfolio Management; and

- Investment Research

ESG Integration in Investment Strategy

The MSCI believes that benchmarks are essential tools to enable asset owners to identify and explain their strategic investment objectives and evaluate the performance of their investment strategy.

- Market benchmarks - A market benchmark aims to measure the return and risk characteristics of the unconstrained relevant market (e.g. a country, a region, all emerging markets, the world) in an objective and comprehensive manner.

The MSCI believes that market benchmarks should reflect the entire unconstrained investment opportunity set and, therefore, should not incorporate ESG considerations. ESG investment strategies can be measured against market benchmarks or against ESG benchmarks depending on what investors are trying to measure.

- Policy benchmarks - A policy benchmark aims to reflect the investment objectives and strategy of an asset owner and typically incorporates many dimensions such as risk tolerance, liability profile and eligible asset classes. It will generally deviate from underlying market benchmarks to reflect the specific investment strategy of the asset owner.

MSCI believes that asset owners who have included ESG considerations in their long-term investment objectives should incorporate them into their policy benchmark.

- ESG Integration in Portfolio Management

The MSCI believes that portfolio managers should incorporate ESG considerations throughout the entire portfolio management process, and looks at Active portfolios and Indexed portfolios.

- ESG Integration in Investment Research

The MSCI believes that investment research should include an assessment of a company’s ESG exposures in order to effectively assess the long-term resilience of companies to ESG risks and opportunities, and that such assessments, including any methodology developed for an ESG score or rating, should reflect the following principles:

- Industry Specificity;

- Company Disclosure; and

- Independent Verification

These three principles apply to all ESG research processes, both in-house and third-party. For investors and managers who use third-party ESG data and ratings, the MSCI says that two additional critical principles apply:

- Feedback Mechanism; and

- Editorial Independence.

The MSCI’s conclusion

The MSCI urges all investors globally to integrate ESG considerations into their investment processes, adding that there should not be specialized “ESG Investing” on one side and “Non-ESG Investing” everywhere else. It views ESG integration as a transitional step to full incorporation of ESG considerations embedded as a core component of standard security selection, portfolio construction and risk management practices. And it believes this is a permanent change to how investment strategies will be constructed and how investments will be allocated and managed.

The MSCI believes that a systemic and large-scale integration of ESG considerations throughout the entire investment process will enable a more efficient allocation of capital globally towards the most productive assets in the long term and will contribute to a more effective and balanced transition towards a sustainable and inclusive economy.

You can read the full MSCI report here.

Source: MSCI Press Release: The MSCI Principles of Sustainable Investing – dated 21/01/2020

PENSIONS

HMRC update guidance on tax relief on contributions to overseas pension schemes

(AF3, FA2, JO5, RO4, RO8)

It is possible to get UK tax relief on contributions made to an overseas scheme in certain situations. As with contributions to a UK scheme any tax relievable contributions will be subject to the annual allowance and lifetime allowance and tax relief on personal contributions is limited to the client’s level of UK earnings.

The types of relief that can apply are:

- Migrant member relief,

- Double taxation relief, and

- Transitional corresponding relief.

Migrant member relief and Double taxation relief can apply when a member moves to the UK and continues to make contributions to an existing overseas scheme. Migrant member relief may apply if the scheme is a Qualifying overseas pension scheme whereas double taxation relief may apply where the relevant Double Taxation Agreement allows.

Transitional corresponding relief can only apply where the individual received relief on contributions to an overseas scheme between 6 April 2005 and 5 April 2006.

The guidance provides details of when these can apply and can be found here.

PPF publishes updated PPF 7800 index - January 2020

(AF3, FA2, JO5, RO4, RO8)

Since July 2007 the Pension Protection Fund has published the latest estimated funding position, on a s179 basis, for the defined benefit schemes in its eligible universe.

January 2020 update highlights

- The aggregate deficit of the 5,450 schemes in the PPF 7800 Index is estimated to have decreased over the month to £35.4 billion at the end of December 2019, from a deficit of £71.1 billion at the end of November 2019.

- The funding ratio increased from 96.1 per cent at the end of November 2019 to 98.0 per cent.

- Total assets were £1,740.3 billion and total liabilities were £1,775.7 billion.

- There were 3,168 schemes in deficit and 2,282 schemes in surplus.

- The deficit of the schemes in deficit at the end of December 2019 was £184.9 billion, down from £208.9 billion at the end of November 2019.

The PPF 7800 index is published on the second Tuesday of every month, and the PPF publishes The Purple Book each year.

NHS Wales confirm they will offer the same interim annual allowance solution as NHS England

(AF3, FA2, JO5, RO4, RO8)

Last month we reported that NHS England will cover the annual allowance charges for senior clinicians in 2019/20. This is intended to a be an interim solution until the Government works with the NHS and their representatives to find a solution for future tax years.

Initially the announcement only covered those working for NHS England. NHS Wales have now confirmed they will offer the same solution.

This will involve the clinician making a Scheme Pays election in relation to the excess accrual within the NHS scheme in the normal way. When the member takes their benefits, the Scheme Pays deduction will be made. There will then be a contractual commitment to provide a payment equivalent to the annual allowance deduction.

More details including links to employee and employer frequently asked questions are available here.

GMP Rectification – HMRC’S timetable slips again, with consequences for GMP equalisation

(AF3, FA2, JO5, RO4, RO8)

A passing reference in HMRC’s recent Countdown Bulletin 50 indicates that its “final data cut” on the GMP information it holds has been put back once more.

The last public announcement about timescale was back in May 2019 when HMRC said that it expected to issue its final data cut on the GMP information it holds on members from mid to late November 2019.

The original plan was to do this in March 2019.

In its latest update no date is given but we understand that the delay could be substantial – possibly right through until the summer.

PPF hits 1000th schemes

(AF3, FA2, JO5, RO4, RO8)

The Pension Protection Fund (PPF) has announced that the Carillion Rail (GTRM) Pension Scheme has become the 1000th scheme to transfer into the PPF since it was established in 2005. Oliver Morley, PPF Chief Executive Officer, said in their Press Release: “The transfer of the 1000th scheme marks a significant milestone in protecting close to 260,000 members who have come to the PPF following a company insolvency. While the arrival of the 1000th scheme represents a lot of insolvencies and change for our members, it shows the value of the PPF and that the legislation put in place to protect our members makes a real difference to people’s lives.”

The Pension Regulator news

(AF3, FA2, JO5, RO4, RO8)

Ex-BHS owner owes pension scheme £9.5m

Dominic Chappell has been ordered to pay £9.5m into two pensions schemes connected to the collapsed high street chain BHS, which he bought for £1 in 2015.

When BHS went into administration a year later, the company’s scheme had around 19,000 members and a deficit of around £571m.

In February 2017 the Pensions Regulator (TPR) agreed a £363m cash settlement with previous owner Sir Philip Green, boss of Arcadia, and also began a series of actions against Chappell, a former bankrupt and ex-racing driver with no retail experience.

A warning notice was issued against Chappell in November 2016, which he went on to dispute in legal challenges with the TPR’s determinations panel and then at an Upper Tribunal.

The tribunal has now struck out his claim, finding that Chappell had failed to supply documents requested and had not followed due process, so the panel’s decision stands and he faces a demand for £9,542,985.

In its Determination Notice, TPR found Chappell had engaged in a series of acts which were materially detrimental to the pension schemes.

These included the acquisition of BHS, management decisions at the company, the appointment of inexperienced board members, the implementation of an inadequate business plan and the way money was extracted and distributed to Chappell, advisers, company directors and family members.

Nicola Parish, TPR’s executive director of frontline regulation, said in their Press Release: ‘We are pleased that the decision to issue two contribution notices to pay money into the BHS pension schemes stands.

‘This case illustrates how TPR is willing to pursue a case through the courts to seek redress for pension savers. It illustrates the situations our anti-avoidance powers were designed to meet and which allow us to protect the retirement incomes that savers deserve.’

Former accountant fined for misleading TPR over workplace pensions duties

A former accountant, Paul Eugene Rewrie, has pleaded guilty to one charge of knowingly or recklessly providing false or misleading information to TPR. He was ordered to pay a fine of £2,667, a £120 victim surcharge and £2,200 in costs by District Judge Teresa Szagen sitting at Brighton Magistrates’ Court on 8 January. Mr Rewrie was the sole director of accountancy company PR Finance and Development Ltd, formerly Paul Rewrie Ltd. Having been hired by a Cambridge-based company to enrol its employees into a pension scheme, Mr Rewrie admitted that he had falsely declared that staff at the company had been enrolled into a workplace pension scheme when he knew it was not the case.

ts latest update no date is given but we understand that the delay could be substantial – possibly right through until the summer.

This document is believed to be accurate but is not intended as a basis of knowledge upon which advice can be given. Neither the author (personal or corporate), the CII group, local institute or Society, or any of the officers or employees of those organisations accept any responsibility for any loss occasioned to any person acting or refraining from action as a result of the data or opinions included in this material. Opinions expressed are those of the author or authors and not necessarily those of the CII group, local institutes, or Societies.