Taxation and trusts update

Technical article

Publication date:

19 May 2020

Last updated:

25 February 2025

Author(s):

Technical Connection

Update from 30 April 2020 to 13 May 2020

Taxation and trusts

- Tax consultations – extensions to deadlines

- Inheritance Tax receipts down

- Changes to processing Inheritance Tax accounts during COVID-19

- COVID-19: switching to a more affordable mortgage – new FCA statement

- COVID-19: FCA information for firms

- Time for a protection audit?

- Tax Credits customers will continue to receive payments even if working fewer hours due to COVID-19

- COVID-19 delays business rates revaluation

- Job Retention (Furlough) Scheme - extended

Tax consultations – extensions to deadlines

(AF2, JO3)

The Government is extending deadlines to ten consultations and calls for evidence, currently underway, by three months and there will also be a short delay to the publication of other documents announced at Budget 2020.

The extensions will give all stakeholders, who are facing disruption due to COVID-19, more time to submit their views and allow them to fully engage with these documents and contribute to the tax policy-making process.

Amongst the documents that the Government will continue to publish over the Spring and Summer, are:

- The call for evidence for the fundamental review of Business Rates;

- The consultation on further entitlement to use Red Diesel;

- The consultation on the design of a carbon emissions tax;

- The consultation on National Insurance Contributions holiday for employers of veterans;

- A summary of responses to the call for evidence on the operation of Insurance Premium Tax;

- HMRC’s civil information powers; and

- A summary of responses to the non-UK resident SDLT surcharge consultation.

The Government will delay the publication of the following documents until the Autumn:

- A discussion document on the wider application of tax conditionality; and

- The consultation on whether qualifying R&D tax credit costs should include investments in data and cloud computing.

The Government will provide more detail on the publication of the following documents in due course:

- The consultation on aviation tax reform;

- The call for evidence on disguised remuneration schemes;

- The review of the UK funds regime;

- The conclusion of the Small Brewers’ Relief Review;

- A summary of responses to the call for evidence on Social Investment tax relief.

As the EU exit transition period will end on 31 December 2020, the consultation on duty-free and tax-free goods carried by passengers and the informal consultation on the VAT treatment of overseas goods will therefore continue to the existing timetable. This, says the Treasury, will provide businesses with clarity as early as possible on the policies that will apply from 1 January 2021. It will also give businesses enough time to prepare and ensure the right legislation is in place for 1 January 2021. However, the Government says that it appreciates that some stakeholders may not be able to respond by the deadline and where late submissions are received, it will take them into account as far as possible.

Also, the Government’s consultation on the Climate Change Agreement scheme extension and reforms for any future scheme will continue as planned.

The ten tax policy consultations extended for three months are:

- Plastic Packaging Tax: Policy Design – now closing on 20 August 2020

- Preventing abuse of the R&D tax relief for SMEs: second consultation – now closing on 28 August 2020

- Tackling Construction Industry Scheme abuse – now closing on 28 August 2020

- Notification of uncertain tax treatment by large businesses – now closing on 27 August 2020

- Vehicle Excise Duty: call for evidence – now closing on 3 September 2020

- Call for evidence: raising standards in the tax market – now closing on 28 August 2020

- Consultation on the taxation impacts arising from the withdrawal of LIBOR – now closing on 28 August 2020

- Hybrid and other mismatches – now closing on 29 August 2020

- Tax treatment of asset holding companies in alternative fund structures – now closing on 19 August 2020

- Consultation: HMRC Charter – now closing on 15 August 2020.

For more information on the above delays, please see here.

The Government’s position on the publication of tax policy documents will be kept updated through the public consultations tracker.

Sources:

- HM Treasury News story: COVID-19: Update on tax policy documents – dated 28 April 2020;

- Parliamentary Business: Update on tax policy documents: Written statement - HCWS211 -dated 28 April 2020.

(AF1, RO3)

The latest HMRC statistics for tax receipts show inheritance tax receipts for 2019/20 at £5.125 billion, which is 4.4% down on 2018/19’s figure of £5.359 billion. However, that doesn’t reduce the need for estate planning – see below.

HMRC’s summary points out that May and June 2018 were unusually high due to a number of contributing factors including an increase in the number and value of payments. March 2019 receipts were also particularly high. In November 2018, the Ministry of Justice announced it would be increasing probate fees from April 2019 (although this was subsequently delayed). HMRC suggests this may have caused some executors to bring their tax payments forward into March 2019, to avoid the higher probate fees, although HMRC adds that they are unable to verify this until full administrative data becomes available. Nevertheless, it does appear that the 2019/20 reduction in tax receipts, compared to 2018/19, may merely be a result of the bringing forward of tax payments to March 2019.

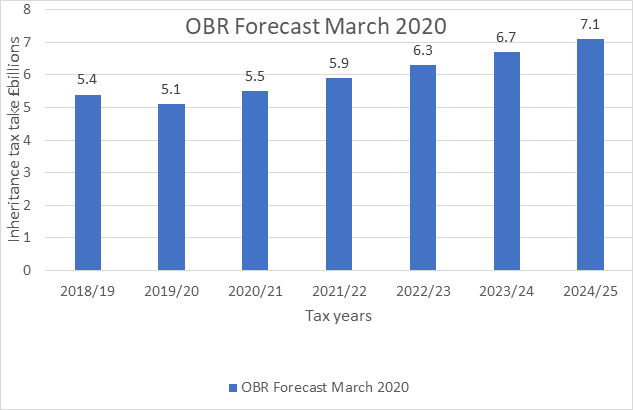

Indeed, the Office for Budget Responsibility’s (OBR’s) latest projections, produced in March, and based on Office for National Statistics (ONS) data, show a marked increase in the expected inheritance tax take over the next few years. See the table below:

The OBR does, however, concede that, as its projections were made in the relatively early days of the current coronavirus (COVID-19) outbreak, it is too early to identify any economic impact on the ONS data. So, it will be interesting to see how future projections will be impacted.

In the meantime, it’s important to remember that estate planning isn’t all about tax. While inheritance tax may be a major concern for many individuals and their heirs, there is much more to estate planning than just reducing the Chancellor’s slice. Indeed, for many people inheritance tax is a price that has to be paid to achieve their other objectives. Before considering any steps to mitigate inheritance tax, it’s important for clients to consider some fundamental questions, such as:

- What should any surviving spouse or civil partner inherit? Often the simple answer is ‘everything’, leaving many decisions about wealth distribution to other potential beneficiaries until second death.

- Who are the other intended beneficiaries?

- Are there specific items – from jewellery to shares in a family business – that the client wants to leave to particular individuals?

- What framework – if any – is needed for their bequests? They might be happy to leave capital outright to a 40-year old architect daughter, but the same may not be true of a 19-year old student son.

Answers to these questions will help a client to shape their will, and provide them with a structure for their inheritance tax planning. It may also prompt a client to consider whether making some lifetime gifts is a sensible option.

Certain gifts made during lifetime will be altogether exempt from inheritance tax and so will fall out of a client’s estate for inheritance tax purposes as soon as they are made, such as the:

- Annual exemption: gifts of up to a total of £3,000 each tax year. To the extent that this exemption wasn’t used in the last tax year it can be carried forward and used in the current tax year, but only once the current year’s exemption has been used.

- Small gifts exemption: gifts of up to £250 to as many people as desired. However, the exemption does not apply to gifts to anyone who in the same tax year has received a gift covered by the £3,000 annual exemption.

- Normal expenditure gifts exemption: regular gifts out of surplus income that do not reduce the donor’s standard of living.

And other lifetime gifts, particularly if made outright, will in most instances attract no inheritance tax when they are made and inheritance tax will be avoided altogether if the donor survives for the following seven years.

Trusts can, of course, provide a way of controlling gifts by interposing a third party, the trustees, between the settlor and their beneficiaries, to deal with the gifted property in accordance with the terms of the trust that the client creates. Trusts can be as rigid or as flexible as the client would like and can offer a range of tax and non-tax benefits.

Of course, the onset of the COVID-19 crisis means that a large section of the population need to self-isolate and all of us need to practice social distancing. This creates issues with the signing and witnessing of legal documents, in particular trusts. As a result, many providers and professional advisers will have needed to amend their processes to hopefully make life easier.

In relation to the making of wills, the Government is still reviewing the case for reform of England and Wales law, given the current circumstances. Whilst, in Scotland, the Scottish Law Society has introduced guidance allowing for video witnessing of wills in certain circumstances.

Source: HMRC National Statistics: HMRC tax receipts and National Insurance contributions for the UK – dated 23 April 2020.

Changes to processing Inheritance Tax accounts during COVID-19

(AF1, RO3)

As a result of the current pandemic, HMRC has changed the way it will deal with inheritance tax accounts and will accept a signature from the agent acting on behalf of personal representatives or trustees to sign inheritance tax forms, as long as the named account remains the same.

This applies to forms IHT100 and IHT400 where there is a professional agent acting, and:

- the names and other personal details of the legal personal representatives or trustees are shown on the declaration page;

- the account includes a clear and unambiguous statement from the agent to confirm that all the legal personal representatives or trustees have seen the account and have agreed to be bound by the declaration.

HMRC has offered guidance on the wording needed to help ensure that all forms are accepted.

The suggested wording is:

“As the agent acting on their behalf, I confirm that all the people whose names appear on the declaration page of this Inheritance Tax Account have seen the Inheritance Tax Account agreed to be bound by the declaration on (page 14 of the IHT400) or (page 8 of the IHT100).”

Note, if a change of account is needed all parties who originally signed the IHT100 or IHT400 forms must still sign the letter.

Source: https://www.gov.uk/government/publications/inheritance-tax-inheritance-tax-account-iht100

https://www.gov.uk/government/publications/inheritance-tax-inheritance-tax-account-iht400

COVID-19: switching to a more affordable mortgage – new FCA statement

(ER1, LP2, RO7)

The FCA has been working for some time to support mortgage prisoners, and it says that this work has continued during the disruption caused by coronavirus (COVID-19).

So far, it says its action has resulted in reductions in mortgage payments for the vast majority of mortgage prisoners, by ensuring base rate cuts are passed on where possible. These actions are in addition to the changes it made in October 2019 to make it easier for mortgage prisoners to switch to new lenders.

As a result of coronavirus, and particularly due to the difficulty in establishing property values and the Government’s advice to delay house moves where possible, there have been significant changes to the mortgage market.

Lenders have removed a large number of products from the market for all consumers since the beginning of March. Lenders have also faced challenges serving existing customers and have granted 1.6m payment holidays. Realistically, the current economic conditions mean that lenders are not yet in a position to offer new options for borrowers.

The FCA’s rules, based on pre-coronavirus conditions, require firms to write to those who may be eligible letting them know they may be able to switch their mortgage. However, given lenders’ inability to offer new switching options to mortgage prisoners, the FCA says that it would be wrong to require letters to be sent to consumers at this time.

The FCA is therefore extending the window during which it expect firms to contact consumers about switching options by three months. The FCA says that it does not want mortgage prisoners to receive communications encouraging them to switch, when there are no suitable products available for them.

The FCA has also written to some firms to reiterate that customers on variable rate mortgages taken out before the financial crisis with higher risk characteristics must be treated fairly, and that lenders should be actively reviewing their rates.

In particular, in respect of firms administering books on behalf of lenders, the FCA is reminding them of their obligation to treat customers fairly where they have discretion to set rates on behalf of the lender.

Where they do not, the FCA says that it expects them to comply with general consumer protection law including the Consumer Protection from Unfair Trading Regulations 2008. This includes having regard to the standards of professional diligence and the FCA’s expectations of lenders across this sector to review their rates in light of current circumstances. The FCA adds that it will act where it sees outlier rates and considers their practices to be unfair.

Please also see the FCA’s guidance to mortgage firms on how to manage the impact of coronavirus remains in place and borrowers can use it to pause payments if they are affected. Firms should not commence or continue repossession proceedings against customers.

Source: FCA News: Statement on mortgage prisoners – dated 1 May 2020;

COVID-19: FCA information for firms

(AF4, FA7, LP2, RO2)

Accessing restricted savings

According to Citizens Advice nearly two in five (38%) people have seen their income decline, with nearly one in 12 (8%) losing 80% of their household income or more.

Research conducted by YouGov on behalf of the Standard Life Foundation also shows that one in five consumers (21%) have used some form of savings to make ends meet in recent weeks.

Data from the FCA’s Financial Lives Survey suggests that several million people may have restricted savings as their only form of savings. If they cannot access their savings, they may be unable to cover essential outgoings, or need to take on additional debt instead. The YouGov/Standard Life Foundation research also found that 19% have used credit to make ends meet in recent weeks.

Customers may contact firms asking to withdraw funds from these accounts.

The FCA says that it would expect firms to:

- pay due regard to the interests of their customers and treat them fairly (see Principle 6 andBCOBS 5.1),

- communicate in a way that is clear, fair and not misleading (see Principle 7 andBCOBS 2.2), and

- consider the needs of vulnerable customers in their actions or communications (see Principles 6 and 7).

Meeting these obligations does not require firms to offer access to all customers, or to offer unlimited access to funds in a restricted-access account. Firms are free to form a judgement on a case by case basis, balancing their customers’ needs with their own obligations, including managing their prudential risk.

However, in doing so, firms should also be aware that for some people the impact of coronavirus is likely to exacerbate the personal circumstances that can cause vulnerability. It may also cause consumers who would not normally think of themselves as vulnerable to suddenly face personal circumstances that can cause vulnerability, such as a sudden and significant loss of income.

In deciding how to respond to customers in a way that is consistent with the above obligations, firms should consider the customer’s vulnerabilities and the impact that an inability to access funds would have. Relevant factors that firms may want to consider in doing so include the reason for the request (for example, whether the withdrawn funds would be used to pay for essential goods and services), or the consumer’s access to other forms of income such as Universal Credit.

The FCA adds that it welcomed the steps several firms have already taken to allow access and to waive penalty fees or charges on restricted savings products. It will monitor customer demand for access through its contact centre engagement with consumers, and use its usual supervisory engagement with firms to understand how they are approaching the issue.

The FCA will keep its guidance under review as necessary.

You can read the FCA’s full guidance for firms here.

If firms have any questions they should contact it in the usual way.

Source: FCA News: Coronavirus (COVID-19): Information for firms – dated 5 May 2020.

(AF2, LP2, RO5)

The announcement, on 27 April, of the new life assurance scheme benefit, payable to the families of frontline NHS and social care workers who die through contracting COVID-19 in the course of serving, is to be applauded. The £60,000 payment, it was reported, amounts to twice the average pay of NHS staff - not an unusual multiple for many pension scheme death benefits.

Will it be enough for most families where the main breadwinner (or one of the main breadwinners) has died? Probably not – by any measure. Of course, “enough” is a highly subjective measure. However, where there is (full or part) financial dependency on a deceased person, a sum equal to twice their pay is likely to deliver a sub-optimal financial safety net.

Past surveys carried out (most notably by Swiss Re) to measure the existence and size of the protection gap in the UK have ascertained that the gap is real and material. One of the main reasons for the gap in personal protection, it seems, is that individuals dismiss the need for protection because “I’m already covered by the firm’s scheme”. Of course, some will be labouring under a misconception, but more, though covered, will not have taken the next step to uncover how much cover and almost certainly not tested whether the level of provided cover amounts to enough cover.

Without taking these extra steps, asking these extra questions, it’s likely that those individuals shunning even thinking about extra cover are deluding themselves. Hard questions need to be asked and if the individual isn’t going to ask themselves (and the evidence is that too few do) then it’s the role (actually, responsibility) of the financial adviser to do so.

Do you have cover?

How much?

Is it enough?

Hard questions but important ones. To quote Carl Richards “You may fire me for asking these questions but you should definitely fire me if I don’t”. This is a great quote.

Of course, the “is it enough?” question requires good knowledge of the client, their family and their responsibilities. But that shouldn’t be a problem for great engaged advisers. You will know what the “ideal” would be for the individual or family that you are dealing with. And you will know (or have access to knowing) what delivery that “ideal” will take, expressed as a capital sum. Part of that adviser “know-how” will be a knowledge of how much capital it takes to generate a particular level of income. It won’t have escaped you that expected yield from investments are set to be a little lower than they might have been only a few months back. If we expect a 2.5% yield it will take £1.2m to generate £30,000 per annum – and that’s pre tax. Now that won’t factor in any overt provision for income to increase over time – though it might, of course, if yields increase. It also has to be said that this “model” also rests on a desire to maintain (at least the nominal value of) the capital that generates the income, and, for some, that may be excessive. It all depends. As mentioned earlier “enough” is a very subjective measure.

Of course, your knowledge of the client will enable you to finesse this calculation of “enough” which may lead to a lower amount of capital being needed to generate the regular payment required. Note “payment” not income. The amount required may be generated, at least in part, by drawing down on capital - sequencing risk (reverse pound cost averaging) permitting. Tax planning strategy may lend weight to this and it goes without saying that if you can deliver tax alpha, the amount you need to draw out from your capital share could well be less. Having clarity over what the client’s aspirations are in relation to capital drawdown/preservation will also be hugely important.

All of that said though, there is no doubt in the absolute importance of challenging clients about the level of the protection that they have in place. Of course, these conversations need to be had in a sensitive, non-opportunistic and genuinely client-centred way. This is absolutely critical. It is also important that these “protection gap exposing” conservations need to be had in relation to both individual and business protection.

Now seems like an appropriate time to be having professional, balanced, sensitive and client centred personal and business protection conversations founded on carefully and knowledgeably constructed audits. It’s not an opportunity, it’s a responsibility.

Tax Credits customers will continue to receive payments even if working fewer hours due to COVID-19

HMRC has issued a news story confirming that individuals will continue to receive their usual tax credit payments even if they can’t work their normal hours during the current pandemic. This means that even those who are furloughed will not have their tax credit payments affected if they are still employed, and those who are self-employed, who can’t work their normal hours, will not have their tax credits affected if they are still self-employed.

Note these individuals do not need to contact HMRC about this change. HMRC will use the information it holds about the number of hours they normally work. However, they can still report other changes, for example in income, childcare and their hours. Information regarding losing their job, being made redundant or ceasing to trade must be disclosed to HMRC.

Those who are claiming Working Tax Credit can continue to do so, and be treated as though they are working their normal hours, but they should also check GOV.UK to see whether further additional or alternative support is available based on their personal and financial circumstances.

COVID-19 delays business rates revaluation

(AF2, JO3)

Cast your mind back to the Autumn Budget of 2017.

In that Budget, Philip Hammond (remember him?) announced a consultation on shortening the business rate revaluation cycle in England and Wales from five years to three years. In the Spring Statement (remember them, too?) of the following year, a move to bring forward the next revaluation to 2021 was announced. Given the lag in the rating process, the 2021 revaluation was to be based on open market rental values as at 1 April 2019. This was four years after the previous valuation point which is still in force (1 April 2015) and a half-way step towards the three year valuation cycle which would come into operation from 2024 (with a 1 April 2022 rental valuation date).

On 6 May the Ministry of Housing, Communities & Local Government (MHCLG) announced that the 2021 revaluation would be “postponed…to help reduce uncertainty for firms affected by the impacts of coronavirus”. Legislation for the switch to a 2021 revaluation, in the form of the Non-Domestic Rating (Lists) Bill 2019-21 was already before Parliament and awaiting a second reading in the House of Lords.

The MHCLG statement did not provide any new valuation or revaluation dates. A pre-COVID-19 valuation date applying from next year would have invited huge business criticism. However, if both dates are simply pushed out one year, the result would be a valuation date of 1 April 2020. As that almost perfectly coincides with the (current) peak of the COVID-19 outbreak, it would raise some near impossible questions about rental valuations for shuttered retail properties and unoccupied offices.

To complicate matters further, this year’s Budget promised yet another “fundamental review” of business rates, with a report due in the Autumn. The MHCLG’s announcement of the revaluation postponement made no reference to any revision of this timing but did note that “The call for evidence for the review will be published in the coming months”.

As has been underlined by the Small Business Grants Fund (SBGF) and Retail, Hospitality and Leisure Grants Fund (RHLGF), rateable valuations have wide business consequences beyond pure rate costs. While the MHCLG says that one of the key aims of the business rates review is “reducing the overall burden on businesses’, the Chancellor may be less enthusiastic given that before COVID-19 hit business rates were to have accounted for about £32bn of income in 2020/21.

Source: MHCLG 6 May 2020

Job Retention (Furlough) Scheme - extended

(AF1, AF2, JO3, RO3)

The Chancellor announced in Parliament on May 12 the extension of the Coronavirus Job Retention Scheme (CJRS/JRS), or Furlough scheme, to October.

The key highlights are that:

- The JRS is extended to 31 July 2020 – with no change, i.e. 80% of salary up to £2,500 per month;

- From 1 August to 31 October 2020 – flexibility is to be added to allow furloughed employees to return to work on a part-time basis at which point employers will be requested to fund part of the salary - it is unclear at this stage if this will correlate to the percentage of the week worked by the employee. Further details are expected at the end of May.

This is the announcement released on gov.uk on the subject:

https://www.gov.uk/government/news/chancellor-extends-furlough-scheme-until-october

Source: HM Treasury News story: Chancellor extends furlough scheme until October – dated 12 May

This document is believed to be accurate but is not intended as a basis of knowledge upon which advice can be given. Neither the author (personal or corporate), the CII group, local institute or Society, or any of the officers or employees of those organisations accept any responsibility for any loss occasioned to any person acting or refraining from action as a result of the data or opinions included in this material. Opinions expressed are those of the author or authors and not necessarily those of the CII group, local institutes, or Societies.