Investments update: Dow Jones Index

Technical article

Publication date:

11 August 2020

Last updated:

25 February 2025

Author(s):

Technical Connection

Update from 23 July 2020 to 5 August 2020

Dow Jones Index

(AF4, FA7, LP2, RO2)

The Dow Jones Index is just about to lose a significant slice of its technology exposure.

On July 30, Apple announced that it would undertake a 4 for 1 share split at the end of August. Instead of one share worth around $400, Apple investors will own four shares worth $100 each, come September.

Share splits in the USA have become much less common in recent years – about 2% of the S&P 500’s constituents have split each year over the past decade, according to Reuters. Partly the disappearance of splits has been because share trading platforms have allowed investors to hold fractions of a share, rather than insisted upon round numbers.

Apple’s split will prove a reminder about the fallibility of the Dow Jones Industrial Index (DJI) as a measure of USA stock market performance. The problem is that the Dow is a share price-weighted index, whereas modern broad market indices, such as the S&P 500, are nearly always weighted by market-capitalisation.

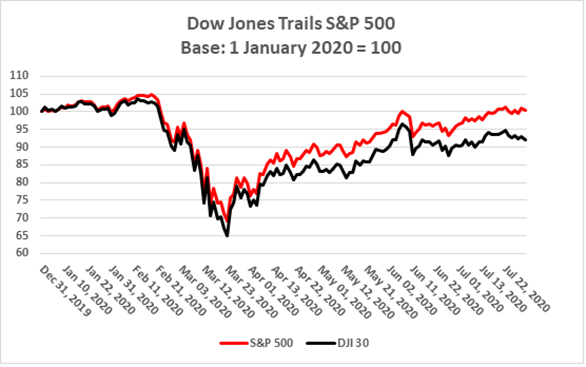

The mathematics of price-weighting means that higher priced shares have more influence on an index number than lower priced shares. The rule had the bizarre result that until Boeing hit severe turbulence with the 737 Max, it was the most heavily weighted share in the DJI. Boeing’s share price has just about halved since the start of the year, which means its weighting in the DJI has had a similar loss of altitude. Its performance (sic) is one reason why, as the graph illustrates, the Dow has fallen 8.11% this year (to 30 July) while the S&P 500 is up (just) by 0.35%.

Currently, Boeing’s former number 1 slot in the DJI is occupied by Apple, which has the largest share price of all the Dow’s constituents, giving it a weighting of 9.82% (against 5.75% in the S&P 500). Once Apple carries out its 4-for-1 share split, it will sink to a ranking of around 17 in the Dow 30 shares and its weighting will reduce to about 2.5%.

A corollary of the change is that the DJI will see its Information Technology (IT) sector weighting drop by about 7.3%, to around 19%. At the moment, the S&P 500 has an IT weighting of around 27.5% - slightly higher than today’s Dow. Technology has been the driving force of US markets in 2020 so, if that trend continues, the Dow will further lag the S&P 500.

We have said it before, and we will say it again: if the Dow Jones Index did not exist, nobody would invent it now.

Source: Apple Investor Relations: Apple will undertake a 4 for 1 share split at the end of August – dated 30 July 2020

This document is believed to be accurate but is not intended as a basis of knowledge upon which advice can be given. Neither the author (personal or corporate), the CII group, local institute or Society, or any of the officers or employees of those organisations accept any responsibility for any loss occasioned to any person acting or refraining from action as a result of the data or opinions included in this material. Opinions expressed are those of the author or authors and not necessarily those of the CII group, local institutes, or Societies.