Individual Chartered

Chartered status is a symbol of technical competence and signifies a public commitment to professional standards. Holding the Chartered Financial Planner title will help ensure that you are recognised as such by your peers, your employer and, most importantly, by those seeking advice. Independent research confirms that the public places huge importance on talking to a professional; it also confirms that 'Chartered' is the most respected indicator of professionalism.

How Chartered status sets you apart:

- Differentiation – you will join a prestigious group of members at the forefront of the profession

- Specialised knowledge – you will develop your technical knowledge through study towards CII level 6 qualifications

- Acknowledged professionalism – Chartered status provides parity with other professions, reinforcing your credentials

- Chartered status is recognised and respected by consumers as a mark of trust

Eligibility

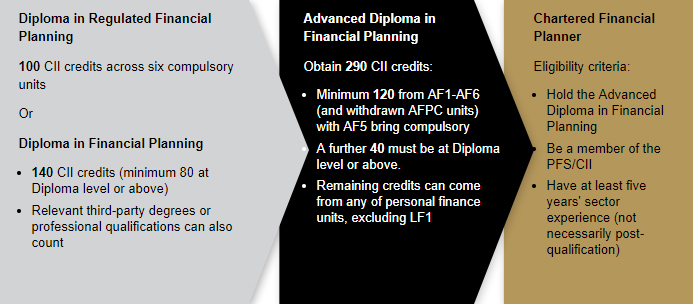

If you hold a Chartered Insurance Institute Advanced Diploma, then it's likely you already satisfy the requirements to become Chartered. Qualifying criteria for Chartered Financial Planner status:

- Advanced Diploma in Financial Planning/PFS Fellowship

- Member of the Personal Finance Society

- Five years' relevant sector experience (not necessarily post-qualification)

Steps to becoming Chartered

Chartered status requires you to obtain 290 credits. Chartered Insurance Institute Diploma holders already have more than a third of this number and, in many cases, more.

Further information

- Chartered marks are the most effective way to promote your Chartered status. Displaying the Chartered mark ensures that customers, employers and professional peers recognise your achievement and technical expertise.

- Rules about how it can be used are covered in Guidelines for Chartered mark usage (PDF)

- Contact Customer Service on +44 (0)20 8989 8464 or customer.serv@cii.co.uk

- Chartered members also receive other member benefits

Individual Chartered

Apply to become a Chartered Financial Planner

Individual Chartered - Join Online