Taxation and trusts update: Consumer credit; Entrepreneurs’ Relief; Probate; Cryptoassets; and more

Technical article

Publication date:

15 July 2020

Last updated:

18 December 2023

Author(s):

Technical Connection

Taxation and Trusts update from 25 June 2020 to 8 July 2020

Taxation and trusts

- Coronavirus: FCA announces proposals to further support consumer credit customers

- Conditions for Business Assets Disposal Relief/Entrepreneurs’ Relief

- DAC 6: Deferral of reporting deadlines

- Probate applications surge

- Taxpayer numbers

- Coronavirus: More firms can now benefit from the future fund

- Financial Services: New bilateral agreement with Switzerland

- Spike in cryptoasset buyers according to FCA

Coronavirus: FCA announces proposals to further support consumer credit customers

In April, the Financial Conduct Authority (FCA) announced a package of targeted temporary measures to help people with some of the most commonly used consumer credit products.

The FCA’s latest proposals outline the support firms would be expected to provide credit card and other revolving credit (store card and catalogue credit) and personal loan customers coming to an end of a payment freeze, as well as those who are yet to request one.

For customers yet to request a payment freeze or an arranged interest-free overdraft of up to £500, the time to apply for one would be extended until 31 October 2020.

For those who have already taken up support and are still experiencing temporary payment difficulties due to coronavirus, firms would continue to offer support with options including a further payment deferral or reducing payments to an amount the customer can afford for a further three months.

The proposals include:

- At the end of a payment freeze, firms should contact their customers to find out if they can resume payments – and, if so, agree a plan on how the missed payments could be repaid. If customers can afford to return to regular repayment it is in their best interest to do so.

- Anyone who continues to need help gets help – for customers still facing temporary payment difficulties as a result of coronavirus, firms should provide them with support by reducing payments on their credit card and personal loans to a level they can afford for three months.

- Support for overdraft customers – allowing customers who are negatively impacted by coronavirus and who already have an arranged overdraft on their main personal current account, to request up to £500 interest-free for a further three months, and providing further support in the form of lower interest rates on borrowing above the interest-free buffer; and repayment plans for those who would benefit from them.

- Extending the time the scheme is available to people who may be impacted at a later date – customers that have not yet had a payment freeze or an arranged interest-free overdraft of up to £500 and experience temporary financial difficulty, due to coronavirus, would be able to request one up until 31 October 2020.

- Where a customer needs further temporary support to bridge the crisis, any payment freezes or partial payment freezes offered under this guidance should not have a negative impact on credit files. However, consumers should remember that credit files aren’t the only source of information which lenders can use to assess creditworthiness.

When implementing this guidance, firms should be particularly aware of the needs of their vulnerable customers and should consider how they engage with them. Firms should also help customers understand the types of debt help and money guidance that are available and encourage them to access the resources that can help them.

This guidance only applies to credit cards and other retail revolving credit, such as store cards and catalogue credit, personal loans and overdrafts. It does not apply to other consumer credit products, such as motor finance, high-cost short-term credit, rent-to-own, pawnbroking and buy-now pay-later, which are covered by separate guidance which will be updated soon.

The FCA does not propose to extend this temporary measure across the whole market. However, overdraft customers who are financially impacted by coronavirus will continue to be able to request a reduced interest rate on any additional borrowing in excess of £500. The FCA will continue to monitor overdraft pricing.

For more information, please see here.

Source: FCA News: FCA announces proposals to further support consumer credit customers – dated 19 June 2020.

Conditions for Business Assets Disposal Relief/Entrepreneurs’ Relief

(AF2, JO3)

The following is a short summary/reminder of the main conditions for Business Assets Disposal Relief which is Entrepreneurs’ Relief renamed.

Background:

Following the reduction in the lifetime limit for Entrepreneurs’ Relief (ER) from £10m to £1m in the 2020 Budget, Entrepreneurs’ Relief has now, from 2020/21 onwards, become known as Business Assets Disposal Relief (BADR).

The conditions for BADR are as they were for ER. The relief applies a 10% rate to qualifying disposals up to a limit of £1m – which means the maximum saving from BADR is £100,000. This reduced from £10m for qualifying disposals made on or after 11 March 2020. Qualifying disposals made before 11 March 2020 count towards the new £1m limit.

There are no transitional provisions. In addition, a couple of anti-avoidance measures were introduced in the Budget, which can result in the £1m limit applying to certain disposals made before 11 March 2020.

BADR is available to disposals of a sole trader and its assets, partnership interests and shares in your own company – see below for key conditions to satisfy. In all cases the main activity of the business must be trading.

The main conditions:

- If you are a sole trader or partner you must have owned the business or your share in it for at least two years (the Qualifying Period).

- If you are selling shares or securities in your company then, for at least two years up to the date of sale (the Qualifying Period), you should have been an employee or office holder (director) in the company; and

- For at least the Qualifying Period, the company must be your Personal Company, which means you have at least 5% of both:

- Ordinary Share Capital; and

- Voting rights;

And

You are entitled to at least 5% of either:

- Profits available for distribution and, in a winding up, the company’s assets, (which must come from your own holding of ordinary share capital); or

- Disposal proceeds if the company is sold.

(For these two conditions, it is not necessary that a distribution is made, a winding up takes place, or the company is sold. The conditions are based on what you would be entitled to if those events were to happen.)

- If the company stops being a trading company, or stops trading, you can still get BADR relief provided you sell your shares within three years.

- To be a trading company the main activities of the business must be trading. If there is a mix of trading and non-trading activities, then the non-trading activities must not be “substantial”.

The test of “substantial” non-trading activities will be applied “in the round” and, broadly, there should be no problem if non-trading activities, e.g. rental, or investment, are no more than 20% of overall activities.

In determining this 20% test HMRC will consider income, assets (including goodwill) and time spent.

It is reiterated that HMRC will take account of all of these factors and make a decision in the round with appropriate weighting to the factors being given.

Merely holding cash on deposit generated from trading may not necessarily deny BADR relief, provided it is being held on deposit for a specific business purpose. Where appropriate, indicating that cash is needed for future trading activities in both the directors’ report and directors’ minutes will be helpful. It is important also to note that the Qualifying Period for being a trading company is the 24 months before disposal or, in the case of a post cessation disposal, the 24 months up to the date the business ceased.

A non-binding opinion on trading status can be obtained from HMRC.

Special rates apply for shares issued under the Enterprise Management Incentive.

Investors’ Relief

In 2016, the Government extended Entrepreneurs’ Relief to external investors in unlisted trading companies, applying a 10% rate of CGT to gains accruing, on or after 6 April 2019, on the disposal of newly issued shares purchased on or after 17 March 2016. Investors’ Relief is a “version of BADR” but with a few very big differences:

- No minimum shareholding;

- Only available in relation to new ordinary shares subscribed for by the investor which were fully paid up in cash;

- The investor must not be an officer or employee of the company;

- The qualifying period is three years (not two years); and

- The lifetime limit is £10m (not £1m).

For more information on Investors’ Relief please see HMRC’s guide here.

DAC 6: Deferral of reporting deadlines

(AF1, RO3)

DAC6 is a European Directive that introduces an additional level of disclosure designed to detect potentially aggressive tax planning with an EU cross-border element. The purpose of DAC6 is to enable tax authorities to obtain early knowledge of such arrangements so that they can take prompt action where appropriate to counteract them.

The reporting requirements were meant to apply from 1 July 2020, including retrospective reporting of historic arrangements as far back as June 2018. And Member States were meant to be exchanging information within one month from the end of the quarter in which the information was filed. So, the first exchanges were therefore intended to happen by 31 October 2020.

However, the Government has now announced that it is deferring the first reporting deadlines by six months. It says that this will provide taxpayers and intermediaries dealing with the impacts of the COVID-19 pandemic with additional time to ensure that they can comply with their obligations.

The postponement follows the European Council of Ministers' formal agreement on 24 June to delay the previously agreed commencement date of 1 July 2020 by up to six months, because of the disruption caused by the coronavirus pandemic. A further three months' delay could be agreed later on if necessary.

The delay also applies to automatic exchanges of information on financial accounts whose beneficiaries are tax resident in another Member State.

Belgium and Luxembourg have reportedly already announced they will postpone the activation of DAC6, and it is very likely that other Member States will follow.

HMRC’s International Exchange of Information Manual has been updated with details of how the deferral will work in practice. You can find the updated guidance here.

The Government will amend the, already-enacted, International Tax Enforcement (Disclosable Arrangements) Regulations 2020 to give effect to this deferral. And, although the amended Regulations may not be in force by 1 July 2020, the Government has confirmed that no action will be taken for non-reporting during any period between 1 July and the date that the amended Regulations come into force. There is therefore now no expectation that reports will be made in July.

In light of this deferral, HMRC will not be switching on the IT system that will be used for reporting on 1 July. The IT system will be made available to taxpayers and intermediaries to report arrangements ahead of the new, deferred deadlines. HMRC has said that it will use the additional time to work with taxpayers and intermediaries on this.

HMRC says that it intends to publish guidance shortly to help businesses in their preparations to meet their reporting obligations.

Sources:

- CIOT News: DAC 6 deferral of reporting deadlines - message from HMRC – dated 25 June 2020;

- STEP News: UK postpones EU DAC6 cross-border reporting regime - dated 25 June 2020;

- HMRC Manuals: Deferral of reporting deadlines for DAC 6 - dated 25 June 2020.

(AF1, JO2, RO3)

According to an article published by the Law Society, HM Courts & Tribunals (HMCTS) confirmed that while there was a decrease in probate applications last month, it is now receiving more applications per week than it is issuing. This is partly down to the easing of restrictions due to the current pandemic as more solicitors are now able to go into their offices to collect wills and other necessary paperwork. As a result, applications are currently being turned around within five to six weeks.

Around 4,000 to 5,000 probate applications are being processed weekly. HMCTS said it has capacity for 7,000, although did warn that waiting times could vary in the coming weeks if applications continue to increase.

While the Government has hired new staff and retrained existing employees who, previously dealt with Court hearings, to keep on top of the increasing number of applications as the lockdown is lifted, it is encouraging solicitors to apply for probate online to speed up the process.

Source: The Gazette: Probate applications expected to surge according to HMCTS – dated 29 June 2020

https://www.thegazette.co.uk/all-notices/content/103775

https://www.gov.uk/applying-for-probate/apply-for-probate

(AF1, RO3)

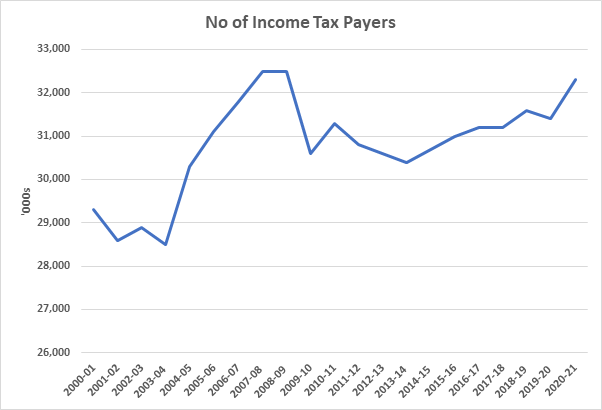

HMRC has just published the latest set of statistics on the numbers of income taxpayers. As usual, the deeply detailed material (e.g. percentile income points) is some years old – 2017/18 in this round. The broader data (e.g. number of taxpayers by marginal rate) does include estimates for 2020/21.

However, these use 2017-18 Survey of Personal Incomes information melded with ‘economic assumptions consistent with the OBR’s March 2020 Economic and Fiscal Outlook’. That makes them effectively pre-COVID-19 numbers. Thus, in HMRC’s latest statistics the number of income tax payers is projected to rise by 900,000 (2.9%) this tax year, as the graph below indicates. The notion of more taxpayers sits uncomfortably alongside the latest Office for Budget Responsibility (OBR) Coronavirus Reference Scenario (published on 14 May) which projects total income tax receipts falling by £29.3bn (14.2%) between 2019/20 and 2020/21.

There is another distortion which makes the more recent data difficult to interpret – Scotland. The divergence in the higher rate threshold since 2017/18 between Scotland and the rest of the UK has boosted the proportion of higher rate taxpayers north of the border relative to the rest of the UK (RUK). Between 2016/17 and (the theoretical) 2020/21, higher/additional rate taxpayer numbers have risen by 23.6%. in Scotland, whereas in RUK the number has fallen by 6%. The RUK drop stems from the drive to a £50,000 higher rate threshold (as opposed to £43,430 in Scotland). Across the UK as a whole, the 2020/21 projection is that 14.5% of all income tax payers will pay tax at more than basic rate. Ten years ago, that proportion was 10.4%.

Additional rate taxpayers remain a rare breed, although the frozen £150,000 threshold means that there are projected to be 481,000 such individuals in 2020/21, as opposed to 236,000 in 2010/11 when the additional rate (then at 50%) came into being. Additional rate taxpayer numbers may be small, but they are projected to account for just over one third of all income tax paid.

The publication of these numbers has been later than in previous years. Given the uncertainties about the outcome for 2020/21, it is arguable that the current year figures are best ignored.

Source: HMRC National Statistics: Percentile points for total income before and after tax – dated 26 June 2020.

Coronavirus: More firms can now benefit from the future fund

More start-ups and innovative firms will now be able to apply for investment from the Government’s Future Fund.

The Future Fund was made available in May, to provide convertible loans, in partnership with the British Business Bank, to UK-based innovative companies, of between £125,000 to £5m, subject to at least equal matched funding from private investors.

To date, more than 320 companies have benefited from £320 million of Future Fund support.

A relaxation to the scheme’s eligibility criteria means that UK companies who have participated in highly selective accelerator programmes and were required, as part of that programme, to have parent companies outside of the UK, will now be able to apply for investment.

Accelerator programmes, such as TechStars or Y-Combinator, give businesses access to finance, mentorship and expert networks.

Participants in accelerator programmes are often required to set up a non-UK parent company in order to participate which means some did not meet the Future Fund criteria of having a

UK parent company when it opened for applications in May.

The change, which applies from 30 June, covers accelerator alumni only. Companies will still be required to meet the ‘substantive economic presence’ tests (that half or more employees are UK-based and/or half or more revenues are from UK sales).

Source: HM Treasury News story: More firms can now benefit from the Future Fund – dated 30 June 2020.

Financial Services: New bilateral agreement with Switzerland

The Chancellor of the Exchequer and his Swiss counterpart have signed a commitment on cross-border financial services trade between the UK and Switzerland.

The commitment, signed on 30 June, outlines the UK and Switzerland’s shared ambition to negotiate an outcomes-based mutual recognition agreement on financial services. It is intended to reduce costs and barriers for UK firms accessing the Swiss market, and vice versa, and cover a wide range of sectors. Of course, Switzerland is not an EU Member State.

In what he described as “a further sign of the two countries’ integrated equity markets”, the Chancellor also announced that the Treasury had completed its equivalence assessment of Switzerland in relation to Swiss stock markets and found them to be equivalent. This should benefit investors in both countries.

Equivalence refers to a decision by one state to recognize another state’s legal requirements for regulating a good or service, even though they may not be exactly the same. In practice, this means that a trader need only comply with one set of requirements in both states.

You can see the full joint statement between the Treasury and the Federal Department of Finance on ‘deepening cooperation in financial services’ here.

Next steps

Details of the agreement will be discussed over the coming months ahead of the UK/Switzerland Economic & Financial dialogue in early September.

And a Statutory Instrument will be laid in Parliament “at the earliest opportunity” once the Treasury’s equivalence powers come into force at the end of the transition period.

Source: HM Treasury News story: Switzerland and UK to negotiate a bilateral financial services agreement –dated 30 June 2020.

Spike in cryptoasset buyers according to FCA

(AF4, FA7, LP2, RO2)

In a press release dated 30 June, the Financial Conduct Authority (FCA) reported that it had commissioned research to understand market size, consumer profiles and attitudes towards cryptoassets. This was conducted online by YouGov as part of the FCA’s work alongside the Government and Bank of England.

The research showed that an estimated 2.6 million UK consumers have bought cryptoassets at some point. This marks a 1.1 million increase since the FCA completed a face-to-face survey on the same topic last year. Of the 1.9 million that still hold their cryptoassets – such as Bitcoin, Ripple or Ether – half have more than £260.

Given that the FCA has previously warned that these investments are risky and volatile due to lack of regulation in the UK these numbers come as a bit of surprise especially as only around 300,000 cryptoasset owners believe they have protection.

Sources: https://www.fca.org.uk/news/press-releases/fca-research-reveals-11million-spike-cryptoasset-buyers and https://www.fca.org.uk/publications/research/research-note-cryptoasset-consumer-research

This document is believed to be accurate but is not intended as a basis of knowledge upon which advice can be given. Neither the author (personal or corporate), the CII group, local institute or Society, or any of the officers or employees of those organisations accept any responsibility for any loss occasioned to any person acting or refraining from action as a result of the data or opinions included in this material. Opinions expressed are those of the author or authors and not necessarily those of the CII group, local institutes, or Societies.