Workplace pensions

News article

Publication date:

13 May 2022

Last updated:

18 December 2023

Author(s):

Chris Jones

The latest workplace pensions statistics confirm the success of automatic enrolment but show that more needs to be done particularly in the private sector.

The Office for National Statistics (ONS) recently published provisional results from the 2021 Annual Survey of Hours and Earnings and final results for 2020.

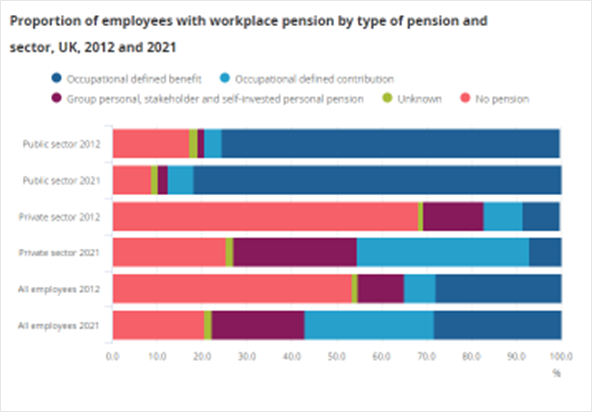

The figures show that since the auto enrolment reforms were introduced in 2012, the proportion of private sector workers saving in a workplace pension scheme had more than doubled from 32% to 75% by April 2021.

In the public sector, over the same period, there was a much smaller growth in participation, rising from an already very high rate of 83% to 91%, which is to be expected given the focus on pensions as part of the public sector pay structure.

The overall rate of participation was 79% as at April 2021 which equates to 22.6 million employees. This is 1% higher than in 2020 which the ONS believe is partly explained by increased public employment driven by the government’s response to the COVID pandemic.

Across public and private sector pensions the participation rate is 79%, representing 22.6 million employees.

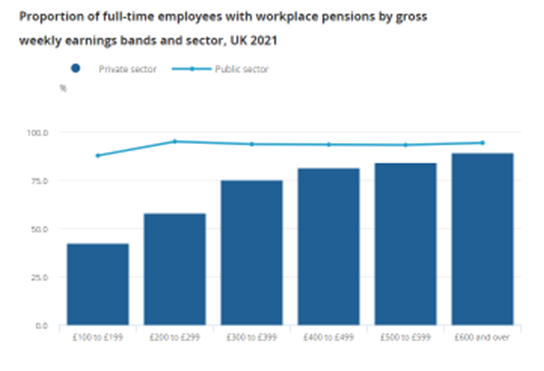

The difference in participation between public and private sector is exacerbated at the lower earnings levels. This is likely to be because of the auto enrolment trigger being set at £10,000 since 2015, meaning those earning the least in the private sector won’t be auto enrolled.

Only 43% of the lowest earning full-time private sector employees (earning £100 to £199 per week) were participating in a pension. This was less than half the rate of equivalent earners in the public sector where the participation rate was 88%. There are further discrepancies in participation in comparison between those in full and part time work, those in full time work are more likely to be a member of their workplace scheme, the difference is even greater when you compare public and private sectors.

This will continue to be an issue and with the low auto enrolment contribution rates in comparison to the benefits provided in the public sector we will see significant disparities in retirement.

In terms of age, the participation rate was highest for those aged 40 to 49 years at 86%. However, participation rates were similar in each age range between those ages 22 and State Pension Age (SPA) again, in line with auto enrolment eligibility. For employees of SPA or over there was a 5% increase in participation over the year to 5 April 2021.

Whilst the overall participation rates are encouraging the other issue is the funding levels. The bare minimum auto enrolment contributions are unlikely to provide a significant sum at retirement. This means that for the millions of employees auto enrolment will deliver disappointing retirement. For example:

- A 30-year-old earning £30,000 a year could end up with a fund worth around £306,000 at 68 (their state pension age) if they contribute 8% of their salary into a pension each year.

- This could deliver pre-tax income in drawdown worth £10,000 a year until age 97, along with £76,500 tax-free cash.

- A 40-year-old earning £30,000 a year could end up with a fund worth £168,000 at 68 if they contribute 8% of salary per year.

- This could deliver a pre-tax income in drawdown worth just £5,500 a year until age 97, along with £42,000 tax-free cash.

Clearly more needs to be done, particularly for those on low incomes in the private section. However, in the current climate there is unlikely to be much appetite for increasing minimum contributions or extending the scope of auto enrolment to lower earners.

This document is believed to be accurate but is not intended as a basis of knowledge upon which advice can be given. Neither the author (personal or corporate), the CII group, local institute or Society, or any of the officers or employees of those organisations accept any responsibility for any loss occasioned to any person acting or refraining from action as a result of the data or opinions included in this material. Opinions expressed are those of the author or authors and not necessarily those of the CII group, local institutes, or Societies.