What's new bulletin August 2022

News article

Publication date:

15 August 2022

Last updated:

18 December 2023

Author(s):

Technical Connection

Update from from 29 July to 11 August 2022.

TAXATION AND TRUSTS

Statistics on non-UK domiciled taxpayers

(AF1, RO3)

HMRC has published statistics on those claiming non-domiciled status in the UK. It is estimated the numbers have decreased from 76,500 to 68,300 individuals claiming non-domiciled status.

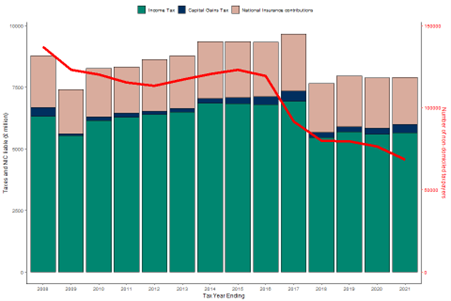

Non-UK domiciled taxpayer numbers, income tax, capital gains tax and national insurance contributions

This decrease was largely due to the decrease in number of such individuals coming to the UK in 2020/21 6,000 fewer new arrivals in 2020/21, compared to the previous year. HMRC also sees more than 3,000 fewer people stay for a second year than in recent years. HMRC believes that the primary driver of this is fewer new non-UK domiciled taxpayers coming to the UK to replace those who normally leave. This is coincident with the travel restrictions caused by the COVID-19 pandemic that led to a substantial reduction in international aviation, sea and rail travel options to the UK. HMRC says that it would therefore not expect to see similar effects in the future unless a similar situation were to occur.

According to their estimates, non-UK domiciled taxpayers accounted for £7.896 billion in income tax, national insurance (NIC) and capital gains tax (CGT) in 2020/21. Despite the lower number of non-UK domiciled taxpayers, their aggregate tax and NICs liabilities remain broadly similar to the previous year’s figure of £7.878 billion in 2019/20.

Since the changes to the deemed-domiciled rules in 2017, there has been a fall in the number of those being able to call themselves non-UK domiciled. These changes meant that an individual who was formerly non-UK domiciled might be deemed UK domiciled for tax purposes if they were born in the UK and have a UK domicile of origin (Condition A), or if they were resident in the UK for at least 15 of the 20 tax years immediately before the relevant tax year (Condition B). There were 10,100 individuals claiming deemed UK-domicile status in 2020/21. These are individuals that were formerly treated as non-UK domiciled for UK tax purposes prior to the 2017 policy change. This is broadly consistent with 2019/20, following two years of consistent increases. However, HMRC believes this to be an underestimate. HMRC estimates that £3.414 billion in income tax, NIC and CGT was paid by deemed UK-domiciled individuals in 2020/21 (up from the £3.096 billion in 2019/20).

The remittance basis of paying UK tax is an option available to non-UK domiciled individuals, meaning they only pay UK tax on income/profits remitted to the UK from overseas. In 2019/20, such individuals paid £6.352 billion in income tax, NIC and CGT. Those with unremitted income of more than £2,000 and who have been resident in the UK for seven of the last nine years pay a remittance basis charge (‘RBC’) of £30,000 to use the remittance basis. Those who have been resident in the UK for 12 out of the last 14 years have to pay £60,000. There were 1,900 RBC-payers in 2018/19, increasing to 2,000 in 2019/20 - those individuals paying £925 million to £987 million respectively in income tax for those years.

The figures show that in 2019/20, 58% of those claiming non-UK domiciled status resided in London.

Remittance basis users can avoid paying UK tax on their remittances if the monies are invested in UK businesses. This is known as Business Investment Relief and has been in place since April 2012. Between then and 2020, £6.3 billion has been invested accordingly, with £853 million invested in 2019/20 alone from 500 individuals.

TRS penalty structure announced

(AF1, JO2, RO3)

HMRC has confirmed the penalties that will apply where trustees fail to register on time or fail to keep the register up to date. The penalties are imposed under Part 9 of the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017. Where trustees appeal the penalties, the details of this process will be set out in any penalty notices issued.

Failure to register on time

A £5,000 penalty may apply per offence where trustees fail to register the trust. This means the penalty will apply where there is a deliberate act on behalf of the trustees. However, HMRC have confirmed that in recognition of the fact that the registration requirements are new and an unfamiliar obligation for trustees, there will be no penalty for a first offence, either for failure to register or late registration, unless this is due to deliberate action by the trustees.

What this means is that, should HMRC become aware of a trust which has not been registered by the relevant deadline, a warning letter will be issued. The trustees ought to register the trust within the deadline stipulated in the letter, otherwise a fine may be issued to the trustees. Where deliberate non-compliance takes place, each case will be looked at individually by HMRC.

Failure to keep the information held on the Trust Registration Service (TRS) up to date

Where the lead trustee fails to keep the register up to date they may be fined a £5,000 penalty and, similar to failure to register a trust, where this is a deliberate act on behalf of the trustee the penalty will apply. Again, HMRC have also established that there will be no penalty for a first offence, unless the failure is shown to be due to deliberate behaviour on the part of the trustees.

In a similar vein to the failure to register a trust, where the trustees do not keep the information on the TRS up to date, HMRC will issue a warning letter to the lead trustee. They will be given a specific time period in which to update the information before a penalty applies. Full details of the HMRC's expectations can be found on their website.

Where more than one piece of information is being updated, and is outwith the timeframe where a penalty becomes payable, only one penalty will apply.

Comment

This is one of the last remaining missing pieces in the TRS puzzle, keenly anticipated and subject to considerable speculation, from optimistic announcements that HMRC will be very lenient in their penalty approach to one confident statement from a well-known firm of solicitors only two weeks ago that "HMRC have indicated that they will begin issuing penalties (from £100 to £300) to trustees for failure to comply with registration requirements immediately after 1st September 2022/"

We have anticipated that there will only be "nudge letters" for the first time offenders. However, the level of the proposed fine, at £5,000, has come as a surprise. Trustees need to be aware that if they receive such a penalty, this will be their personal liability, i.e. they will not be able to use the trust funds to pay it. (Note that trust funds can usually be used to pay an agent’s fee for the TRS registration).

Another point to remember, for trustees who may think that they don’t need to register their trust until they receive a letter from HMRC, is that, without a proof of registration, trustees of registrable trusts will not be able to deal with financial institutions or professional advisers.

HMRC Capital Gains Tax (CGT) statistics

(AF1, RO3)

HMRC has published statistics on CGT taxpayer amounts and numbers covering 2020/21. They tell a couple of interesting stories.

This was the first full tax year in which Entrepreneurs’ Relief (ER, with a limit of £10 million) was replaced by Business Assets Disposal Relief (BADR, with a limit of £1 million) and it shows in the numbers:

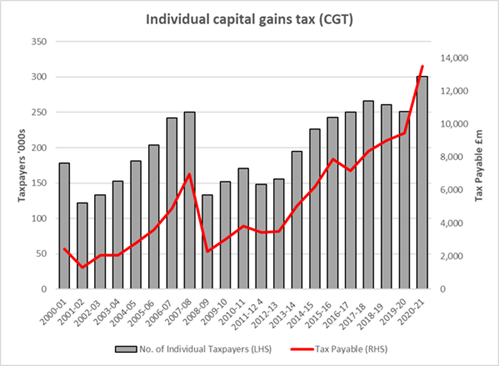

- CGT liabilities amounted to £14.3bn in 2020/21, of which £13.503bn (94.3%) was payable by individuals and £0.811bn (5.7%) by trusts. The current Office for Budget Responsibility (OBR) March 2022 projection for 2022/23 CGT receipts (the bulk of which relates to 2021/22 gains) is £15bn.

- The amount of CGT raised from individuals more than tripled in the ten years to 2020/21. For trusts, the figure almost doubled over the same period. The year-on-year increases in 2020/21 were 43% and 32% respectively. The HMRC commentary to the statistics notes that the OTS review of CGT, which proposed aligning tax rates more closely with income tax and reducing the annual exemption, could have encouraged taxpayers to bring forward disposals.

- The number of CGT taxpayers has increased over the same ten years period, but by no means as rapidly (the graph scales hide this). Individual taxpayer numbers rose from 171,000 to 301,000 while trustee numbers increased from 18,000 to 22,000. The corollary is that average CGT payments per taxpayer have increased sharply.

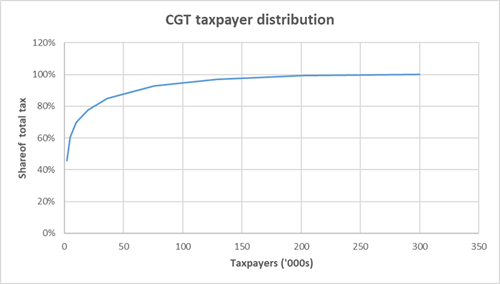

- As usual, the small population of CGT payers – less than 1% of income taxpayers – shrinks to almost invisible levels when shares of tax are considered. The chart below highlights this – just 5,000 CGT payers (1.7% of the total number) account for 61% of the tax paid. Their gains were a minimum of £2m, their average CGT bill £1.63m and the average CGT rate they paid was 19.7%.

The data highlights why the then-Chancellor replaced ER with BADR in the 2020 Budget. The new(ish) relief was claimed by 47,000 taxpayers in 2020/21, with gains totalling £11.85bn attracting 10% tax. In the previous tax year, the same number of taxpayers claimed ER, but their total gains taxed at 10% amounted to £29.07bn. If the same amount of business gains was realised in the two tax years, the move from ER to BADR accounts for about £1.7bn extra CGT, close to half the extra CGT raised in 2020/21 over 2019/20.

Comment

The jump in CGT revenue is unlikely to be repeated in 2021/22, as the OBR projections confirm. Nevertheless, in terms of revenue, CGT now raises more than double the amount of inheritance tax (IHT), and is projected to produce £6.7bn in 2022/23. At some point, the idea of applying CGT on death and scrapping IHT might make a reappearance.

INVESTMENT PLANNING

Why the central banks are raising interest rates

(AF4, FA7, LP2, RO2)

With a few exceptions, central banks around the world are pushing up interest rates in response to rising inflation. Why? The Bank of England's Monetary Policy Report offered a gloom-laden 101 pages. Its baseline projections included:

- Inflation reaching a peak of over 13% in the final quarter of this year and still at 9.5% in 2023 Q3

- A fall in real post-tax household income of around 2% in the year to 2022 Q4

- A 2.25% contraction in GDP in 2023 followed by another 0.25% shrinkage over the following 12 months

- Unemployment rising from 3.8% in May 2022 to 6.3% in three years’ time

With such a dire outlook, why did the Bank decide to raise interest rates by 0.5%, its largest increase in 27 years and the sixth consecutive rise? The answers are many, including:

- The markets had anticipated such an increase, helped by various messaging from the Bank of England. A smaller increase or none would have surprised the markets, something central bankers avoid because they need credibility to be effective. If markets suddenly decide a central bank is faltering, there can be volatile and unwelcome consequences.

- The Federal Reserve, European Central Bank, Bank of Canada and Swiss National Bank had all raised rates by more than 25 basis points in recent weeks. The Old Lady of Threadneedle Street needed to show similar resolution. This harks back to the need for credibility.

- Raising interest rates is the one piece of the central bankers’ toolkits which is seen as the main way to constrain rising prices.

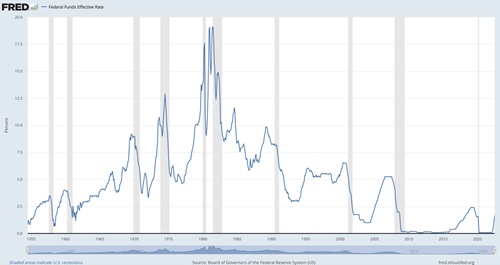

Proof of the effectiveness of rate rises is often summed up in one word: Volcker. Paul Volcker became Chairman of the US Federal Reserve in 1979, at a time when inflation was running at 11.0%. Volcker was tasked with beating inflation, which had been a problem for the USA economy for over a decade. His strategy was to push up interest rates to above 19% (the blue line on the graph below), creating two recessions (in 1980 and 1981-82 – the grey shading), during the second of which unemployment reached nearly 11%. That medicine produced a political backlash, but Volcker had engineered himself into an impregnable position and, by the end of 1982, inflation had come down from a 1980 peak of 14.8% to under 5% and interest rates had dropped below 9%.

Effective Federal Funds rate 1955-2022 (Source: St Louis Federal Reserve)

The Volcker approach can be summarised as:

- Raising interest rates to reduce demand in the economy;

- Keeping the interest rate pressure in place so that the reduced demand worked through to lower supply

- Letting that fall in supply lead to increased unemployment; and

- Allowing that rising unemployment to bring down wage inflation, breaking the wage/price spiral.

The current Chairman of the Federal Reserve, Jerome Powell, is viewed by some commentators as adopting a Volcker-type policy, given that the US is already in a technical recession (two consecutive quarters of negative growth). At the most recent rate setting press conference he said "[The Reserve] actually think[s] we need a period of growth below potential, in order to create some slack so that the supply side can catch up." Powell carefully avoided accepting that the US was already in recession, pointing out that "there are just too many areas of the economy that are performing too well" for that to be the case.

Friday’s news that nonfarm payroll numbers rose by 528,000 gives some support to Powell’s stance. The current view of the US financial markets is that, by the middle of next year, the US economy will be in a recession deep enough to prompt the Fed to start reversing the rate increases of 2022.

There has been some debate about whether the Reserve was too late in beginning to raise rates – its first increase was not until 17 March 2022. That illustrates one of the difficulties in using interest rates as a counter-inflationary weapon: no central bank wants to slow the economy unless it is necessary. Up until the turn of the year, the Fed has seen inflation as ‘transitory’ – a blip caused by post-COVID supply chain issues that would not have any long-term effects. On that basis, the Federal Reserve held rates at around zero and let the economy grow, even though inflation reached 6.2% by October 2021. In the mid-2000s the Bank of England took the same look-through-the-blip approach when inflation spiked because of a fall in the value of sterling. Interest rates are not a tool to deal with inflation driven by external events over which a central bank can have no or very little control.

Which brings us to the UK in August 2022. Last year the Bank of England, like the Federal Reserve in the US, was a member of 'team transitory' on the inflation front. It is easy to forget now that in July 2021, UK CPI inflation was 2.0% — exactly on target. Four months later it was 5.1%, prompting the Bank to raise the base rate from 0.1% to 0.25% just before Christmas. What drove that jump in inflation was largely transport and energy costs, not the Ukraine war, which did not begin until 24 February 2022. By the end of 2021, five out of the 12 CPI categories, accounting for about 35% of the index, had inflation rates below 4%.

That war is a perfect example of an inflation-creating external event over which the Bank has no control, so why is it increasing interest rates now? The answer goes back to the problem Volcker faced – inflation that had become embedded in the economy via a wage/price spiral. The Bank of England says in its latest Monetary Policy Report that "the labour market remains tight, and domestic cost and price pressures are elevated. There is a risk that a longer period of externally generated price inflation will lead to more enduring domestic price and wage pressures."

Break down June's inflation numbers and, while transport and energy are still the main drivers, only two of the 12 CPI categories have inflation at less than double the Bank’s 2% target and, unfortunately, that duo (Health and Communication) represent just 4.6% of the index; inflation has spread throughout the economy Unlike the Federal Reserve, which must also consider maximising employment, the Bank of England has a single mandate to control inflation. It can therefore be bolder in its recognition that a recession is looming. How much the rate rises are responsible for that recession is a moot point. They will not help, but the driving forces are rising food and energy costs, which leave the consumer with less to spend elsewhere as earnings are not keeping pace. Markets were pricing in an interest rate peak of 3% in 2023 Q2 when the Monetary Policy Report was produced, although that has now fallen to 2.8%. Either way, in inflation-adjusted terms that is still very cheap borrowing.

The Bank is under unusual political pressure at present, stemming from the comments of Liz Truss in the Conservative Party leadership battle. Hindsight makes it easy to say rates should have been raised earlier, adding to the impression that the Bank was – and still is – behind the curve. The Bank does not want to lose the independence it was granted 25 years ago, so it will keep raising rates until it can see evidence that inflation is turning down. However, rates are not going to come anywhere near Volcker’s 1980 levels, if only because that would bankrupt UK finances. Do not forget that the Treasury pays base rate on the funds created by the Bank of England under Quantitative Easing (QE) – currently totalling over £865bn.

PENSIONS

Changes to the Pension Protection Fund and Fraud Compensation Fund Regulations

(AF3, FA2, JO5, RO4, RO8)

The Department for Work and Pension (DWP) has published a consultation on technical amendments to the Pension Protection Fund (PPF) with regards to interim payments to schemes who are applying for the Fraud Compensation Scheme.

The consultation is set out in two parts. The purpose of each parts is to seek views on whether proposed change meets the policy intent and whether there are any impacts or unintended consequences.

Chapter 1 is focused on the proposed change to the Fraud Compensation Fund (FCF). It outlines the rationale for inserting an additional prescribed liability that the Board of the PPF, which administers the FCF, can make interim payments under section 186 of the Pensions Act 2004.

Chapter 2 deals with proposed changes to the Pension Protection Fund (Compensation) Regulations 2005, so that surviving child dependants who have a gap in full-time education of more than one year do not lose their entitlement to PPF compensation.

Current legislation doesn’t take account of the option for many students to take a gap year, between their courses. If a student ceases full time education for more than a year, then their payments will cease. This doesn’t currently apply to those in receipt of benefits from the Financial Assistance Scheme (FAS) and it isn’t policy intent to restrict such payments. These proposed changes are designed to rectify this.

The consultation runs to 9 September. Responses can be sent to pensions.consultations@dwp.gov.uk.

The Pensions Regulator produces scam-fighting plan

(AF3, FA2, JO5, RO4, RO8)

The Pensions Regulator (TPR) is warning that savers may be lured by offers to access their pension savings early to cover essential household bills or be attracted by fake investments offering high returns that never materialise. This has driven them to publish their Scams Strategy which sets out their aims, what they are seeking to prevent and actions required over the next two to three years.

|

Harm |

People losing some, or all, of their pension savings to scammers |

||

|

Key drivers |

Savers not being enabled to make good decisions |

Practices which lead to saver harm |

Pension fraud and criminality |

|

Strategic aims in response |

Educate savers about the threat that scams present |

Encourage higher standards and prevent practices by schemes, advisers, and providers which lead to saver harm |

Fight fraud through the prevention, disruption, and punishment of criminals |

|

Outcome we will deliver |

All savers are made aware of the risk of scams |

Most savers are in schemes providing gold-standard protections |

Schemes report potential fraud activity to authorities. |

Actions are set out by TPR as follows.

All savers are made aware of the risk of scams

Year 1

- set expectations that schemes include a pension scam warning in every annual benefit statement with a link to ScamSmart

- support Stronger Nudge to guidance

- support UK Financial Strategy for Wellbeing

- support the ScamSmart campaign

Year 2

- explore scam prevention guidance for employers

- work to improve the pensions consumer journey including a review of guidance on member communications for scam-prevention messaging

Year 3

- continue and review for new opportunities.

Most savers are in schemes providing gold-standard protections

Year 1

- monitor, nudge, and set expectations that schemes under TPR's master trust and relationship supervision are Pledge compliant

- monitor and update the Trustee toolkit, so that it is reflective of Pension Schemes Act 2021 and Pension Scams Action Group (PSAG) Threat assessment if required

- encourage consolidation of small schemes

- review data sharing agreements with MaPS and FCA and revise where needed

- analyse amber flag data provided to MaPS and continue to have open dialogue on trends

- work with PSAG partners to consider developing consumer protection messaging around SIPPs and SSASs

Year 2

- introduce policy/guidance changes as per insight provided by amber flag data

- work with the biggest administrators so that they voluntarily adopt best practice on transfers

Year 3

- include Pledge compliance as an expected part of the ‘scheme oversight and customer service’ Value for Money assessment for trust-based schemes subject to consultation findings

- as schemes consolidate, explore Chair accreditation/professionalisation subject to evidence and policy development

Schemes report potential fraud activity to authorities; creation of a hostile environment for those seeking to defraud savers using improved data

Year 1

- continue to investigate and prosecute scam cases, issue penalties and suspend and prohibit trustees

- support the continued (annual or every two years) development of a new PSAG strategic threat assessment

- scope and develop senior-level strategic partnership with key organisations across PSAG family to facilitate enforcement

- encourage industry to report fraud, including reporting red flags

- engage alongside PSAG partners with other relevant proposed legislation to protect savers including the Online Safety Bill

Year 2

- set up a new dedicated and fully funded PSAG scams hub to coordinate intelligence and direct fraud disruption and prevention activity

- engage in 18-month review of Pension Schemes Act 2021 regulations with supporting data to improve legislation where possible

- open a regulatory sandbox to allow industry to test solutions for scam prevention and intelligence gathering

Year 3

- continue to create hostile environment by using improved data to support PSAG partners law enforcement efforts

Comments

It is positive that TPR are taking a good look at what can be done to protect consumers. It yet again brings to light the vulnerabilities caused with the cost of living increases. The whole industry, from providers, advisers and the regulators, needs to work together to ensure that those most at risk are not targeted and, if they are, they aren’t caught out by these scams. Many people have lost so much to scams over the years that this is just another way for those scammers to target them.

Redress calculations for non-compliant pension transfers: new consultation

(AF3, FA2, JO5, RO4, RO8)

In 2017, the Financial Conduct Authority (FCA) published the final guidance (FG17/9) for calculating redress payments where defined benefit transfers were deemed unsuitable. As part of this publication, the FCA committed to reviewing the methodology at least every four years. This consultation publishes the proposed changes, the reasoning behind them as well as questions on these proposals.

The review commenced in September 2021 and Deloitte where engaged to conduct the review. Alongside the consultation, the FCA has published Deloitte’s technical report as well as their technical manual. The FCA also took external specialist legal advice from Michael Furness QC, which they have also published.

Deloitte concluded that the methodology, which has been used to calculate redress for many years, remains broadly appropriate to achieve the basic objective of redress. The FCA agree, so are not proposing any major changes. There have been some minor changes that have been suggested to deal with the four main challenges that were identified.

These four challenges are:

- ensuring consistency of approach between the large number of firms carrying out calculations

- making the methodology as responsive as possible to consumers’ individual circumstances

- ensuring consumers understand how any offer of redress they receive has been calculated

- reducing the impact of market volatility, which we have no control over, on the calculation

The high levels proposals are:

- consolidating the methodology as rules and guidance in the FCA Handbook

• changing the approach to determining the consumer’s retirement age

• payment of redress and how it is explained to consumers

• frequency of updates to the economic assumptions (Chapter 4)

• consumer price index (CPI) inflation assumption (Chapter 4)

• pre retirement discount rate assumption (Chapter 4)

• proportion married or in a civil partnership at retirement assumption (Chapter 5)

• adviser and product charges assumption (Chapter 6)

• slight differences that impact redress for British Steel cases (Chapter 8)

There are more detailed discussions on various areas within the extensive consultation paper with 74 questions asked of the reader. The consultation is open until 20 September 2022 and can be responded to using the online form or by emailing queries-cp22-15@fca.org.uk

DWP publishes consultation on DB funding draft regulations

(AF3, FA2, RO4)

The DWP has published draft funding and investment strategy regulations for defined benefit (DB) pension schemes in order to amend the funding regime as required by the Pension Schemes Act 2021. The draft regulations set out new requirements for the funding and investment strategy of schemes as they move towards maturity. The objective is "better, and clearer, funding standards, but not to move away from the strengths of a flexible scheme specific approach." The standards are intended to "enable TPR to intervene more effectively" where required.

Schemes will need to capture their approach in a written statement of their funding and investment strategy at the first valuation after the regulations come into force, but no target date is given for their implementation.

Scheme maturity

A key requirement of the new approach is that once a scheme is mature it should be in a state of low dependency on their sponsoring employer. The draft regulations propose measuring scheme maturity using the duration of liabilities determined according to a standard “weighted mean time” approach which will be further defined in The Pensions Regulator’s (TPR’s) Defined Benefit Funding Code of Practice.

The DWP proposes that the relevant duration for determining what is "significantly mature" should not be set out in the Regulations, but instead set by TPR in its Code of Practice – with 12 years expected to be the proposed duration. The date on which the scheme is expected to have this duration is the "relevant date" on which the scheme must be fully funded on its low dependency basis.

Low dependency requirements

To achieve a state of low dependency a scheme will need to be invested in appropriate assets which broadly match the expected liability cashflows and be highly resilient to changes in market conditions. The actuarial assumptions chosen should reflect this strategy and there should be no expectation of any need for further employer deficit contributions under reasonably foreseeable circumstances.

The scheme should be fully funded on this basis when significant maturity is reached. Unlike the requirements that apply over the period to reaching maturity, the draft regulations propose that the low dependency target applies equally to all schemes regardless of covenant or whether there are supporting contingent assets, although DWP is consulting on some very limited relaxations to the investment requirements if high-quality contingent assets are available.

Employer covenant

For the first time, employer covenant is defined in legislation. In considering employer covenant, Trustees will have to assess the likelihood of employer insolvency, the employer’s cash flow and how other factors may affect the business. These should be viewed taking into account the size of the scheme’s deficit on its low dependency and solvency bases. Contingent assets can be taken into account provided they are legally enforceable and provide sufficient support in the circumstances in which they may be required.

The journey plan

The amount of investment risk that can be taken while on a Journey Plan to the low dependency target, and the strength of the actuarial assumptions chosen for funding purposes are dependent on both the strength of the employer covenant and how near the scheme is to reaching significant maturity. In the statement of strategy, the trustees will be required to set out their contingency plans in the event that any such risks materialise.

Technical provisions

A new requirement is added to the technical provisions that the assumptions used in calculating the technical provisions on or after the relevant date are consistent with how the pensions and other benefits under the scheme will be provided over the longer term, as set out in the scheme’s funding and investment strategy. The impact assessment acknowledges that this requirement may lead to material increases in technical provisions for schemes that currently do not fund in this way.

Recovery plan

While it has always been a TPR objective, the regulations also introduce a new legal requirement for any recovery plan to be met "as soon as the employer can reasonably afford." DWP is consulting on whether this should have primacy over other Recovery Plan requirements.

Investment strategy

During the Act’s Parliamentary passage, the Government committed to not fettering trustees’ investment powers. However, the statement of funding and investment strategy which needs to be agreed with the employer will include a specification of the intended high level allocation between asset classes at the relevant date. The consultation appears to acknowledge this shift in the Trustee’s investment powers at that date, proposing that flexibility remains because the Trustees will continue to be responsible for investing funds.

Contents of the statement of strategy and its review

The regulations set out a number of detailed requirements for the statement strategy, which include a number of new requirements for information on maturity, liquidity and investment strategy. This will need to be revised at least at each future actuarial valuation, but will also need to be reviewed and if necessary revised if there is a material change in the scheme funding position, or a material change to the employer covenant.

Open schemes

The consultation states that the intention is that open schemes with "adequate sponsor support" should not need to "undertake inappropriate de-risking of their investment approaches." However, the regulations require open schemes to comply with all the above requirements, with the flexibilities being that:

- It is acknowledged that the "relevant date" for open schemes is likely to roll forward at each valuation if the scheme has not in fact matured.

- Schemes further away from reaching significant maturity can take more investment risk, provided this is supported by the strength of the employer covenant.

However, the requirements remain for such schemes to both set and fund for a journey plan to low dependency, even if they do not expect to ever reach significant maturity. The consultation runs to 17 October 2022.

This document is believed to be accurate but is not intended as a basis of knowledge upon which advice can be given. Neither the author (personal or corporate), the CII group, local institute or Society, or any of the officers or employees of those organisations accept any responsibility for any loss occasioned to any person acting or refraining from action as a result of the data or opinions included in this material. Opinions expressed are those of the author or authors and not necessarily those of the CII group, local institutes, or Societies.