Technical news update 13/01/2020

Technical article

Publication date:

14 January 2020

Last updated:

18 December 2023

Author(s):

Technical Connection

Update from 12 December 2019 to 8 January 2020.

Taxation and trusts

- The date of the next Budget

- The OBR revisits the 2019 Budget numbers

- Open finance – FCA call for input

- Loan Charge Review reports

- LISA comes to the fore

- The Queen’s Speech take 2

- The National Living Wage and National Minimum Wage

- April 2020’s IR35 changes - Government Review

- Financial Services and Brexit – FCA update

- Press release - 'get quacking' - with less than a month to go

Investment planning

- An interesting insight into VCT investors

- Review of open-ended funds - FCA and Bank of England statement on joint review

- The November inflation numbers

- A much better year for UK shares

- A decent year for bonds

Pensions

- PPF publishes updated PPF 7800 index - December 2019

- New life expectancy figures released

- Recruitment agency ordered to pay £10,890 for misleading tpr and avoiding workplace duties

- Trustees urged: engage early and be transparent – 18 December 2019

- Supreme court rules in case concerning pensions for part-time judges

- Employment tribunal makes interim declaration in favour of firefighters

- Bank of England Governor warns pension funds to address climate change

TAXATION AND TRUSTS

(AF1, AF2, AF3, AF4, ER1, FA2, FA4, FA5, FA7, JO2, JO3, JO5, LP2, RO2, RO3,RO4, RO5, RO7, RO8)

Early on 7 January the Treasury confirmed news that emerged overnight that the Budget will be held on Wednesday 11 March.

The March date is something of a surprise as the Conservatives ‘First 100 Days’ press release issued on 4 December stated:

‘Before 100 days are up, a Conservative majority Government would have also taken the following actions:

Delivering a post Brexit Budget in February which will cut taxes for hardworking families…

Cynics might consider that given the previous administration’s difficulty in meeting deadlines (ditch-based or otherwise), it is no surprise that February has now become March and that an Autumn Budget (originally due 6 November) will arrive in what meteorologists class as Spring. In practice, the deferral probably makes sense:

- The official ten weeks’ notice the Treasury is meant to give the OBR to prepare an Economic and Financial Outlook would have taken us to 21 February, assuming notice was given on 13 December, the day after the Election. Throw in Christmas holiday season and you end up in March.

- The delay gives the Chancellor and OBR the chance to see and take account of the all-important January borrowing figures, which capture 31 January self assessment payments and last year produced a £14.9bn surplus for the month.

- The Chancellor can hope for some better economic data as businesses react to the election of a government with a meaningful majority, if not yet an end to uncertainty surrounding post-Brexit trade relationships. The IHS MARKIT/CIPS PMI Services data, released on 6 January, suggested some stabilisation during December, even though the Composite PMI index fell marginally. As the IHS MARKIT/CIPS news release notes, “There were signs that service providers have become hopeful that a more stable political backdrop will help to support business conditions over the course of 2020”.

One consequence of the deferral to 11 March of the Budget is that the Finance Bill 2020 will probably not become a Finance Act until Summer, in the tradition of former Spring Budgets. Draft clauses were published on 11 July 2019. These covered some important changes due to take effect at the start of 2020/21, including the extension of off-payroll working rules to the private sector and the tightening up of legislation on CGT and private residences. Once more we will be in a situation where it becomes necessary to comply with laws before they formally exist.

The first Budget of a new Parliament is traditionally when a Chancellor delivers the bad news, taking advantage of the fact that it is furthest from the next Election. Given the limited wriggle room Mr Javid has in terms of current spending and his no income tax/VAT/NICs rates increase pledge, there could be some creative surprises. Pension tax relief reform is one possibility.

Source: FT.com 7/1/20

The OBR revisits the 2019 Budget numbers

(AF1, AF2, AF3, AF4, ER1, FA2, FA4, FA5, FA7, JO2, JO3, JO5, LP2, RO2, RO3,RO4, RO5, RO7, RO8)

Now that the Election is out the way, the Office for Budget Responsibility (OBR) has been able to publish a recast of its March 2019 Spring Statement forecast.

The original plan was that the OBR would publish some reworked economic numbers on 7 November, the day after the Autumn Budget that never was. The OBR was never going to issue a fully revised forecast as work on that had stopped when the Budget was pulled. Instead, we were to see the March Economic and Financial Outlook (EFO) figures amended for the recent bout of statistical changes, such as the new, more realistic treatment of student loans and overstatement of corporation tax revenue. No account was to be taken of economic developments since March.

On 6 November the plug was pulled because “the Treasury raised concerns about the publication’s consistency with the Cabinet Office General Election Guidance”, worries which were subsequently supported by the Cabinet Secretary. Conspiracy theorists speculated that Mr Javid did not want the revised projections to appear until after the polls had closed.

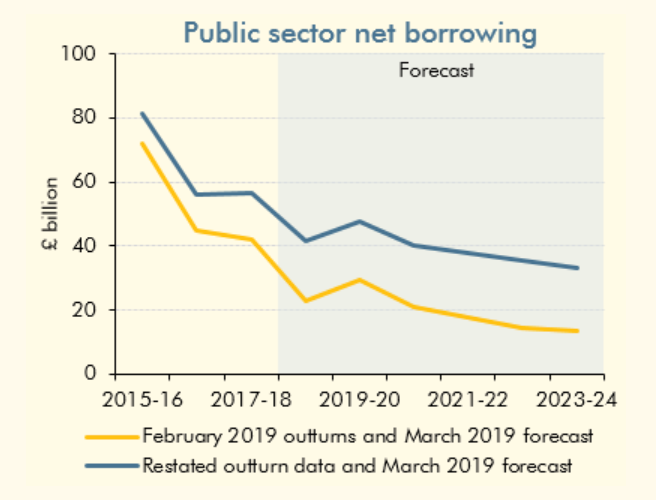

Whether or not you believe speculation, the OBR’s revised numbers, published on 16 December, do not look rosy, as the graph below shows.

The restated projection for the Public Sector Net Borrowing Requirement (PSNBR) in 2019/20 is £47.6bn, an increase of £18.3bn (62%) on the original figure. As at October 2019, the PSNBR for the financial year to date (seven months in) on the restated basis was £46.3bn (£4.3bn up on 2018/19). Tempting though it is to do so, as the OBR says “…experience shows how a simple extrapolation of revision-prone data may be misleading”.

The OBR has also calculated figures for the current budget deficit, which is basically the PSNBR plus public sector net investment. The current budget deficit has assumed more importance as the Chancellor has said that he will now aim to balance the current budget rather than bring the PSNBR down to zero. The OBR restatement brings the 2019/20 current budget deficit down from -£-17.7bn (i.e. a surplus of £17.7bn) to just -£2.5bn.

For 2020/21 the restated current budget is £13.3bn in surplus (cf £29.3bn), but that is before taking account of the IFS estimated £11.7bn extra day-to-day expenditure announced in the Spending Round statement in early September. Net that off and you have a surplus of £1.6bn – almost a rounding adjustment.

It is a shame that these figures did not emerge before the Election, as they would have shown a better – if not up to date – picture of Government finances. They serve to explain why the Conservative manifesto was so light on tax cuts and spending increases and why the 2020 corporation tax cut was reversed. The truth is that the Chancellor looks to have already used up virtually all of his available day-to-day spending ammunition.

Sources: OBR revised EFO 16/12/19

Open finance – FCA call for input

The Financial Conduct Authority (FCA) has launched a Call for Input on the opportunities, and potential risks, presented by so-called ‘open finance’.

Open finance refers to the extension of open banking-like data sharing and third-party access to a wider range of financial sectors and products.

Open banking was designed to increase innovation and competition in banking and payment services. Along with the revised Payment Services Directive (PSD2), it introduced a secure environment enabling customers to consent to third parties accessing their payment account information or making payments on their behalf.

Open finance builds on the principles of open banking – the sharing of data which provides new ways for customers and businesses to make the most of their money. Open finance would extend those principles to a wider range of products, such as savings, insurance, mortgages, investments, pensions and consumer credit.

It is based on the principle that the data supplied by, and created on behalf of financial services customers, are owned and controlled by those customers. Re-use of these data by other providers takes place in a safe and ethical environment with informed consumer consent. This would mean that a financial services customer who consents to a third-party provider (TPP) accessing their financial data, could be offered tailored products and services as a result. Access would be provided by that customer’s current financial services provider under a clear framework of consent.

The FCA has, however, identified a number of potential risks, such as customers with certain characteristics being excluded from certain markets, exclusion of consumers who opt out of data sharing, and those consumers getting less advantageous pricing (a so called ‘privacy premium’). For full details, please see here.

The Call for Input will launch a discussion on the opportunities and risks arising from open finance, what is needed to ensure it develops in the best interests of consumers and what role the FCA should play.

The FCA has set up an advisory group to help drive forward its future strategy. It has also published the advice of this group, which comprises industry experts, consumer and business representatives, academics and Government departments.

The FCA is seeking feedback to the Call for Input by 17 March 2020 and says that it will publish a feedback statement in Summer 2020.

Source: FCA News: FCA asks for proposals on how open finance could transform financial services – dated 17 December 2019.

(AF2, JO3)

The review of the Loan Charge has been published by the Treasury. It will cut the tax bills of many of those who used the scheme.

A Friday before Christmas week begins is probably up there on the list of times to bury bad news. It is perhaps therefore no coincidence that it was the day chosen by the Treasury to publish the Review by Sir Amyas Morse into the Loan Charge and the Government’s response.

The Review is damning of the approach adopted by the Treasury and HMRC to disguised remuneration schemes. Morse accepts that ‘…some form of policy like

the Loan Charge [is] necessary and in the public interest”. However, he also says “… the evidence provided to the Review prompts serious questions about how proportionate the Loan Charge was in terms of its design and effect on individuals”. The Review made 20 recommendations, all but one of which were accepted by the Treasury.

The main points to note are:

- The Loan Charge will now only apply to loans taken out on or after 9 December 2010, the date when legislation was announced removing “any doubt that tax was due”. Amounts already voluntarily paid for years when the Charge no longer applies will be refunded.

- Furthermore, the Loan Charge will not apply to users of loan schemes between 9 December 2010 and 5 April 2016 who fully disclosed their schemes on their tax return and where HMRC failed to take action.

- Loan scheme users will be allowed to defer filing their returns and paying their Loan Charge liability until September 2020.

- Taxpayers will be able to split the loan balance over three years.

- The Government will “invest in a new HMRC team to collect tax from those who used the avoidance schemes pre-2010”.

The Treasury says these changes are estimated to reduce bills for over 30,000 people subject to the Loan Charge, more than 60% of the total number of users. An estimated 11,000 will be taken out of the charge completely.

The Treasury does not indicate the lost revenue cost of these changes, but the original expectation at the time of the 2016 Budget was £2.35bn. Earlier this year HMRC announced that it had already collected £1bn and anticipated total receipts of £3.2bn. That suggests Mr Javid has lost a little more of his very limited wriggle room ahead of the Budget scheduled for Wednesday 11 March.

There are lessons for all sides from this sorry saga. Attempts at quasi-retrospective legislation are now likely to be fewer, but early legislation against any unacceptable schemes is now more likely.

Source: HMT 20/12/19

(AF4, ER1, FA7, LP2, RO2, RO7)

Just as the Help-to-Buy ISA disappears, a Freedom of Information request has revealed that LISA penalties are proving a nice little earner for HMRC.

At the start of December, the Help-to-Buy ISA was withdrawn. Existing Help-to-Buy ISA investors can continue to contribute up to £200 per month and have until 1 December 2030 to claim their 25% Help-to-Buy bonus.

With the demise of the Help-to-Buy ISA, more attention is now likely to fall on the Lifetime ISA (LISA) as the only incentivised savings plan for first-time homebuyers. The LISA is different from the Help-to-Buy ISA in several significant ways:

|

Feature |

Help-to-Buy ISA |

Lifetime ISA |

|

Minimum starting age |

16 |

18 |

|

Maximum starting age |

N/A |

39 |

|

Savings must cease |

30 November 2030 |

Age 50 |

|

Maximum investment (counts to £20,000 limit) |

£1,000 initial, then £200 a month |

£4,000 per tax year |

|

Bonus |

Given as 25% of accumulated fund when first home purchased. Maximum £3,000, minimum £400 |

Given as 25% of each contribution, eg £1,000 for £4,000 contribution |

|

Minimum period before home purchase |

When ISA has reached a value of at least £1,600 |

12 months after opening |

|

Maximum property value |

£450,000 in London, £250,000 throughout the rest of the UK |

£450,000 throughout the UK |

|

Withdrawal |

Penalty free: · At any time. · Bonus only applies for home purchase |

Penalty free: · At any time after 12 months for home purchase; · From age 60 onwards; · If terminally ill, with less than 12 months to live. Penalty levied: In all other circumstances a penalty of 25% of the sum withdrawn applies. |

At first sight the LISA penalty appears to be clawing back the government bonus, but the mathematics means the penalty claws back more than that, see example:

LISA makes a grab…

Sandra saved £200 a month in a cash LISA for 12 months from June 2018, receiving a £50 government bonus on each contribution. In June 2019 she stopped contributions on losing her job and three months later, short of money, she cashed in her LISA. The pre-penalty value of her LISA was £3,056. The 25% penalty on encashment amounted to £764, which meant he received £2,292 which is £108 less than her total contributions.

A recent Freedom of Information request by Royal London revealed that HMRC had collected over £9m in penalties from LISA in the 19 months from 6 April 2018.

The FoI numbers suggest that the LISA could be the next source of consumer complaints.

Source: Royal London 21/12/18

(AF1, AF2, AF3, AF4, ER1, FA2, FA4, FA5, FA7, JO2, JO3, JO5, LP2, RO2, RO3,RO4, RO5, RO7, RO8)

The Queen’s Speech in December was somewhat a déjà vu affair, given that the last one was little more than two months ago. What was different this time was that whereas the Autumn speech was little more than a royally-read manifesto, the December version comes backed with a Government majority of 80. Subject to Harold Macmillan’s warning about events, what the Queen said this time will become law.

There were 29 bills, either announced or re-announced, with seven directly related to Brexit and its aftermath. There was also a raft of promises on consultation and review. As far as the financial services industry is concerned, the main areas of interest are:

Financial Services legislation This is mainly Brexit-driven with three main elements:

- Ensuring “long-term market access between the UK and Gibraltar for financial services firms”;

- “Simplifying the process which allows overseas investment funds to be sold in the UK”. The legislation aims to “maintain [the UK’s] position as a centre of asset management and provide more choice to UK consumers”; and

- Enabling enactment of new Basel rules (Basel IV), strengthening the regulation of global banks.

Social care reform There is no explicit legislation under this heading, which largely repeats the Conservative manifesto pledge to “seek cross-party consensus on proposals for long term reform of social care” while guaranteeing “that no one who needs care has to sell their home to pay for it”. An extra £1bn a year for “adults and children’s social care” is pledged, again a manifesto promise. What was, perhaps understandably, left out of the manifesto is a Government consultation “on a 2 per cent precept that will enable councils to access a further £500 million for adult social care for 2020/21”, i.e. a continuation of the Council Tax surcharge which was due to end in March 2020. There was no mention of the oft-deferred Green (or is it White?) Paper on social care.

Renters’ Reform Bill This will abolish section 21 no fault evictions, reforming grounds for possession and marking another turn of the screw for buy-to-let investors. On the other hand, the Bill will also give landlords “more rights to gain possession of their property through the courts where there is a legitimate need for them to do so by reforming current legislation”. A new ‘lifetime deposit’ will be introduced “so that tenants don’t need to save for a new deposit every time they move house”. The Bill only applies to England and will be accompanied by a range of measures to support home ownership, “including by making homes available at a discount for local first-time buyers”.

Pension Schemes Bill This is a reinstatement of the Pensions Schemes Bill 2019/20 covering collective defined contribution (CDC) schemes, greater powers against errant employers and the establishment of the pensions dashboard.

Cost of living Under this catch-all heading there is a pledge to increase the National Living Wage (NLW) to two thirds of median earnings within five years (projected to be £10.50 an hour in 2024). This is subject to a caveat which did not make the manifesto: “provided economic conditions allow”. Over the same five-year period the NLW would be extended to cover those aged 21 and upwards (the current minimum age is 25). The National Insurance contribution (NIC) threshold will rise to £9,500 in 2020/21 and “The Government has committed to not raise rates of VAT, income tax and national insurance”. There is no mention of any NIC reform, despite the oft deferred demise of Class.

Divorce Bill This will introduce no-fault divorce, taking away the current requirement to make an allegation about the other spouse’s or civil partner’s conduct or demonstrate a period of separation. There will be a new minimum period of 20 weeks between the start of proceedings and applying for the conditional order. The six-week period between conditional and final order – currently called decree nisi and decree absolute – will remain. The legislation will apply to England and Wales only.

National Security and Investment Bill This Bill will ‘strengthen the Government’s powers to scrutinise and intervene in business transactions (takeovers and mergers) to protect national security”.

Business rates Another “fundamental review’ of business rates is promised, along with a commitment to increase the retail discount from one third to one half and extend its coverage. Legislation will bring the next revaluation forward to 2021 and move the process onto a three-year cycle.

There was no mention of the Budget timing in the Speech which has now been scheduled for Wednesday 11 March.

The National Living Wage and National Minimum Wage

(AF1, RO3)

As 2019 ended, the government announced substantially increased new levels of National Living Wage (NLW) and National Minimum Wage (NMW) to take effect from 1 April 2020:

|

Rate |

£ per hour from 1/4/2020 |

Increase on 2019/20 (%) |

|

NLW Age 25 and above |

8.72 |

6.2 |

|

NMW Age 21-24 |

8.20 |

6.5 |

|

NMW Age 18-20 |

6.45 |

4.9 |

|

NMW Age 16-17 |

4.55 |

4.6 |

|

Apprentice Rate |

4.15 |

6.4 |

|

Accommodation Offset |

8.20 |

8.6 |

A few points to note:

- The NLW figure is driven by the goal set in the March 2016 Budget, when the NLW was first announced (at £7.20 an hour for 2016/17). Back then, the intention was that the NLW should reach 60% of median earnings by 2020. The Low Pay Commission’s role in setting minimum rates was thus somewhat usurped.

- The Low Pay Commission concluded that “that the economic and employment picture, while less positive than for other recent rises in the NLW, was strong enough to justify moving to 60 per cent of median earnings in 2020”. It also notes that “the bar of sustained economic growth was more narrowly reached than in previous years”.

- The latest figures from National Statistics show that estimated annual growth in average weekly employee earnings was 3.2% for total pay (including bonuses) and 3.5% for regular pay (excluding bonuses). The November price inflation figures were 1.5% (CPI) and 2.2% (RPI). The increases in NLW and NMW are thus substantially above both general earnings and price inflation.

- The Conservative manifesto promised to raise the NLW to 2/3rds of median earnings by 2024 and extend eligibility to everyone over 21. That implies further growth in the NLW at a rate of about 2.7% above average earnings for the next four years, taking the figure to about £9.70 an hour in 2020 terms (£10.50 in 2024 according to the Conservative manifesto).

- The Resolution Foundation’s Living Wage figures for 2019/20, which have no statutory force but are used by a range of employers, are £9.30 per hour outside London and £10.75 in London.

- In a note issued after Christmas, the Resolution Foundation also says 2020 will begin with average real (inflation-adjusted) pay finally set to surpass its April 2008 peak.

- One interesting aspect of the sharp rise in the NLW since 2016 is that the New State Pension (NSP), which also started in April 2016, is becoming a shrinking proportion of the NLW. In 2016 the NSP was 61.8% of NLW, based on a 35 hour week, whereas by April 2020 it will be around 57.4%. A subtle move on inter-generational fairness..?

Economists disagree on where the point is at which rising minimum wage levels lead to lower employment. The UK is now at the forefront of finding out who is correct.

April 2020’s IR35 changes - Government Review

(AF2, JO3)

The Government has launched a review of the forthcoming changes to the off-payroll working rules (IR 35).

This review follows a number of concerns raised by businesses and affected individuals about how the new rules will be implemented.

The review will, the Government says, determine if any further steps can be taken to ensure the smooth and successful implementation of the reforms, which are due to come into force in April 2020. As part of this, the review will also assess whether any additional support is needed to ensure that the self-employed, who are not in scope of the rules, are not impacted.

The Government will launch a separate review to explore how it can better support the self-employed. That will include improving access to finance and credit, making the tax system easier to navigate, and examining how better broadband can boost homeworking.

As part of the review, which will conclude by mid-February, the Government will hold a series of roundtables with stakeholders representative of those affected by the reform, including contractor groups and medium and large-sized businesses, to understand how the Government can ensure smooth implementation of the reforms. The Government will also carry out further internal analysis, including evaluation of the enhanced check employment status for tax (CEST) tool and public sector bodies’ experience of implementing the reform to the off-payroll working rules in 2017.

In parallel to the review, HMRC will continue its programme of education and support activities, such as one-to-one engagement, webinars and workshops representatives to help them prepare for implementation on 6 April 2020. Anyone can enrol for HMRC’s webinars using the following link: https://attendee.gotowebinar.com/rt/6851279454994685185

Source: HM Treasury News Story: Off-payroll review launched – dated 7 January 2020.

Financial Services and Brexit – FCA update

(AF1, AF2, AF3, AF4, ER1, FA2, FA4, FA5, FA7, JO2, JO3, JO5, LP2, RO2, RO3,RO4, RO5, RO7, RO8)

The FCA has published a webpage providing an update for the financial services sector regarding the UK’s exit from the EU and what the implementation period will mean.

If the UK leaves the EU with a Withdrawal Agreement on 31 January 2020, as expected, we will enter an implementation period during which the UK will negotiate its future relationship with the EU. The implementation period is due to operate until 31 December 2020.

During the implementation period, EU law would continue to apply in the UK. Passporting would continue, as would consumer rights and protections derived from EU law. New EU legislation that takes effect before the end of the implementation period would also apply to the UK.

What this means for the FCA

The FCA will be working to ensure that the UK financial services sector is prepared for the end of the implementation period. This includes continuing to engage with the UK government and other UK regulators.

It will also continue to work closely with the European Supervisory Authorities, national authorities in Member States and all European policymakers on shared issues and priorities.

What firms need to consider

Firms will need to consider how the end of the implementation period will affect them and their customers, and what action they may need to take to be ready for 1 January 2021.

Consumers' rights remain the same during the implementation period

During the implementation period, EU law would continue to apply until 31 December 2020. The current protections and rights available for financial products and services won’t change due to the implementation period.

The FCA’s new webpage can be viewed here.

Source: FCA: What an implementation period would mean – dated 20 December 2019.

Press release - 'get quacking' - with less than a month to go

(AF1, AF2, JO3, RO3)

HMRC recently issued a press release urging individuals to submit their self assessment tax return by 31 January.

According to HMRC, around 5.4 million taxpayers are yet to file and have less than a month to do so.

More than 11 million tax returns are due by the end of January. Around 54% of taxpayers have already filed their returns with more than 5.6 million of those completed online (89% of the total returns filed).

There is information contained within the press release in relation to who is required to file and, for those who are unsure, HMRC provide a useful tool which can be used to check if there is a requirement to file a return.

Anyone who filed a return last year will be required to file again this year even if they have no tax to pay, unless HMRC has written to them to advise otherwise.

There is support and guidance available from HMRC to help individuals through the process of completing and submitting their self assessment tax return – please see here.

Clients should be reminded that if they miss the deadline they will face a minimum £100 penalty, with further penalties added thereafter.

Source: https://www.gov.uk/government/news/get-quacking-with-less-than-a-month-to-go

INVESTMENT PLANNING

An interesting insight into VCT investors

(AF4, FA7, LP2, RO2)

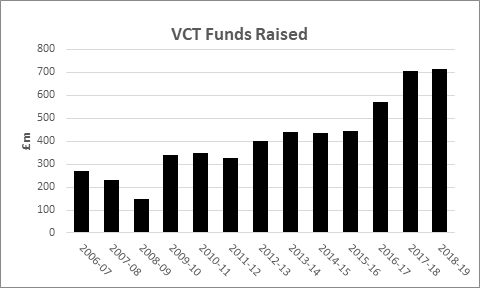

HMRC has issued its latest set of VCT statistics showing the distribution of investors and the amount of investment. As the graph above shows, 2018/19 just pipped (revised) 2017/18 sales, again recording the largest fund raising since 2005/06, which was the second year of a temporary period of 40% tax relief. £780m was raised in 2005/06 across 82 VCTs, whereas £716m was invested in 2018/19, across only 42 trusts.

The statistics show the distribution of investment levels in VCTs over recent years. They do not quite comply with the 80/20 principle, but come close. The latest figures released for 2017/18 are shown in the table below:

|

Size of investment

Upper Limit £ |

Investors

|

Amount of Investment |

||

|

No |

% of Total |

Sum £m |

% of Total |

|

|

1,000 |

1,230 |

6.5% |

1 |

0.1% |

|

2,500 |

815 |

4.3% |

1 |

0.1% |

|

5,000 |

1,720 |

9.1% |

7 |

1.0% |

|

10,000 |

3,470 |

18.4% |

29 |

4.3% |

|

15,000 |

1,700 |

9.0% |

22 |

3.3% |

|

20,000 |

1,875 |

9.9% |

36 |

5.4% |

|

25,000 |

1,140 |

6.0% |

27 |

4.0% |

|

50,000 |

3,395 |

18.0% |

130 |

19.4% |

|

75,000 |

1,020 |

5.4% |

64 |

9.6% |

|

100,000 |

995 |

5.3% |

93 |

13.9% |

|

150,000 |

535 |

2.8% |

66 |

9.9% |

|

200,000 |

1,000 |

5.3% |

194 |

29.0% |

|

TOTAL |

18,890 |

100.0% |

670 |

100.0% |

Working backwards, 81.6% of the total raised by VCTs came from 36.8% of the investors – those investing more than £25,000. The biggest investors, those investing between £150,000 - £200,000, on average invested £194,000 and accounted for over 29.0% of total funds raised.

This year the VCT fund raising season again started early, in anticipation of the Autumn (non-) Budget. Open offers currently total about £500m, with some trusts having already been fully subscribed.

Source: HMRC 10/12/20191

Review of open-ended funds - FCA and Bank of England statement on joint review

(AF4, FA7, LP2, RO2)

In its Financial Stability Report, published last month, the Financial Policy Committee (FPC) set out initial findings of a joint review by the Financial Conduct Authority (FCA) and the Bank of England on open-ended investment funds and the risks posed by their liquidity mismatch.

According to the FCA, the FPC has reviewed the progress of the work and identified that, if greater consistency between the liquidity of a fund’s assets and its redemption terms is to be achieved:

- Liquidity of funds’ assets should be assessed by reference to the price discount needed for a quick sale of a representative sample (or vertical slice) of those assets or the time period needed for a sale which avoids a material price discount. In the US, the Securities and Exchange Commission has recently adopted measures of liquidity based on this concept.

- Redeeming investors should receive a price for their units in the fund that reflects the discount needed to sell the required portion of a fund’s assets in the specified redemption notice period, ensuring fair outcomes for redeeming and remaining investors.

- Redemption notice periods should reflect the time needed to sell the required portion of a fund’s assets without discounts beyond those captured in the price received by redeeming investors.

The review will now consider how these principles could be implemented in a proportionate and effective manner.

The FCA says that it will use the conclusions of the review, which will be released this year, to inform the development of the FCA’s rules for open-ended funds.

And it has added that recognising the global nature of asset management, the conclusions could also be used by UK regulators in international work at the Financial Stability Board (FSB), the International Organization of Securities Commissions (IOSCO) and with other competent authorities.

You can read the FPC’s Financial Stability Report here.

Source: FCA News: FCA and Bank of England statement on joint review of open-ended funds – dated 16 December 2019.

The November inflation numbers

(AF4, FA7, LP2, RO2)

The CPI for November showed an annual rate of 1.5%, unchanged from October. The market had expected a fall to 1.4%, according to Reuters. The CPI thus remains at its lowest level since November 2016. Across October to November prices dropped by 0.2%, whereas they rose by 0.3% a year ago (roundings account for the 0.1% year-on-year difference).

The CPI/RPI gap widened by 0.1% to 0.7%, with the RPI annual rate rising 0.1% to 2.2%. Over the month, the RPI was up 0.2%.

The Office for National Statistics (ONS)’s favoured CPIH index was also unchanged for the month at 1.5%. The ONS notes the following significant factors across the month:

Downward

Restaurants and hotels: Prices fell for this category between October and November 2019 but rose between the same two months a year ago, with the main effects coming from overnight hotel accommodation.

Alcohol and tobacco: The Autumn non-Budget had a marked effect here. Prices for tobacco products rose on average by 3.4% between October to November 2018, reflecting duty increases. With no Budget in 2019, there have been no further duty increases, resulting in a marked fall in year-on-year inflation. This will unwind, probably in March, after the deferred Budget arrives and could flip into still higher inflation if there is an Autumn 2020 Budget, giving a second duty increase in a year.

Clothing and footwear: Overall prices rose between October and November 2019 but by less than a year ago, especially for women’s garments (which rose by 1.3% this year, compared with 2.1% last year). Within this group, the ONS notes that the largest individual contributions came from “women’s formal trousers and strappy tops”

Upward

Food and non-alcoholic beverages: For this category, overall prices rose between October and November 2019 by more than between the same two months a year ago, especially for sugar, jam, syrups, chocolate and confectionery (which rose by 1.8% this year, compared with a rise of 0.1% last year).

Recreation and culture: A similar pattern occurred here, with overall prices rising by 0.5% between October and November 2019 compared with a 0.1% increase between the same two months a year ago.

Transport: Here overall prices fell between October and November 2019 but by less than a year ago. This was caused by various price movements across the category. Upward effects from second-hand cars and air fares were in part offset by a downward effect from rail fares.

In five of the twelve broad CPI groups, annual inflation increased, while four categories posted a decrease and the remaining three were unchanged. Thanks to the non-Budget, Alcoholic Beverages and Tobacco lost its lead as the category with the highest inflation rate, with the mantle reverting to Communications at a 3.3% annual rise.

Core CPI inflation (CPI excluding energy, food, alcohol and tobacco) was unchanged to 1.7%. Goods inflation rose 0.1% to 0.6%, while services inflation was down 0.1% at 2.5%.

Producer Price Inflation was 0.5% on an annual basis, down 0.3% on the output (factory gate) measure, thanks mainly to alcohol and tobacco. Input price inflation increased to -2.7% year-on-year, a 2.3% rise from October. The main driver here – as ever - was oil prices.

These inflation figures were marginally worse than expected, despite the perverse effect of the non-Budget. With earnings growth slowing to 3.2% a year (total pay – 3.5% regular pay only) according to statistics released on Tuesday, 17 December real earnings growth continues to look healthy.

Source: ONS 18/12/19

A much better year for UK shares

(AF4, FA7, LP2, RO2)

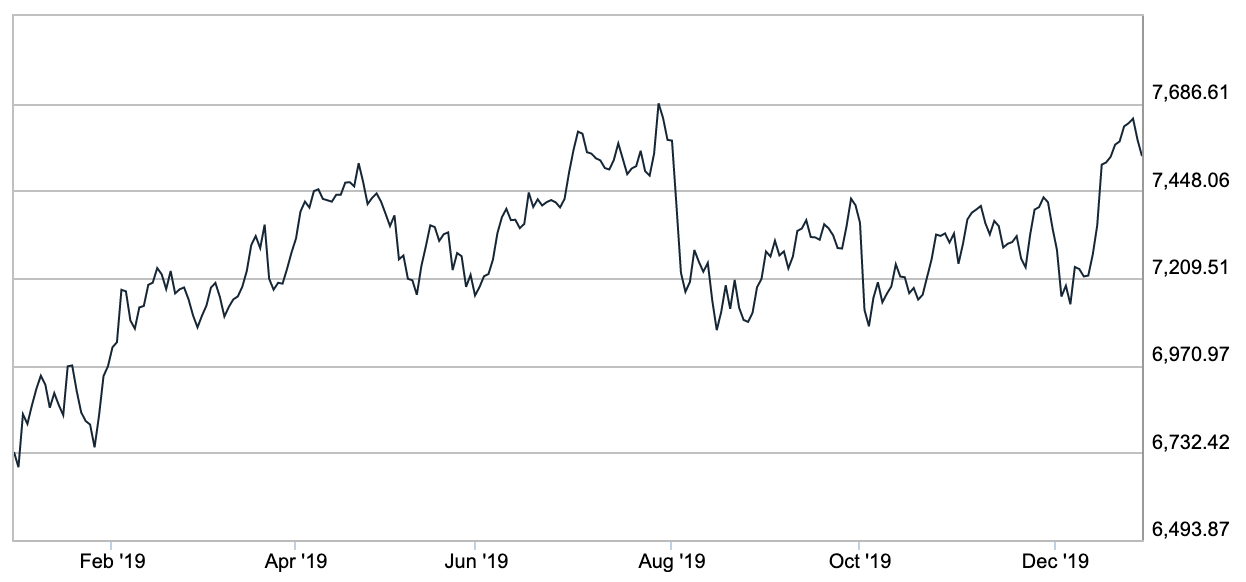

The FTSE 100 in 2019

The FTSE 100 ended 2019 12.1% up, having dropped 12.5% in 2018. Whereas in 2018 the last quarter pulled down the year’s performance, in 2019 the final three months came to the rescue. However, the maths of rises and fall are such that at the end of 2019 the FTSE 100 was still 145 points below where it started 2018. Once dividends are taken into account, the two years produced a positive return of 7.1% - a reminder of how important dividends are these days.

In 2019 the FTSE 100 was substantially outperformed by its FTSE 250 counterpart. This was partly a currency effect, as 75% of the earnings of FTSE 100 constituents originate overseas, whereas the proportion is more like 50% for the FTSE 250. Such a difference matters when – perhaps surprisingly – the pound has a good year. Sterling finished 2019 up 4% against the US Dollar and almost 6% against the Euro. The table below summarises the movements of the main FTSE indices.

|

Index |

2019 Change |

Comment |

|

FTSE 100 |

+12.1% |

A widespread rally |

|

FTSE 250 |

+25.0% |

UK focused cos beat Footsie on £ strength |

|

FTSE Small Cap |

+14.9% |

Small caps nudge past big cap |

|

FTSE 350 Higher Yield |

+7.7% |

Value-investing disappoints again |

|

FTSE 350 Lower Yield |

+21.7% |

Growth thumped value as a strategy |

|

FTSE All-Share |

+14.2% |

Outperformed Footsie due to mid caps |

|

FTSE Technology |

+29.6% |

Top ICB sector |

|

FTSE Telecoms |

-6.3% |

Bottom ICB sector: BT, Vodafone drag |

Over the year, the dividend yield on the FTSE All-Share fell from 4.46% to 4.09%, implying dividend growth of 4.7%. However, as last year, this figure needs to be treated with caution because the performance of sterling was once again a factor. The stronger pound cut the value of the dollar-denominated distributions from the heavyweight dividend payers the likes of BP, HSBC and Shell.

The performance of the UK equity market was below the global average, even after adjusting for currency effects. In sterling terms, the MSCI ACWI was up 19.3%. That worldwide performance was helped by the strong US market (about 56% of the index): the MSCI World ex USA recorded a rise of 13.6%.

In the emerging markets, returns were mostly in the black, with Argentina and Chile major exceptions. The MSCI Emerging Markets Index was up 11.0% in sterling terms (against an 11.5% decline in 2018). Mr Putin will be glad to note that the top performing overseas emerging market was Russia.

At the end of July 2019, the FTSE 100 index very nearly touched its 2018 starting point before dropping 500 points in the next fortnight. It made another attempt to regain that January 2018 level in a post-Election rally before fading in the final days. 2020 begins with some plus points in terms of low inflation, low interest rates and a new government with a working majority. Even if UK equities move little over the year, there will still be that 4% dividend yield to fall back on.

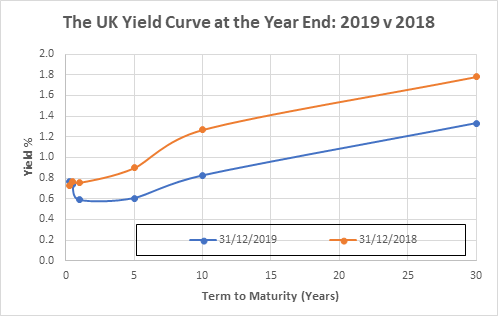

(AF4, FA7, LP2, RO2)

For all the talk that the long bull run in bonds was due to end, 2019 was a good year for UK fixed interest investment, with sector average total returns for the IA’s five main sterling bond categories between +5.3% (Index Linked Gilts) and +11.1% (Sterling High Yield). In contrast to 2018, government securities were outpaced by other fixed interest securities.

|

Bond/Index |

31/12/2018 Yield |

3112/2019 Yield |

Yield Change |

|

2 year benchmark gilt |

0.76% |

0.53% |

-0.23% |

|

5 year benchmark gilt |

0.90% |

0.60% |

-0.30% |

|

10 year benchmark gilt |

1.14% |

0.82% |

-0.32% |

|

30 year benchmark gilt |

1.81% |

1.33% |

-0.48% |

|

1.875% Treas index-link 2022* |

-2.23% |

-2.35% |

-0.12% |

|

1.25% Treas index-link 2055* |

-1.47% |

-1.74% |

-0.27% |

|

iBoxx gilts 10 year + |

1.73% |

1.23% |

-0.50% |

|

iBoxx AA 10 year + |

1.75% |

1.26% |

-0.49% |

|

iBoxx BBB 10 year + |

3.91% |

2.90% |

-1.01% |

|

iBoxx Corporates 10 year + |

3.53% |

2.55% |

-0.98% |

* Real yields

The table highlights three factors which were themes of the year:

- Base rate remained at 0.75% throughout the year, which anchored the shortest term rates at around that level.

- Although yields fell across the year, they have risen from the dark days of early October, when 10-year gilts were yielding under 0.5%, leaving the inversion in the yield curve less marked now than it was in the Autumn.

- The hunt for yield means that the spread between differently rated bonds has narrowed, as illustrated by the iBoxx indices. This is a reversal of what happened in 2018.

The performance of the various IA sterling fixed interest sectors over 2019 echoes these factors:

|

IMA Sector |

2019 Total Return |

|

Sterling High Yield |

+11.1% |

|

Sterling Strategic Bond |

+9.3% |

|

Sterling Corporate Bond |

+9.5% |

|

UK Index-linked Gilts |

+5.9% |

|

UK Gilts |

+7.0% |

Source: Trustnet

In the Eurozone yields many government bond yields spent the year in negative territory, forced down by the European Central Bank’s bond-buying activities. A small notch down in deposit rates in September followed by the resumption of quantitative easing (QE) in November helped keep pressure on yields. The ECB now says it “expects [its] key interest rates to remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within its projection horizon”. The current Eurozone inflation rate is 1.0%.

US yields fell across all durations during 2019, partly in response to the Federal Reserve’s three rate cuts, none of which were expected at the start of the year. The 2-year Treasury benchmark yield dropped from 2.496% to 1.561% over the year, while the 10-year bond yield was down 0.776% at 1.910%. The summer inversion of the yield curve, which caused worries about an impending recession, has unwound. The 10-year US Treasury bond recorded a yield of 1.5% as recently as early September but has since risen by 0.41%. Over the same period the 2-year bond yield is up by just 0.05%.

The 30 year plus bull market in bonds has continued to defy those who say that if it cannot go on forever, it must end. However, in 2020 it is hard to see the central banks giving much more support as they have largely run out of QE and interest rate ammunition. The fact that Sweden, one of the pioneers of negative rates in 2015, increased its rate (to zero) last month might be a straw in the wind....

Source: Investing.Com. Ft.Com Fetrustnet Markit.Com Ecb 2/1/20

PENSIONS

PPF publishes updated PPF 7800 index - December 2019

(AF3, FA2, JO5, RO4, RO8)

Since July 2007 the Pension Protection Fund has published the latest estimated funding position, on a s179 basis, for the defined benefit schemes in its eligible universe.

December 2019 Update Highlights

- The aggregate deficit of the 5,450 schemes in the PPF 7800 Index is estimated to have decreased over the month to £71.1 billion at the end of November 2019, from a deficit of £103.6 billion at the end of October 2019.

- The funding ratio increased from 94.4 per cent at the end of October 2019 to 96.1 per cent.

- Total assets were £1,744.6 billion and total liabilities were £1,815.7 billion.

- There were 3,328 schemes in deficit and 2,122 schemes in surplus.

- The deficit of the schemes in deficit at the end of November 2019 was £208.9 billion, down from £230.5 billion at the end of October 2019.

The PPF 7800 index is published on the second Tuesday of every month, and the PPF publishes The Purple Book each year.

New life expectancy figures released

(AF3, FA2, JO5, RO4, RO8)

In early December the Office for National Statistics (ONS) released updated life expectancy projections based on the assumptions for future mortality from the 2018-based national population projections (NPP), which were published on 21 October 2019. The ONS has also updated its life expectancy calculator.

While life expectancy is still expected to rise in the future, the absolute numbers are now smaller. The ONS says that “The lower projections of life expectancy over time reflect the higher mortality rates observed in recent years than were previously projected and the projected lower rates of mortality improvement at older ages”. That explains why, for example, the 2014 projection said that a male reaching 65 in 2018 would have a life expectancy of 21.8 years, while the 2018 projection is 19.9 years. The drop for women is the same – from 23.9 years to 22.0 years.

Below are the latest expectations and related probabilities. Note that a corollary of the heavier mortality assumption is that the odds of living to 100 reduce markedly. For example, for a 65 year old male they are now just 2.8% whereas the 2014 figure was 8.1%.

|

|

Age 60 |

Age 65 |

Age 70 |

|||

|

|

Male |

Female |

Male |

Female |

Male |

Female |

|

Life Expectancy |

84 |

87 |

85 |

87 |

86 |

88 |

|

1 in 4 chance |

92 |

94 |

92 |

94 |

92 |

93 |

|

1 in 10 chance |

96 |

98 |

96 |

98 |

96 |

97 |

|

Odds on reaching 100 |

3.2% |

5.3% |

2.8% |

4.8% |

2.5% |

4.3% |

Comment

Falls in projected life expectancy have been commonplace in the UK over recent years. This latest set of data calls into question whether the planned increase in State Pension Age (SPA) from 67 to 68 between 2037 and 2039 will survive the next SPA review. The timing for the move to 68 was originally proposed in the Cridland Report, which was based on 2012 and 2014 ONS data.

Recruitment agency ordered to pay £10,890 for misleading tpr and avoiding workplace duties

(AF3, FA2, JO5, RO4, RO8)

SKL Professional Recruitment Agency Ltd and managing director Linus Kadzere were sentenced for wilfully failing to comply with their workplace pension duties and providing false information to The Pensions Regulator (TPR).

Mr Kadzere made a false declaration of compliance stating that the company had automatically enrolled 22 staff. However, although a scheme had been set up the staff hadn’t been enrolled and contributions were deducted from pay but not paid into a scheme.

Mr Kadzere was fined £1,300 plus a victim surcharge or £120 and SKL £6,000 plus a victim surcharge of £120 and costs of £3,350.

Trustees urged: engage early and be transparent – 18 December 2019

(AF3, FA2, JO5, RO4, RO8)

In the latest TPR quarterly compliance and enforcement bulletin trustees are being urged to engage early with TPR during corporate transactions and to be transparent to protect savers.

The latest bulletin covers July to September and includes anonymous case studies demonstrating how employers and pension schemes can avoid falling foul of the law.

The bulletin also includes a warning that failure to provide information when requested will lead to enforcement action. During the quarter TPR issued 128 section 72 notices requesting information and two prosecutions were launched following failure to comply.

In addition, the bulletin also highlights how TPR’s compliance validation inspections are being targeted at both large and small employers. Since the start of automatic enrolment 1,768 inspection notices have been issued.

Supreme court rules in case concerning pensions for part-time judges

(AF3, FA2, JO5, RO4, RO8)

The Supreme Court has issued a Press Summary in the case of Miller and others v Ministry of Justice. It decided an appeal concerning the issue of when time starts to run for a claim by a part-time judge to a pension under the Part-time Workers’ Directive. The Supreme Court ruled in favour of four judges who had been denied pensions for part-time work. Browne Jacobson, a law firm acting on behalf of the judges, commented: “This judgment means that fee-paid judges who were subsequently appointed full-time salaried members of the judiciary will now be entitled to pensions in respect of their former part-time service.” The law firm also estimated that more than 1,000 judges could be entitled to back payments and pensions, which it said could cost the Ministry of Justice up to £1bn. The Ministry of Justice said that it did not recognise the £1bn estimate, adding: “[W]e accept the Court's judgment and are considering how to implement it.”

Employment tribunal makes interim declaration in favour of firefighters

(AF3, FA2, JO5, RO4, RO8)

According to a Press Release from the Fire brigades Union, at a recent employment tribunal an interim declaration was made that more than 6,000 firefighters are entitled to a return to their pre-2015 pension schemes. The declaration covers immediate cases, such as those who have taken ill-health retirement, with a final declaration due in July 2020. It will apply to firefighters who joined the fire and rescue service before 1 April 2012. In December 2018, the Court of Appeal ruled that changes to firefighters’ pensions constituted unlawful age discrimination (see Financial Service Related News etc. to 5 July 2019).

Matt Wrack, General Secretary of the Fire Brigades Union (FBU), said: “The law has now changed and our FBU claimants will be entitled to return to their previous pension schemes. Legislation will need to be amended, but there can be no delay in implementing this remedy. Firefighters were robbed, and they must now be repaid.”

Bank of England Governor warns pension funds to address climate change

(AF3, FA2, JO5, RO4, RO8)

In an interview for BBC Radio 4, (bbc.co.uk/news of 30 December 2019) Mark Carney, the outgoing Governor of the Bank of England, has urged investors to reassess their agenda on climate change. He said that although companies are starting to curb their investment in fossil fuels they are “not moving fast enough” and pension fund investments held by millions of people could become “worthless” unless the financial sector takes urgent action. He added: “A question for every company, every financial institution, every asset manager, pension fund or insurer: What's your plan?”

This document is believed to be accurate but is not intended as a basis of knowledge upon which advice can be given. Neither the author (personal or corporate), the CII group, local institute or Society, or any of the officers or employees of those organisations accept any responsibility for any loss occasioned to any person acting or refraining from action as a result of the data or opinions included in this material. Opinions expressed are those of the author or authors and not necessarily those of the CII group, local institutes, or Societies.